Bitcoin market dominance (BTC) increased to 64%, reaching its highest level in more than four years.

However, experts heard by beincrypto remain divided over what this means for the future. Some predict a season of imminent altcoins, while others warn that Bitcoin’s dominance may continue to suppress altcoins.

What does the growing dominance of bitcoin mean?

To contextualize, the dominance of bitcoin (BTC.d) refers to the percentage of the total capitalization of the cryptocurrency market that the BTC has. It is a key indicator of Bitcoin’s market force compared to other cryptocurrencies. An increase in dominance suggests that Bitcoin is overcoming altcoins, while a decrease can signal growing interest or investment in other digital assets.

In addition, the indicator has been constantly increasing since the end of 2022. According to the latest data, it rose to 64%, marking levels last seen at the beginning of 2021.

Benjamin Cowen, founder of Into The Cryptoverse, stressed that the number is much higher when we exclude the stablecoins.

“Excluding Stablecoins, Bitcoin’s dominance is now 69%,” he said.

The increase in Bitcoin dominance has generated debate between analysts about their implications for altcoins. Cowen believes that there will be a descending correction or movement in Altcoins before substantial gains can be expected in the market. This implies that the Altcoins season may not be imminent yet.

“I think the Alt/BTC pairs need to fall before they can rise,” he said.

Nordin, founder of Nour Group, also expressed caution. He emphasized that Bitcoin’s dominance is approaching the levels seen during the peak of the 2020 low market.

“This is not just a BTC movement. It’s capital spinning out of the Alts,” noted.

In addition, Nordin warned that a break over 66% could intensify the sales pressure on altcoins. This, in turn, could delay the Altcoins season.

“Bitcoin dominance back to 64%. Without Alt seasons in 2024 or 2025,” analyst Alessandro Ottaviani commented.

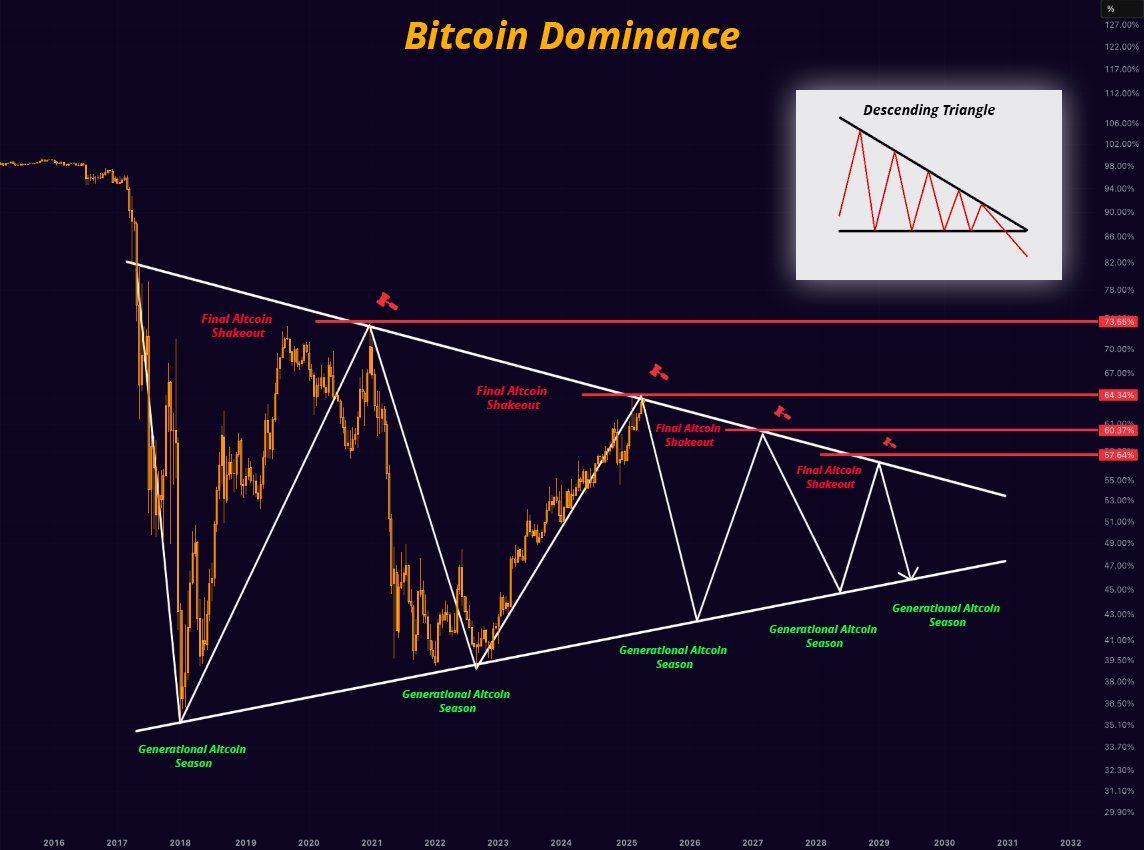

On the other hand, analyst Mister Crypto predicts that Bitcoin dominance can follow a long -term descending triangle pattern. A descending triangle usually suggests a low time, where price or dominance gradually decreases as lower maximums are formed.

However, this could extend your market control before a broader correction allows altcoins to gain strength.

For BitWardinvest CEO Junaid Dar, the scenario is optimistic. According to your analysis, if Bitcoin’s dominance drops below 63.45%, this could trigger a strong upward movement in the Altcoins. He believes this would create an ideal opportunity to profit from Altcoins positions.

“For now, the Alts are stuck. Just a matter of time,” added.

Come on? Tether dominance signals potential Altcoins season

Meanwhile, many analysts believe that Tether’s (USDT.D) dominance trends signal a potential Altcoins season. From the point of view of technical analysis, USDT.D has reached a resistance zone and may be about to correction, suggesting the possibility of capital flowing from USDT to altcoins.

Another Analyst It also emphasized that the dominance of USDT.D and USD Coin (USDC.D) reached resistance, predicting a season of Altcoins. Doğu Tekinoğlu came to similar conclusions by observing the combined graph of BTC.D, USDT.D and USDC.D.

As Bitcoin’s dominance increases, investors are closely monitoring these technical and on-chain signs. The interaction between Bitcoin’s strength and Stablecoins dynamics can determine whether altcoins will return this summer or face more consolidation. For now, the influence of bitcoin on the market remains firm.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.