Standard Chartered predicted that Bitcoin (BTC) will probably exceed $ 88,500 this weekend after a strong performance in the technology industry.

Banco’s global chief of digital asset research, Geoff Kendrick, shared these expectations in an exclusive benchrypto.

What Standard Chartered says about Bitcoin this weekend

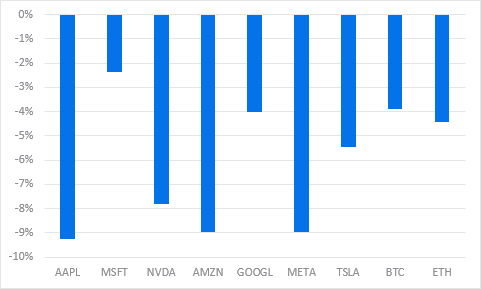

In an e-mail to the benchrypto, Kendrick pointed to the recent price action among major technology actions, including Microsoft, as an indicator of Bitcoin’s short-term trajectory.

“The best performances were MSFT and BTC. The same again for Bitcoin’s sight today and technology futures,” said Kendrick.

He explained that a decisive break above the critical level of $ 85,000 seems likely after data from non -agricultural US jobs. The Standard Chartered executive explained that such a result would pave the way for a Wednesday pre-trifle level of $ 88,500.

However, China’s retaliatory rates may increase market uncertainty, bringing down prices in the short term. This volatility can weaken investors’ confidence, overshadowing any weekend gains.

Kendrick’s statements come before the long-awaited US Employment Report, Non-Farm Payrolls (NFP). The report will present a comprehensive update of the labor market, including added jobs, unemployment rate and wage growth.

US Job Report can redefine Bitcoin and Dollar

A strong report could strengthen confidence in the economy, especially if it came above the previous reading of 151,000 jobs. This is even more relevant if accompanied by a stable unemployment rate of 4.1%. Such a result could contain crypt gains if the dollar rises.

On the other hand, a disappointing result, potentially below the median forecast of 140,000 jobs with unemployment exceeding 4.1%, could light concerns with recession. This would lead investors to seek refuge in Bitcoin and cryptors.

Standard Chartered may be leaning on to the last result, with Kendrick emphasizing the growing role of Bitcoin as a key asset.

Bitcoin is proving as the best positive side of technology when actions go up and also as a hedge in multiple scenarios… I argued that Bitcoin negotiates more as technology actions than gold most of the time. At other times, and structurally, bitcoin is useful as a hedge tradfi, ”he added.

Standard Chartered has increasingly highlighted Bitcoin’s strategic importance in financial markets. The bank recently identified Bitcoin and Avalanche (Avax) as probable beneficiaries of a potential release-postia crypto increase. Beincrypto has reported the forecast, which now aligns with the latest, that institutional investors could be preparing for a rise in the market.

In addition, the bank positioned Bitcoin as a growing hedge against inflation. He argued that his limited offer and decentralized nature make him an attractive alternative to traditional assets of safe haven.

Standard Chartered pede para HODL Bitcoin

Amid the growing role of Bitcoin in the Traditional Finance (Tradfi), Kendrick advised investors to maintain their participation.

“In the last 36 hours, I think we can add ‘US isolation hedge’ to Bitcoin’s list of uses,” he added.

This suggests that bitcoin can serve as a protective asset amid geopolitical and macroeconomic uncertainties.

Meanwhile, the daily BTC/USDT chart shows a critical technical configuration, with the price of Bitcoin currently negotiating around $ 82,643. An old $ 85,000 support level is now resistance, limiting the high potential of pioneer crypto. The offer zone close to $ 86,508 adds more sales pressure.

At the disadvantage, a key demand zone between $ 77,500 and $ 80,708 supports. Despite price consolidation, the relative force index (RSI) is forming higher minimums, indicating sustained growth of Momentum and potential reversal.

If BTC successfully recovers the $ 85,000, this could trigger a movement towards $ 87,480. However, to confirm the continuation of the high trend, the BTC should record a daily candlestick closure above the average offer zone by $ 86,508.

The high volume (blue) volume profile supports this thesis, showing that buyers are waiting to interact with the price of bitcoin above the middle line of the offer zone.

Failing to break the immediate resistance of $ 85,000 may lead to a new test zone test, potentially breaking down. In such a directional bias, a break and closing below the midline of this zone by $ 79,186 could exacerbate the low trend.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.