Asset manager Ark Invest has revised her projections for the price of Bitcoin 5 years from now and, in her most optimistic scenario, estimates that cryptocurrency can reach $ 2.4 million per unit – an appreciation of more than 2,400% over the current quota.

The new estimate follows the previous projection of the manager, which was US $ 1.5 million per unit, representing a 60% increase and reinforcing optimism in relation to the potential for valuing bitcoin.

Will Bitcoin climb a lot until 2030?

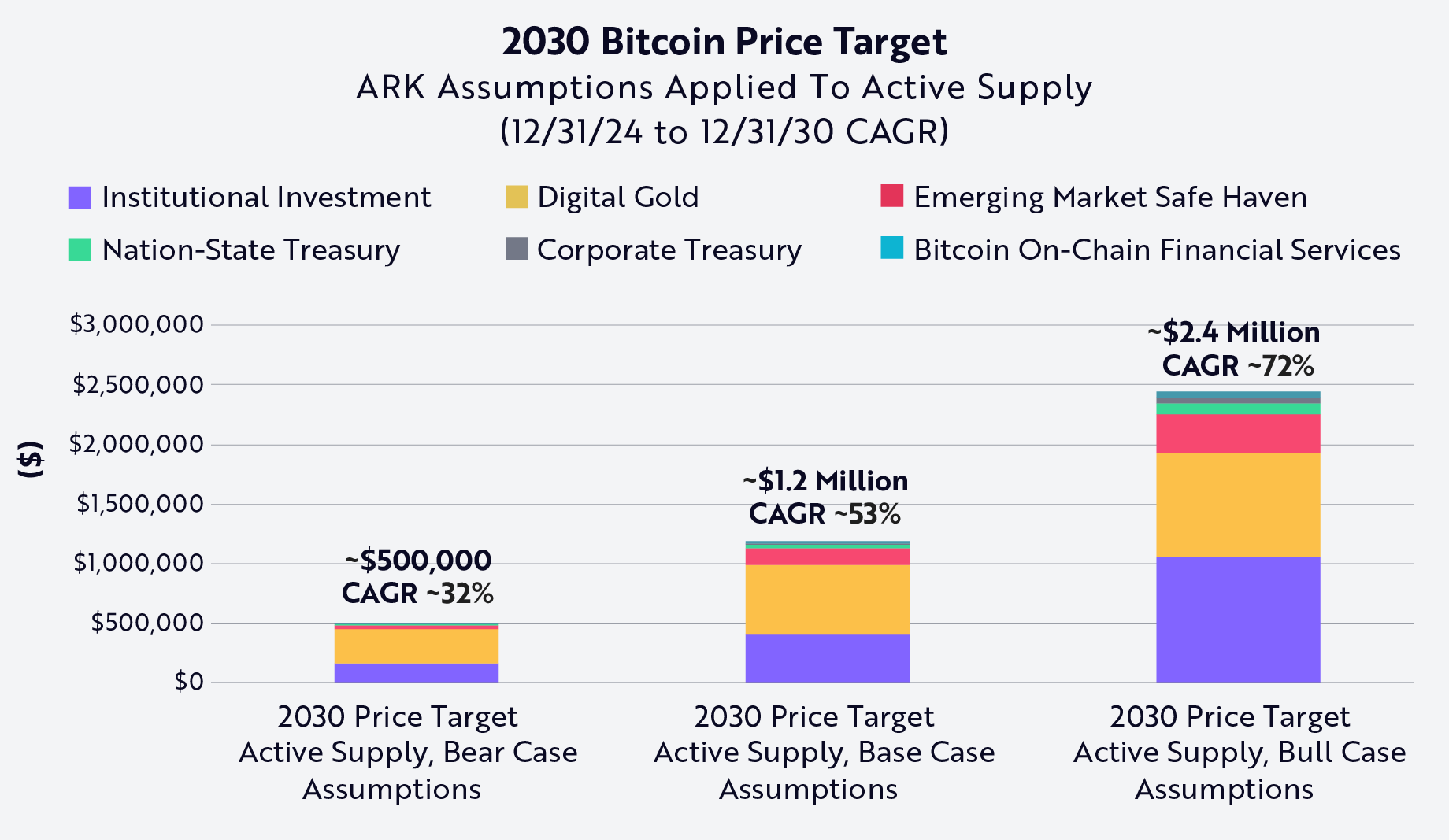

Ark Invest projects that Bitcoin reaches a 72% compound annual growth rate (CAGR) in the most optimistic scenario. Analyst David Puell also updated estimates for base and pessimistic scenarios.

The pessimistic scenario was revised from $ 300,000 to $ 500,000, with an estimated CAGR of 32%. The base projection rose from US $ 710 thousand to $ 1.2 million, indicating a cagr close to 53%.

