The main cryptocurrency, Bitcoin, fell below the $ 75,000 mark. At the time of writing this text, the currency is being negotiated around $ 74,800, levels last seen in November 2024.

The asset fell 7% in the day, while the negotiation volume fired more than 200%, signaling intense sales pressure. With a low -strengthening bias, the main crypto may be about to record new minimums in the short term.

Bitcoin futures show traders coming out, but bulls don’t give up

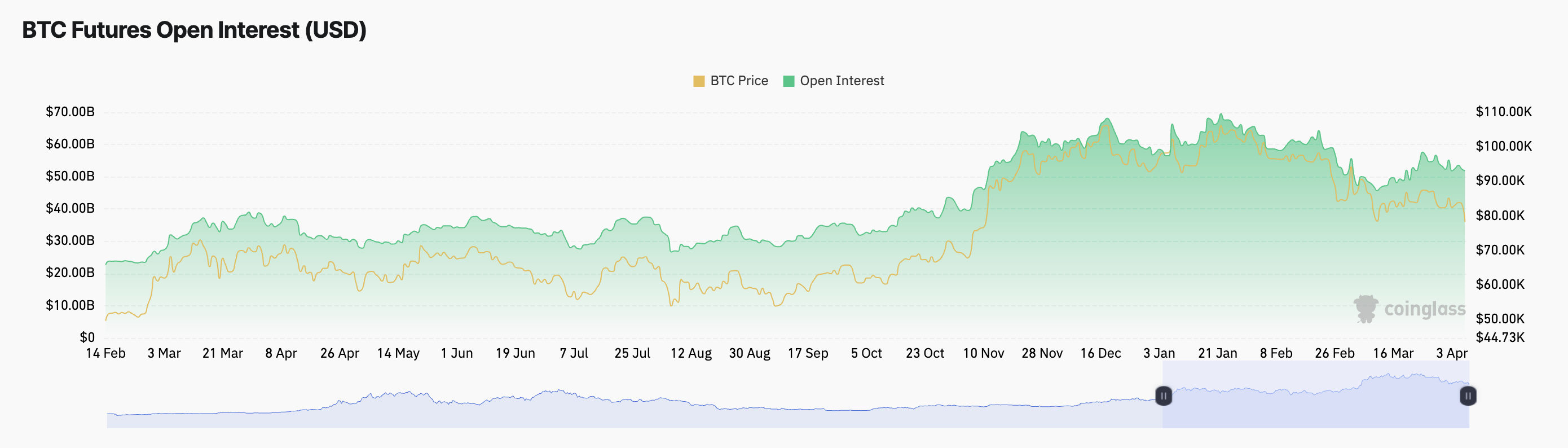

This low wave in the BTC market is reflected in the fall of the currency future Open (OI), which indicates that traders are closing positions and leaving the market. At the time of publication, this is $ 51.88 billion, falling 1% in the last 24 hours.

The BTC futures hi measures the total number of active future contracts that have not been settled or closed. When it falls like this, it usually indicates that traders are ending positions – whether to make profits or cut losses – time to open new ones.

This fall signals a reduced market share and a decreasing confidence in the possibility of any short -term price recovery.

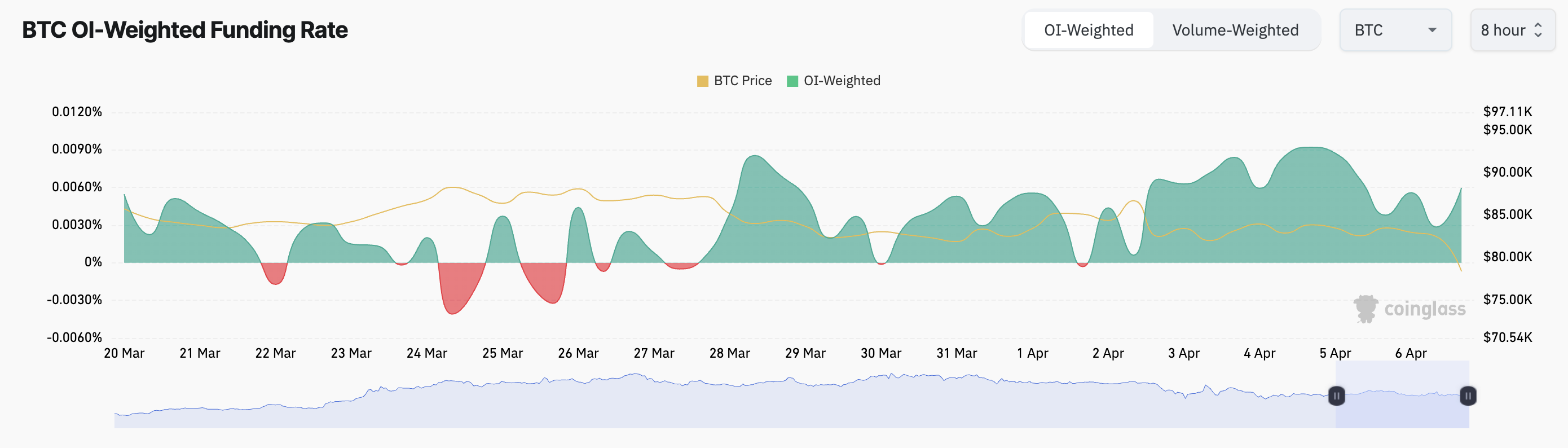

However, despite the sharp drop, the feeling of the market remains surprisingly resilient. BTC’s positive and stable financing rate, currently at 0.0060%, reflects this.

