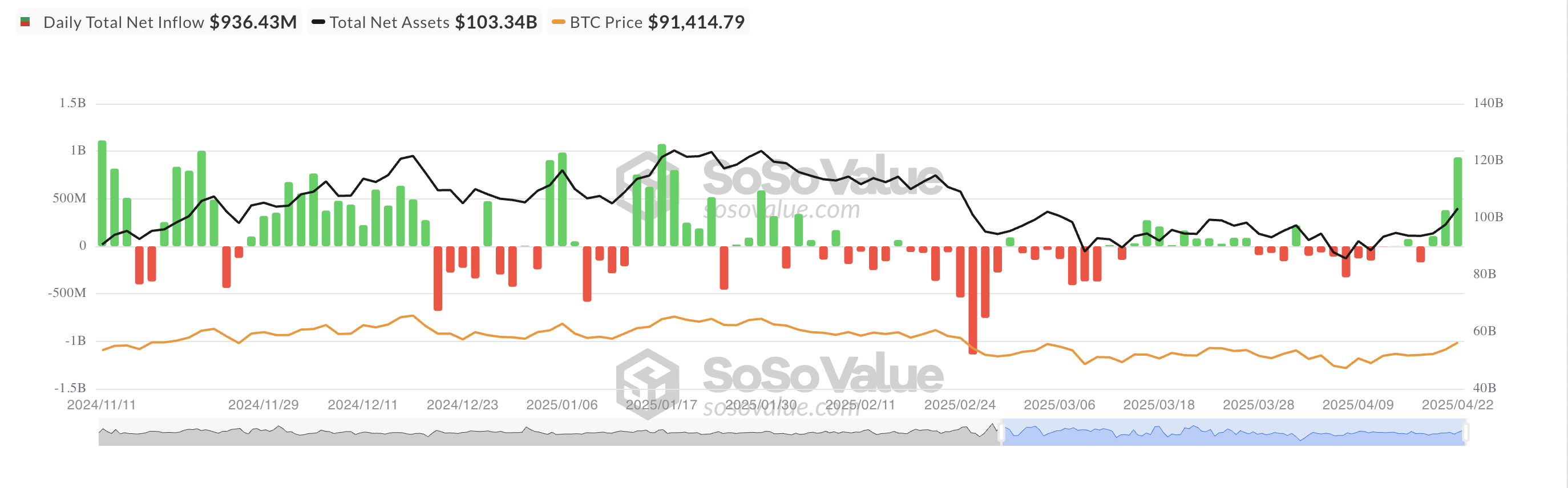

Yesterday (22), Bitcoin’s Stock Exchange Negotiated Funds recorded significant entries, marking the third consecutive day of positive liquid flows.

With the BTC now negotiating again above the $ 90,000 mark, signs point to a renewed institutional interest, as large players seem to be returning to the market after weeks of caution.

BTC ETF inputs increase 146% by one day

Today (23), the US Bitcoin ETF inputs in the US has soaked to $ 936.43 million, a 146% jump compared to the US $ 381.40 million registered on the previous day (22).

This also represented the largest entry in a single day since January 17, signaling a significant resumption in institutional demand for exposure to the BTC.

Ark Invest and 21Shares Arkb ETF led the entries, recording the highest daily net input of US $ 267.10 million, increasing their total accumulated net inputs to $ 2.87 billion.

Fidelity’s ETF FBTC continued with a net input of US $ 253.82 million. ETF’s total historical net entries now total US $ 11.62 billion.

