Bitcoin’s mining industry is becoming increasingly competitive as the network hashrate reaches a Historical Record (ATH). At the end of March 2025, the Bitcoin hashrate reached 850 million th/s.

However, along with this impressive growth, the industry faces difficulties in increasing production costs and new tariff barriers, especially in the US (United States). These factors are exerting significant pressure on mining companies and can reshape the future of the sector.

Hashrate increases and mining costs

Bitcoin hashrate measures the total computational power used by miners to protect the network and validate transactions. It is expressed in Terahashes per second (TH/S), representing the number of hash calculations that the network performs every second.

According to the Blockchain.comBitcoin’s hashrate exceeded 850 million TH/s in March. This increase reflects growth in the number of miners who join the network and a growing confidence in the value and safety of Bitcoin.

Each time the network strengthens, Bitcoin becomes harder to attack, harder to ignore and more justified in commanding a higher assessment. This is not just code. Economic gravity. Bitcoin has become the safer monetary network that humanity has ever seen. And it’s just getting stronger. – Thomas Jeegers, CFO & COO DA commented.

Despite this increase in hashrate, mining profits are not rising in the same proportion. According to a report from Macromicrothe mining cost of a Bitcoin has doubled since the beginning of 2024, now reaching $ 87,000. The main factors behind this increase are the increasing prices of electricity and the high operating costs of Specialized Mining Hardware (ASICs).

With the price of bitcoin oscillating, Many mining companies risk operating with loss unless they optimize their efficiency. This challenge is particularly severe for smaller miners, who do not have the advantages of scale or cheap electricity access that large companies enjoy.

Tariff challenges and Chinese hardware dependence

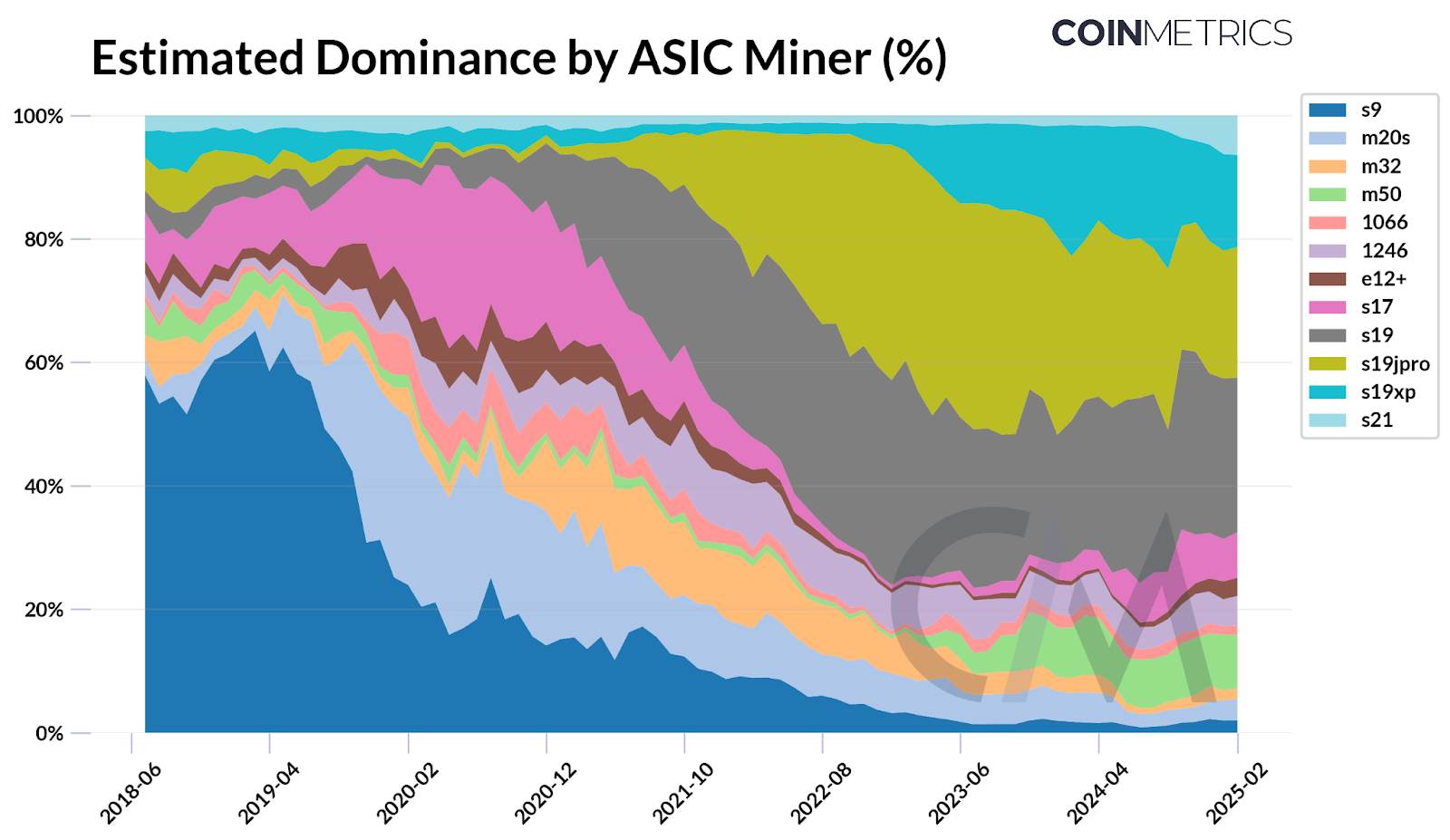

Another major obstacle to Bitcoin miners is commercial restrictions, especially in the US. According to CoinMetricsASIC miners produced by Bitmain, a Chinese company, account for approximately 59% –76% of the total hashrate of Bitcoin.

Bitmain has been a dominant participant in mining hardware, with popular models such as the Antminner S19 and S21 known for its high efficiency. However, in early 2025, some US mining companies faced delays in receiving Bitmain remittances due to stricter customs controls and new rates on Chinese imports.

With Bitmain responding to a majority of the Bitcoin network hashrate, the dependence of a single manufacturer, despite having distributed supply chains, has a potential risk. Because Bitmain is mainly based on China, its domain highlights how geopolitical dependencies can affect the stability of mining operations, coinmetrics reported.

These rates are not new. According to the SCMPthe US have imposed up to 27.6% rates on China imported mining equipment since 2018.

However, recent measures indicate an increase in regulatory inspection and commercial pressures, further raising import costs for mining hardware. This inflates US -based miners’ operating expenses and interrupts supply chains, limiting their ability to climb as the global hashrate increases.

Recently, Hut 8 Corp., a Bitcoin mining company and high -performance computing infrastructure, has partnered with Eric Trump and Donald Trump Jr. to establish the American Bitcoin Corp.

The company aims to become the largest and most efficient bitcoin mining operation globally while building a strong strategic Bitcoin reserve. This movement highlights the growing interest of US institutional investors in the competitive mining industry.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.