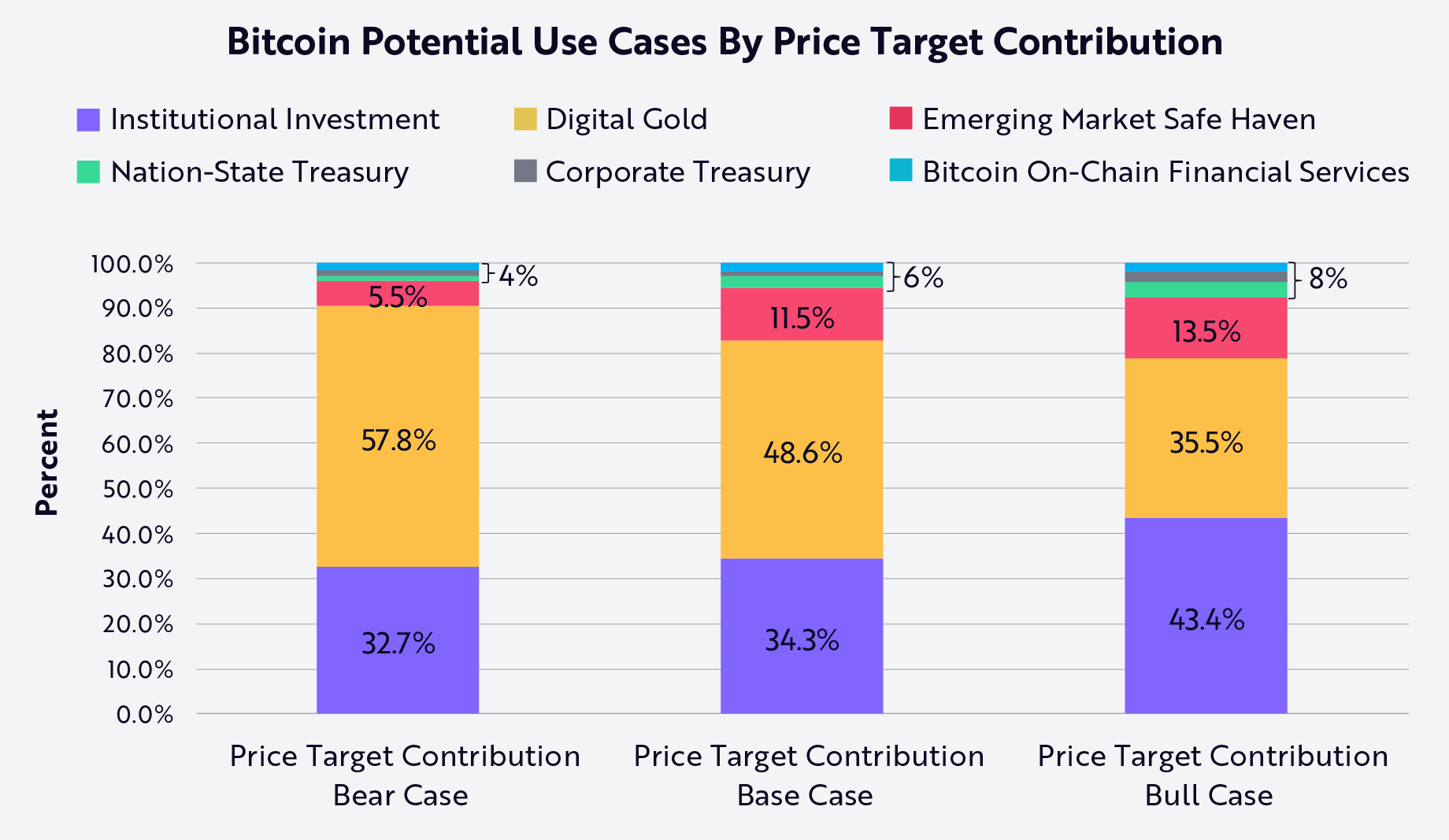

The report highlights six potential taxpayers to appreciate the price of bitcoin. Key factors include institutional investments and the role of cryptocurrency as protection against inflation and devaluation of it. In addition, Bitcoin status as digital gold further increases its price potential.

Among the secondary factors are the possibility of more countries – including the United States – adopting Bitcoin as reserve assets. Corporate treasury also have been diversifying their reserves with BTC, following the example of companies such as Strategy (former Microstrategy). In addition, cryptocurrency on-chain financial services have the potential to attract capital by replacing traditional financial system structures.

Although institutional investment contributes more to our optimistic scenario. Interestingly, nations treasurers, corporate treasurers, and Bitcoin’s decentralized financial services contribute relatively little in each case, Puell commented.

ARK’s new methodology raises Bitcoin price projections

Bitcoin’s price projection by Ark for 2030 is based on the analysis of total addressable markets (TAMs) and estimated penetration rates for each segment. The model also takes into account the deterministic supply schedule of cryptocurrency, which is expected to reach approximately 20.5 million units by the end of the decade.

A key innovation in this year’s model is the use of Bitcoin’s “active supply”, which discounts lost or long -term lost coins. This approach leads to price goals approximately 40% higher than those based on the base model.

Estimates built with this more experimental methodology are more aggressive than those in our pessimistic, base and optimistic scenarios, the report added.

Bitcoin Price Optimistic Predictions

Meanwhile, Ark is not alone in its optimistic perspective. Michael Saylor, founder and president of Strategy, recently It predicted that Bitcoin market capitalization will eventually reach $ 500 trillion, exceeding gold, long -term real estate and financial assets to become the main value reserve.

He made this bold forecast during Digital Asset Summit in March 2025. If Bitcoin reaches a market capitalization of $ 500 trillion with its supply of 21 million tokens, it would result at a price of about $ 23.8 million per currency.

Meanwhile, Standard Chartered predicts Bitcoin could reach $ 500,000 by 2028. Adding to the optimistic perspective, Iren CEO Daniel Roberts emphasized that Bitcoin could reach $ 1 million over the next five years. Thomas Fahrer, co -founder of Apollo, shares a similar perspective.

However, according to Samson Mow, CEO of PixelMatic, cryptocurrency can reach $ 1 million by the end of 2025. The HC Wainwright investment bank also reviewed its projection to the same period, raising it from $ 145,000 to $ 225,000. Already Tom Lee, co -founder of Fundstrat, believes that digital assets can exceed $ 150,000 in 2025, even in the face of its well -known volatility.

Although the numbers reflect the strong belief of the market in the largest cryptocurrency, it is still uncertain if these predictions will actually materialize.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.