Bitcoin (BTC) has shown signs of weakness after failing to break the key resistance at $ 88,800 in recent days. In the last 24 hours, the price has fallen below $ 87,000, further signaling the short -term impetus.

Technical indicators like DMI and Ichimoku Cloud now point to a trend change, with salespeople increasingly taking control. While BTC hangs around critical support zones, US economic data that are coming can play a crucial role in determining whether the next movement will be a deeper recovery or correction.

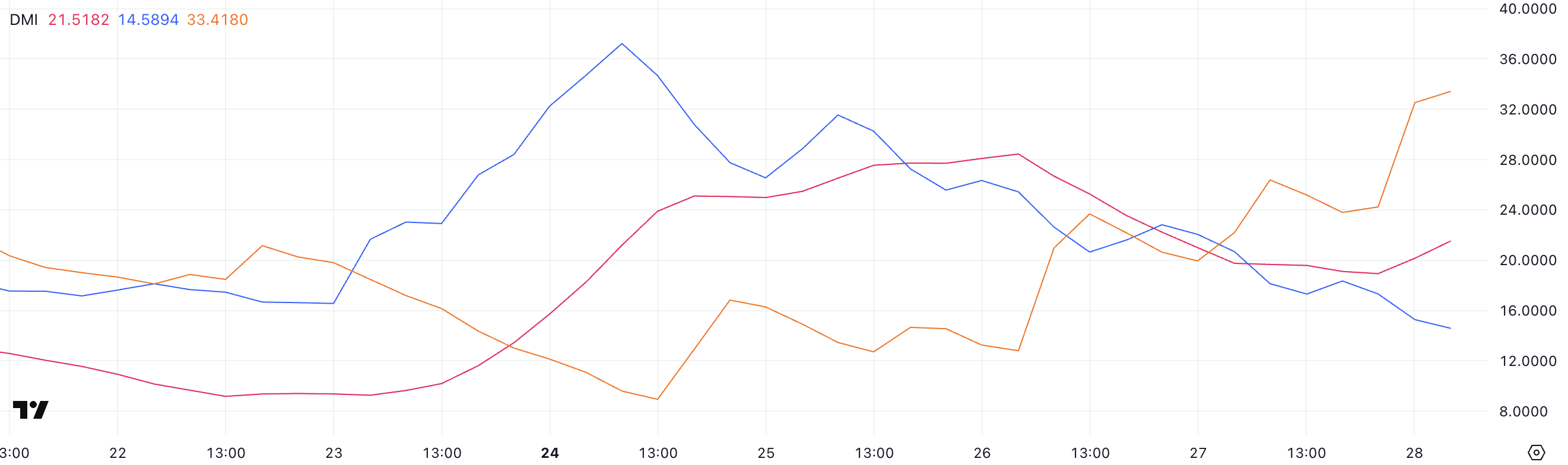

Bitcoin DMI shows that sellers have taken control

The DMI (Directional Movement Index) chart (Currently shows ADX in 21.51, indicating a weakened trend force.

In fact, the trend has recently changed from a tall to a low trend, as reflected in changing directional indicators. In recent days, the BTC has lost its rise, and the bears have taken control.

This transition is significant because it often precedes continuous sales pressure unless bulls can resume control quickly.

ADX (ADX Directional Index) measures the strength of a trend, regardless of its direction. Generally, an ADX below 20 suggests a weak or nonexistent trend, while a reading above 25 implies that a strong trend is underway.

Currently, with ADX in 21.51, Bitcoin is in a growing but not yet strong force zone. Meanwhile, the +di, which represents the high force, dropped dramatically from 26.33 to 14.58, signaling a decline purchase pressure.

At the same time, the -i, representing the low pressure, rose from 13.2 to 33.41, suggesting that sellers firmly assumed control. This sharp cross between +di and -i points to a clear change in market sentiment and can mean more disadvantages to the short -term BTC if the current trend continues.

