Another day, another movement in the markets. From new ETF influences signaling institutional appetite to derivative data revealing where traders are betting, today’s analysis offers important insights on what is boosting price action.

Let’s look at the latest trends that are shaping ETFs and derivatives.

The reduced cryptocurrency market activity observed in March caused BTC ETFs in sight to record a monthly exit of US $ 767 million. However, with the broader recovery of the ongoing market, April started well.

On April 2, BTC ETFs in sight had a positive increase in the influx, with $ 221 million entering Bitcoin products in sight. Ark Invest’s ETF Arkb and 21shares led this influx, with a daily net influx of $ 130.15 million, raising its net assets under management to $ 4.14 billion.

However, not all funds shared this positive trajectory, as Blackrock’s ETF Ibit experienced liquid exits totaling $ 115.87 million.

At the time of this analysis, Bitcoin ETFs in cash have a total amount of net assets of US $ 97.35 billion, representing 5.73% of the market capitalization of the coin of US $ 1.65 trillion.

BTC derivative activity cools, selling options exceeds purchase

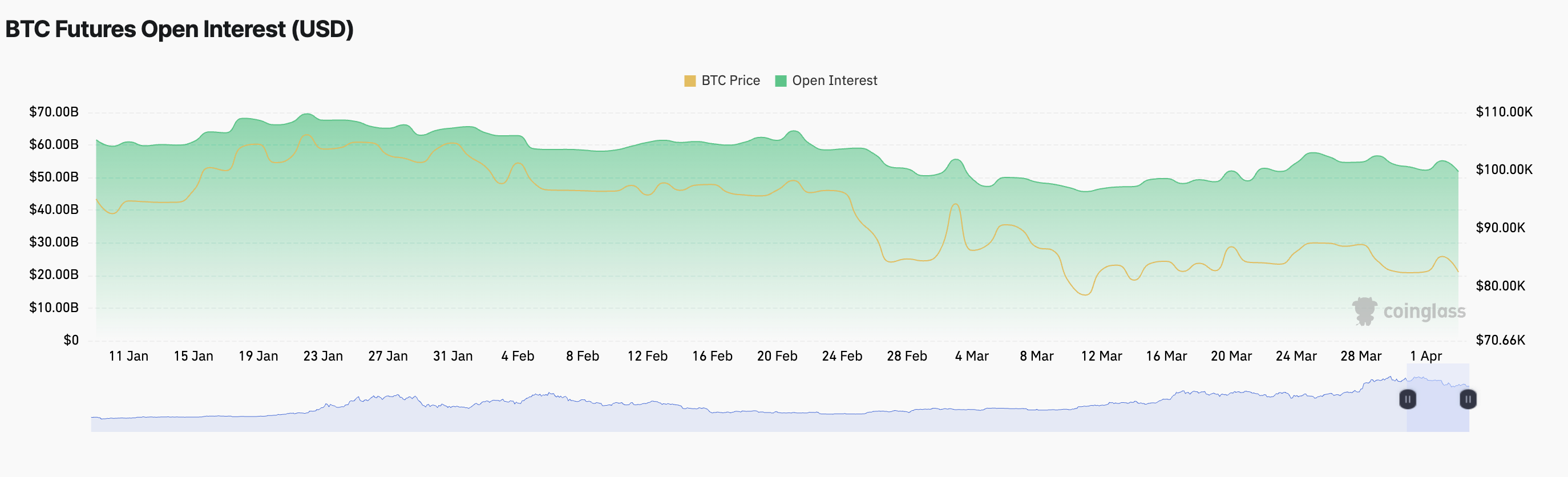

Meanwhile, the activity in the BTC derivatives market has decreased, with the open interest of currency future falling 7% in the last 24 hours. At the time of publication, according to Coinglass data, this is $ 51.82 billion.

The open interest of an asset measures the total number of open derivative contracts (such as future or options) that have not yet been settled.

In fact, the value of the BTC fell 1% during the period under analysis, confirming the drop in negotiation activity. When BTC’s open interest drops along with its value, this indicates that traders are closing positions instead of opening new ones, increasing the low pressure on the price of the coin.

