While the main currency, Bitcoin, has faced one of its lowest weeks since the beginning of the year, on-chain data suggest that miners have significantly contributed to increasing sales pressure.

On-chain data reveal that Bitcoin network miners have increased their coin sales activity, a trend that can aggravate descending pressure on the price of the coin.

Bitcoin bears assume control as a reserve of miners falls

According to Cryptoquant data, the BTC miners reserve constantly decreased this week. At the time of this analysis, it is 1.80 million BTC, a 1% drop from the previous week.

The reserve of BTC miners follows the number of currencies maintained in the miners’ portfolios. It represents the reserves of currencies that the miners have not yet sold.

When the metric rises, miners are holding their coins more minored, usually signaling confidence in future price increases. On the other hand, when the reserve falls like now, miners are moving coins of their wallets, usually to sell, confirming the growing low feeling against the BTC.

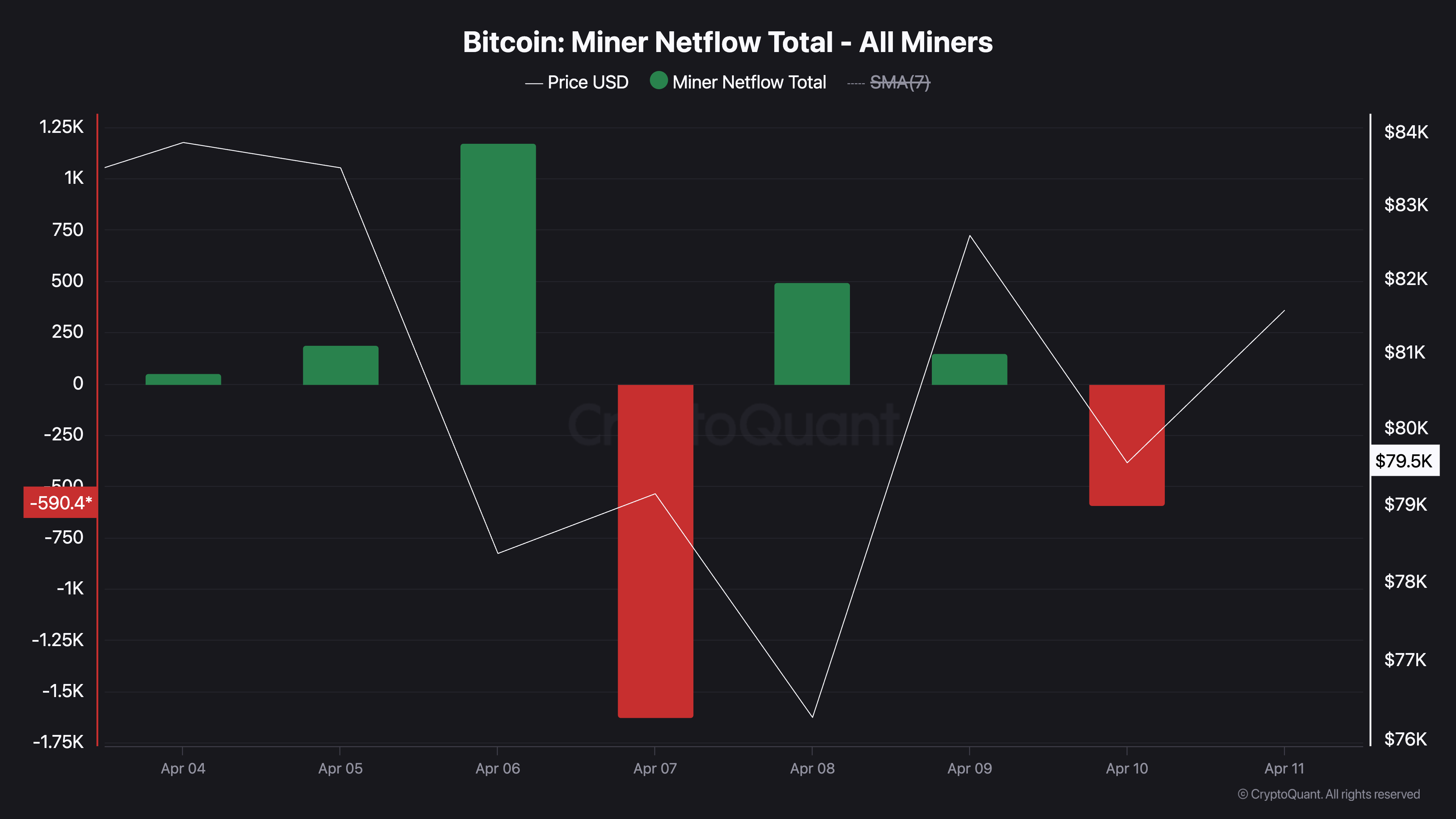

The negative net flow of currency miners confirms this trend further. On April 10, it was -590.40. The net flow of BTC miners follows the difference between the amount of coins sent to Exchange and what is removed.

When its value is negative, more coins are being moved from miners’ portfolios to Exchange, typically a precursor for sale.

With the additional descending pressure of this BTC holder segment, the price of currency can see deeper corrections in the short term if the purchase interest cannot counterbalance the ongoing settlement.

Bitcoin low trend can make price fall to $ 74,000

In the daily chart, the BTC remains significantly below its Super Trend indicator, which forms dynamic resistance above its price at $ 90,911.

This indicator follows the direction and strength of the price trend of an asset. It is displayed as a line in the price chart, changing color to indicate the trend: green to a tall and red trend to a low trend.

When the price of an asset is traded below your Super Trend indicator, the sales pressure dominates the market. This bassist trend can also lead BTC holders to sell, aggravating the price drop. If this happens, the price of coin can fall below key support at $ 80,776 to negotiate at $ 74,389.

However, if the market feeling enhances and currency holders reduce their sales activity, the BTC can reverse its low trend and rise to $ 86,172.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.