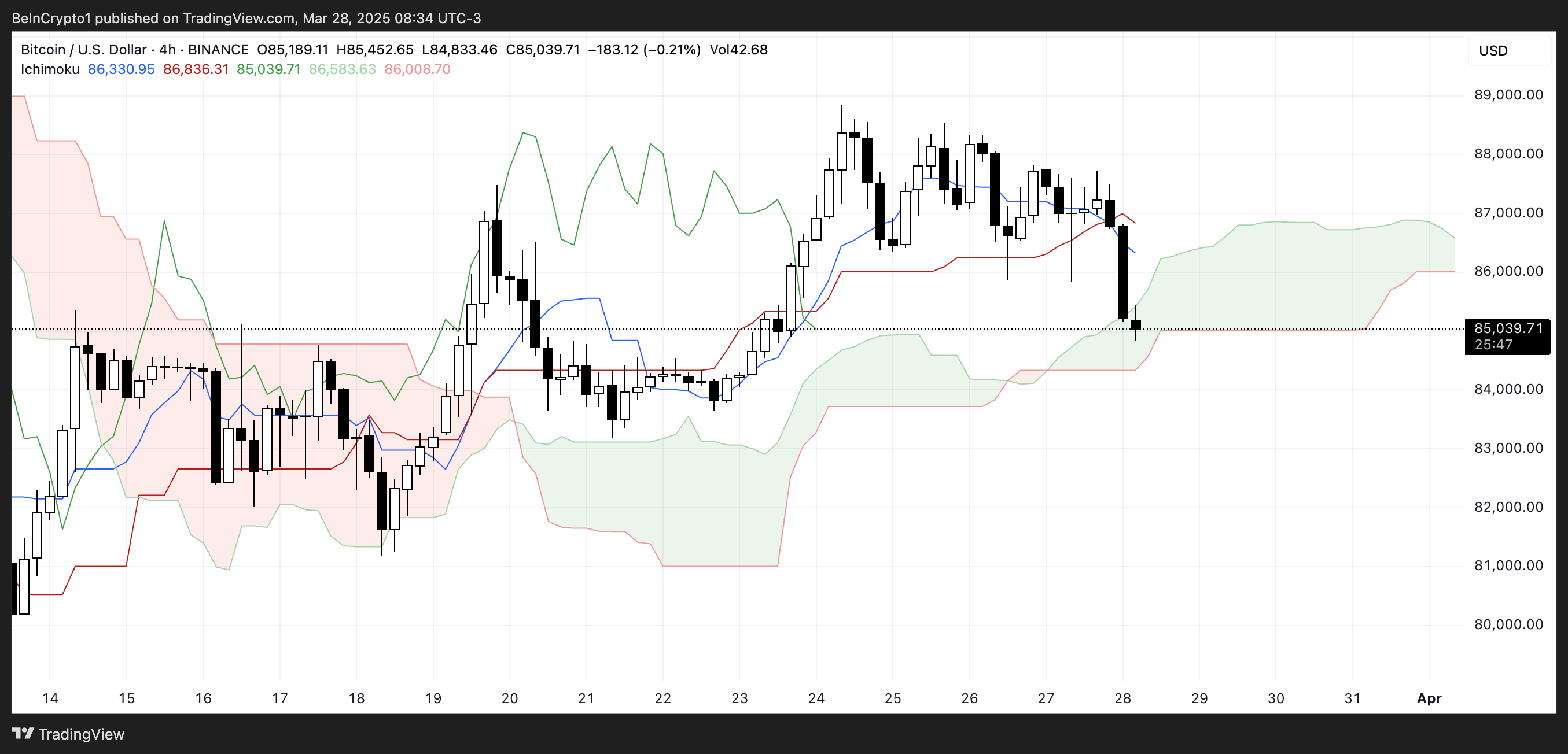

BTC’s Ichimoku cloud shows that the fall can intensify

Bitcoin’s Ichimoku Cloud chart is showing signs of a short -term low change. The price action broke below the Tenkan-Sen (blue line) and the Kijun-Sen (Red Line), indicating a weakening of the moment.

More importantly, the latest candle decisively pierced the lower limit of the green cloud (Kumo), suggesting a potential trend reversal or the beginning of a deeper correction.

This break also means that the cloud, which previously acted as a support, can now start serving as resistance if the price attempts a recovery.

In the Ichimoku system, the cloud represents both support/resistance and feeling of trend. When the price is above the cloud, the trend is high; below it, low; And inside it, the market is in consolidation.

With the current price falling below the cloud, this signals that the low pressure is taking control. The future cloud also seems to be tuning, suggesting a reduced trend force ahead.

Unless the BTC quickly recovers the cloud and resumes Tenkan-Sen, the trend will probably remain low, with salespeople having the advantage.