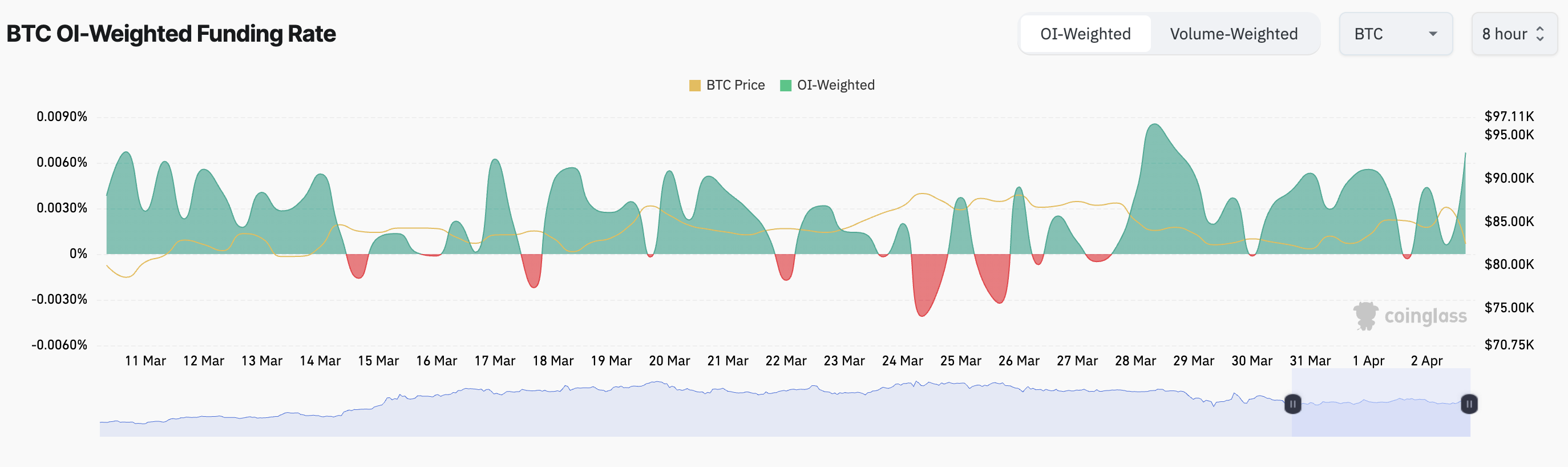

However, the positive currency financing rate offers some relief. At 0.0067% at the time of publication, the BTC financing rate reflects a strong demand for long positions in relation to shorts, highlighting the resilience of holders, despite the volatility of the price of the BTC.

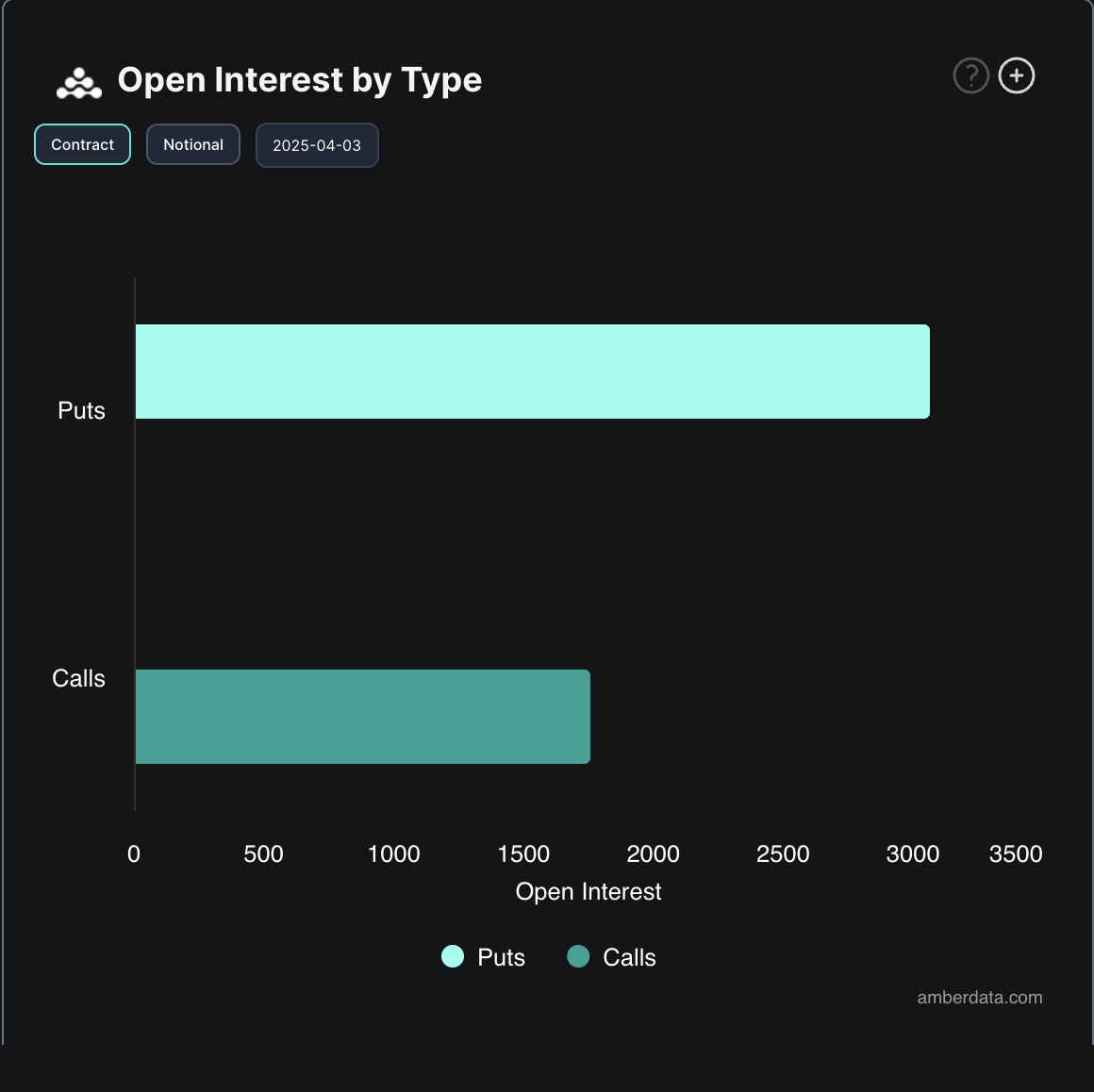

This low bias is also reflected in the options market today, with sales options surpassing purchase. This suggests that traders are increasingly betting on the drop or stagnation of the price of Bitcoin, further reinforcing negative feeling.

In addition, a larger number of selling options such as it signals that market participants are preparing for a possible drop, which can contribute to greater weakness in the price of the BTC if this feeling persists.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.