The financing rate is a periodic payment between long and short traders in perpetual future contracts, designed to keep prices aligned with the market in cash. A positive financing rate means that traders that keep long positions are paying those with short positions, indicating that more traders are betting on high prices.

This trend reflects the mastery of optimistic feeling among many BTC holders in the market, even while currency prices are falling temporarily.

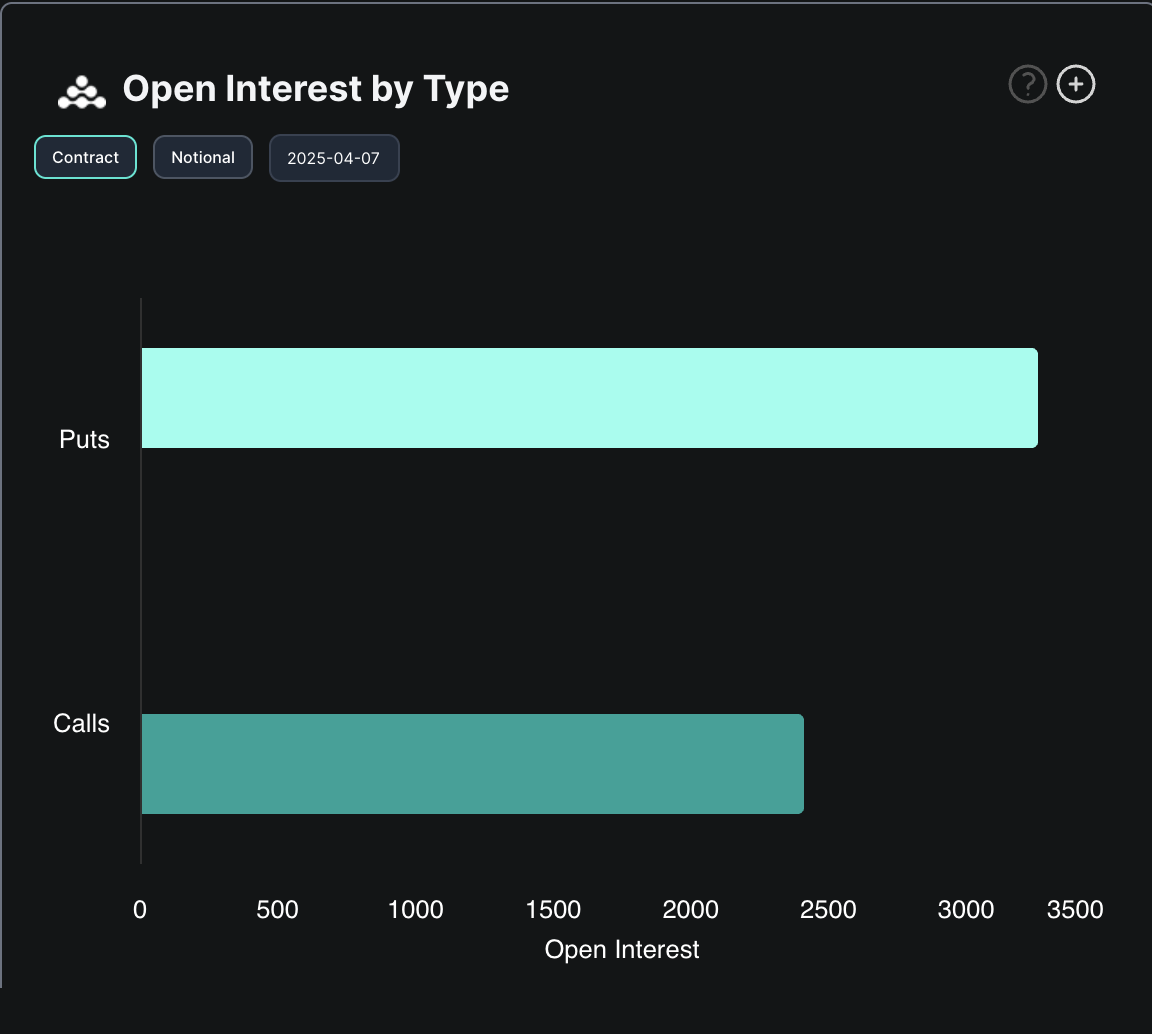

Options traders prepare for more fall

Option market data confirms increased sales pressure between traders. According to Deribit, there are currently more open sales contracts than purchase. This is a clear sign that investors’ confidence in Bitcoin’s short -term recovery continues to decrease.

It can be said that this mixture of optimistic financing signs, pessimistic options positioning and hi falling for one thing. Highlights a conflict market, where the feeling is divided and Uncertainty reigns. Therefore, caution is advised.

The Bitcoin article falls below $ 75,000: Is it time to buy at the fall? It was first seen at Beincrypto Brasil.