BTC price rises, but derivative traders bet on falling

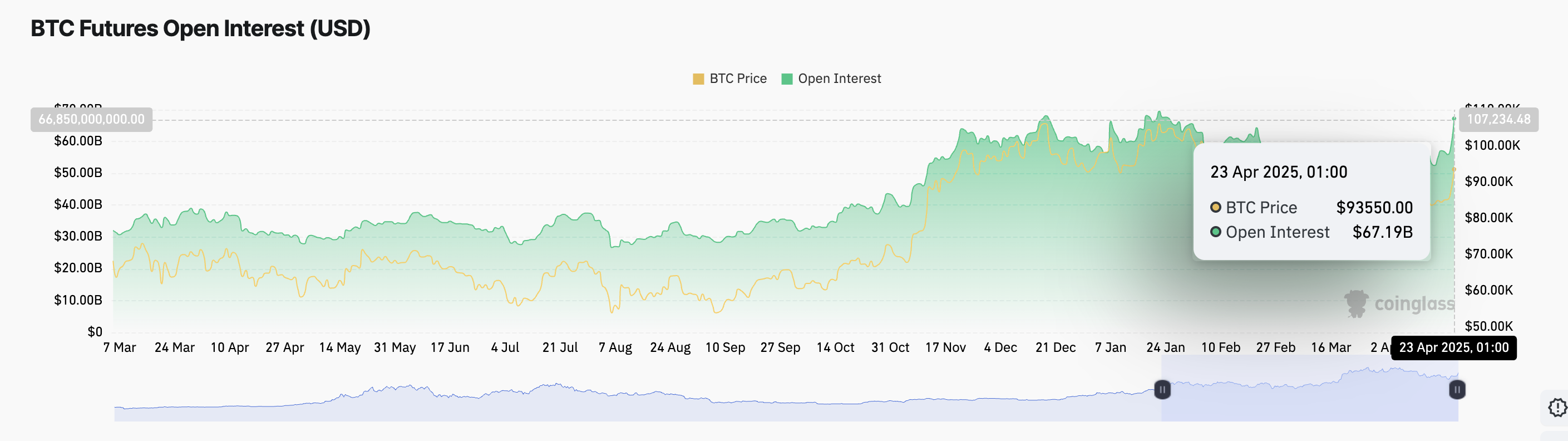

On the derivative side, the open interest in BTC futures also increased, reflecting increasing negotiation activity and speculative positioning while the currency tries to stabilize above $ 90,000.

The BTC is being negotiated at US $ 93,548 at the time of publication, registering a 6% price increase on the last day. During the same period, his open interest in the futures also rose 16%. It is currently $ 67.19 billion, its highest level since January 24.

When the price of an asset and open interest increase simultaneously, this signals strong conviction behind the movement. This means that more capital is entering the market to support the tall trend.

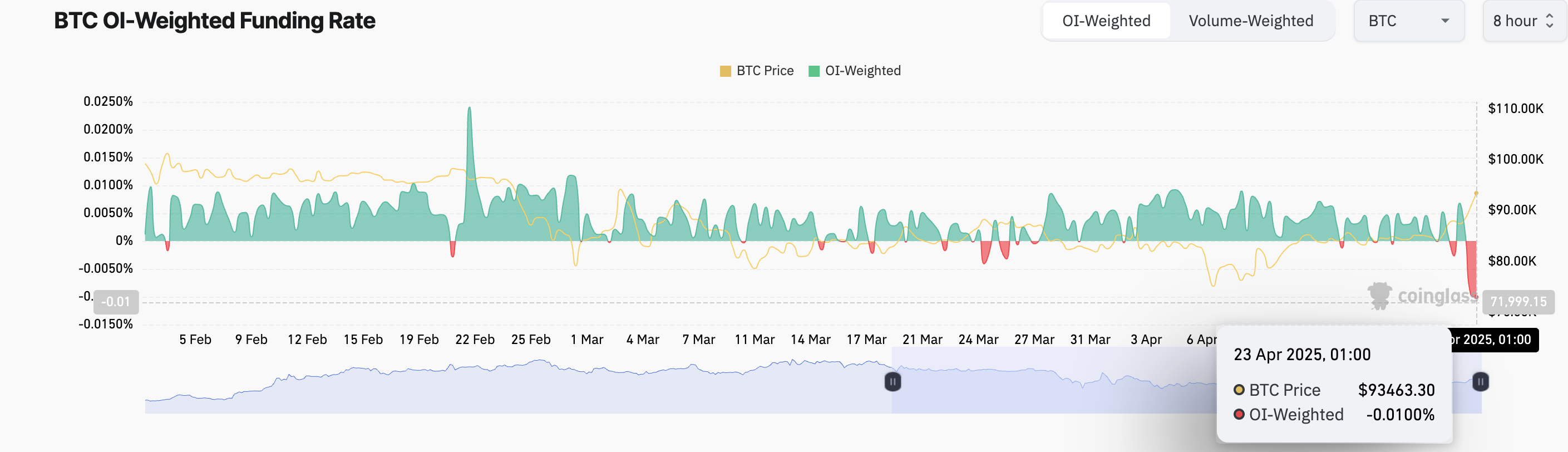

However, not all indicators point to an optimistic feeling.

