The increase in tensions in the trade war intensified volatility in the markets, raising the concern among investors. Still, an analyst points out that this scenario of uncertainty can act as a catalyst for the valuation of bitcoin (BTC).

The perspective arises while Bitcoin struggles to gain impulse, with traditional and cryptocurrency markets showing signs of widespread losses.

Can trade war be the big chance of Bitcoin?

In a detailed analysis published on the social media platform X (former Twitter), Ben Sigman, analyst and CEO of Bitcoin Libre, outlined five factors by which a tariff -driven conflict could trigger an increase in Bitcoin value.

His first point turned around the potential trajectory of the US dollar. According to him, a trade war would strengthen the dollar. However, a subsequent collapse would revert this.

Tariffs increase the dollar. Emerging markets break under $ 12 trillion out of US $. Confidence in the Fiat decreases. Capital seeks security in fixed offer, stated Sigman.

He also suggested that, in this case, capital can seek refuge from fixed-supply assets such as Bitcoin, positioning it as a safeguard against financial instability.

Then he pointed to the potential of cryptocurrency as inflation protection. Tariffs often interrupt global supply chains, increasing the cost of goods and choking economic growth. In response, central banks, including the Federal Reserve (Fed), can reduce interest rates, thus devaluing national currencies.

Sigman argued that the inherent scarcity of Bitcoin and its global accessibility make it an attractive protection in such a scenario.

Bitcoin is highlighted as a neutral asset in the scenario of decalarization

Third, Sigman highlighted the accelerated tendency of decalarization. He explained that nations like China, which now performs 56% of its commercial turnover in Yuan, are increasingly seeking alternatives to the US dollar.

According to him, the BRICS coalition (Brazil, Russia, India, China and South Africa) will also develop alternative financial systems. However, this change is not free from risks as it can lead to capital escape.

Bitcoin thrives in a fragmented world like the neutral and global option, he said.

Fourth, Sigman predicted panic in the market. He estimates that a single cycle of tariffs could delete $ 5 trillion in market value, flatten securities yields, and make traditional refugees such as gold, less attractive.

In this environment, Bitcoin volatility can attract investors in search of high -risk opportunities and high reward, potentially boosting substantial capital entrances.

Finally, Sigman argued that a trade war could expose systemic vulnerabilities in global institutions. Tariffs may precipitate debt defaults and corrite confidence in Fiat -based systems, leading investors to resort to cryptocurrency.

Bitcoin was built for this – without permissions, without borders, without banks, he concluded.

Analysts differ on the direction of cryptocurrency

However, not all analysts share Sigman’s optimism. Another prominent commentator, Fred Krueger, recently described Nine predictions on the possible imposition of rates greater than 100% on China next year. He predicted that this measure could lead to significant falls in bitcoin and other cryptocurrencies such as solana (sun).

Everything falls together. At some point this ends. When? Trump is unfortunately insane and poorly advised, Krueger he wrote.

When asked if Bitcoin will reach zero, he joked, stating,

I accept all $ 1.

As commercial tensions between the US and China intensify – driven by more tariffs on Chinese products and broader geopolitical friction – the role of Bitcoin in the global financial sector remains under criticism. As the largest cryptocurrency will behave in the long run is yet to be seen.

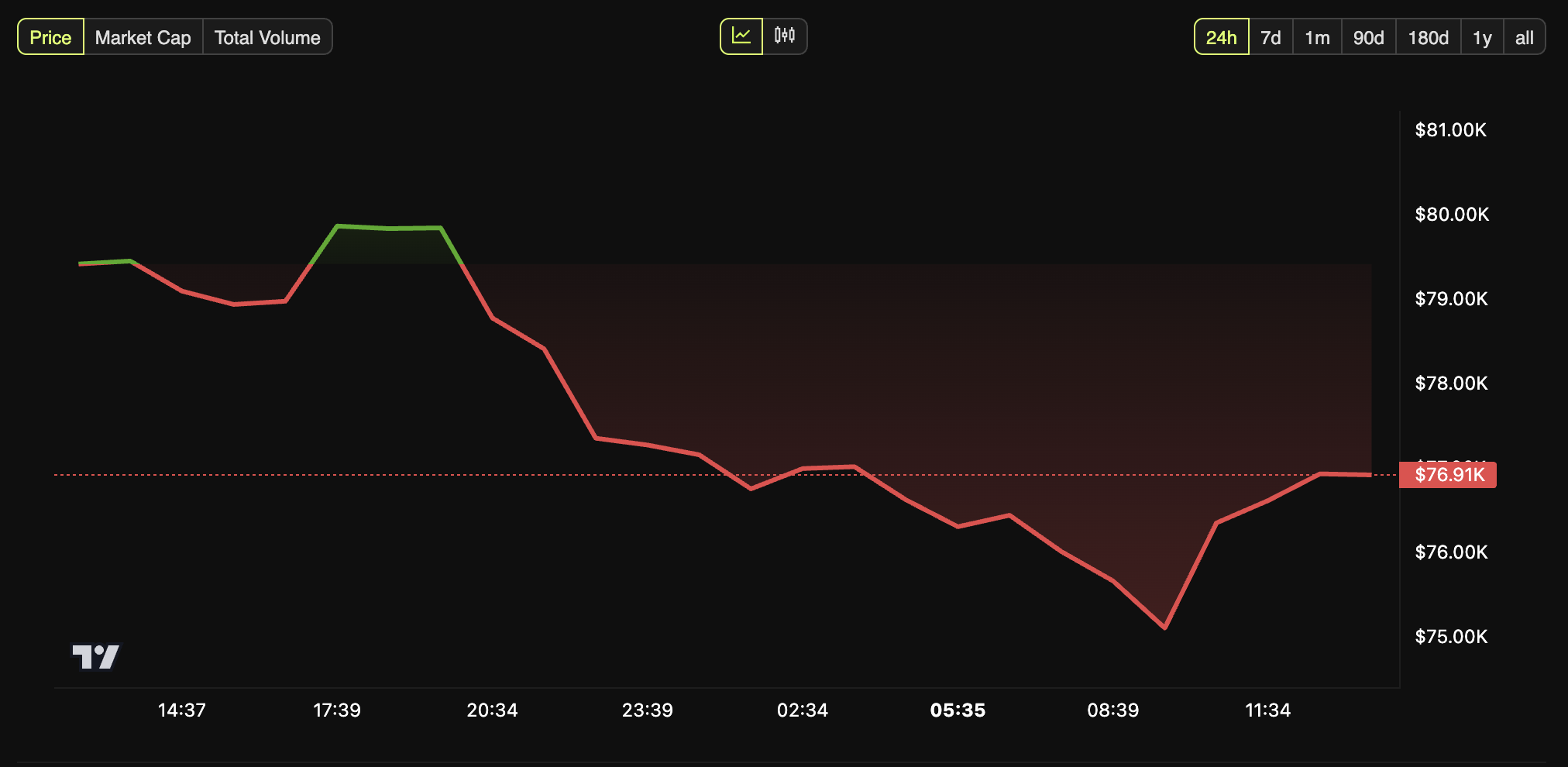

For now, the market seems quite pessimistic. Data from the beincrypto showed that yesterday (8), the BTC fell 3.1%. Until the publication of this text, it was being negotiated at $ 76,914.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.