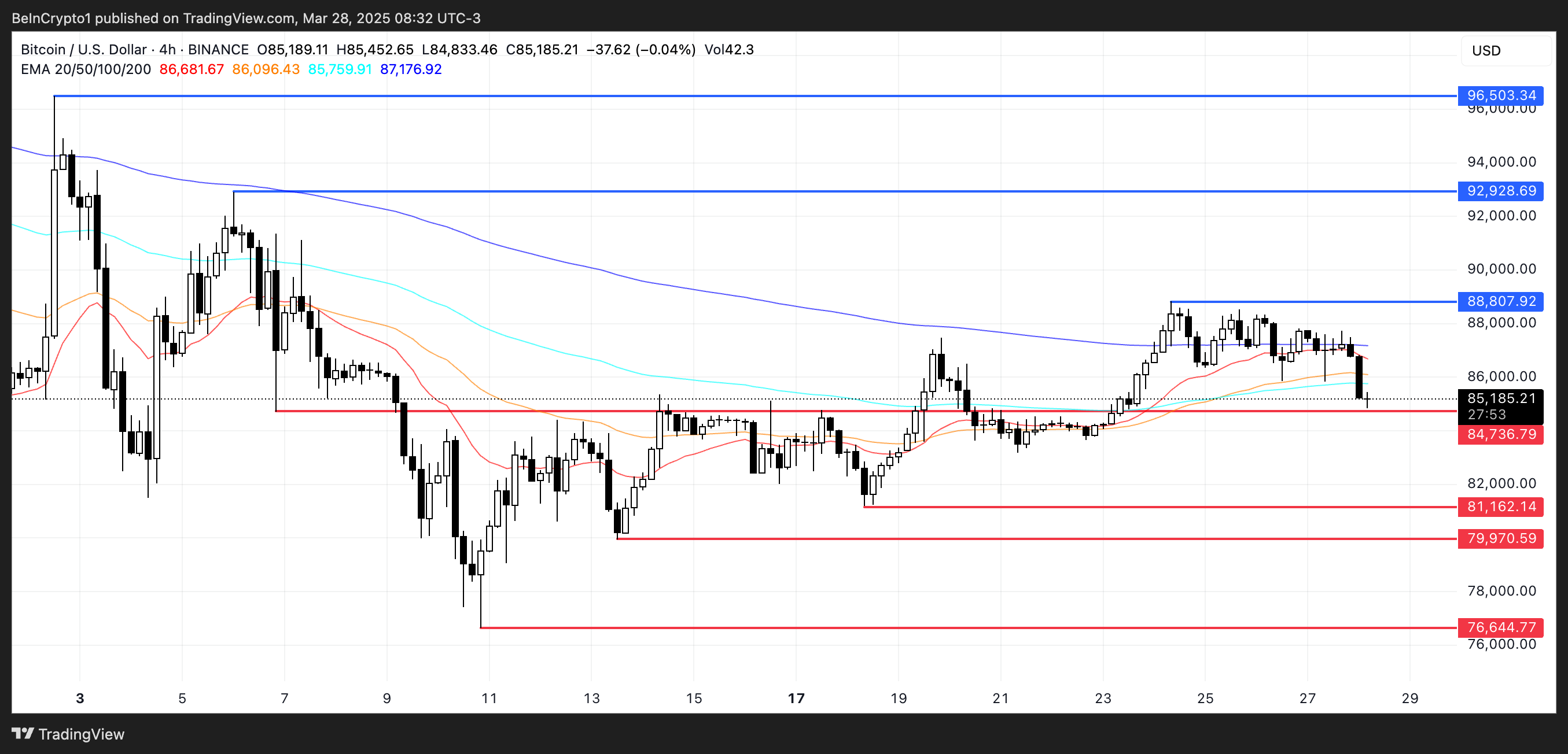

Will Bitcoin recover $ 100,000 in April?

The price of Bitcoin recently failed to break the resistance zone close to $ 88,800 and is now heading for a key -standing level at $ 84,736.

This level will be crucial to determine the price direction in the short term. If it is broken, the market can enter a stronger corrective phase, potentially leading the BTC toward the next $ 81,162 support.

A loss of this area can expose Bitcoin to more disadvantages, including a fall below the $ 80,000 psychological brand, with $ 79,970 and $ 76,644 acting as subsequent support levels. The structure suggests that bears are gradually gaining ground, and unless strong recovery will occur soon, deeper retractions remain at the table.

That said, next US Macroeconomic Catalysts, such as PMI data and consumer trust reports, can influence the moment in favor of bulls.

If these events improve market sentiment and boost Bitcoin up, the price can again test the resistance of $ 88,800. If the BTC breaks above it this time, the next targets are around $ 92,928 and potentially $ 96,503.

Sustained rally beyond these levels can rekindle the hopes of a backward movement towards the $ 100,000 milestone in April.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.