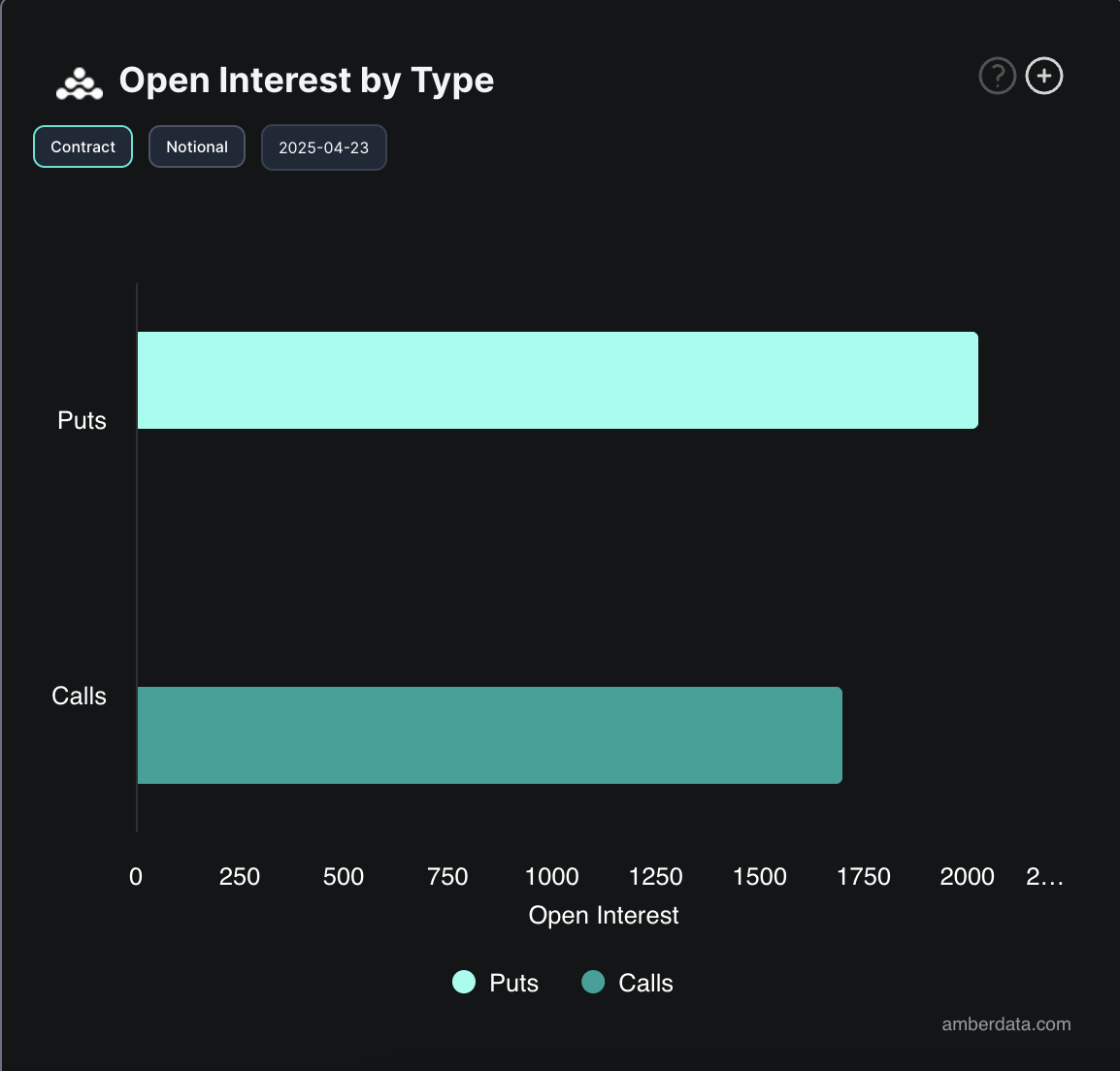

Despite the price increase of the BTC on the last day, the financing rate remains negative, suggesting that traders are paying a prize to sell the currency discovered in future markets. The currency financing rate is currently at -0.01%.

The BTC negative financing rate means that salespeople are discovered are paying to buyers to keep their positions open. This indicates that more traders are betting against the current BTC rally and anticipating a low reversal.

With the BTC hovering above a key psychological level and the institutional entrances increasing, the next few days can reveal if this momentum remains.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.