According to Glassnode, Bitcoin whales – entities that have over 10,000 BTC – reached an accumulation score of approximately 1.0 earlier this month, reflecting intense purchase activity.

This score marks a significant difference from the behavior of small holders, which are inclined to distribution.

Why bitcoin whales are buying while small holders sell

Glassnode highlighted the change in its latest X (former Twitter) publication.

Whales with more than 10,000 BTC briefly reached a perfect accumulation score (~ 1.0) earlier this month, published Glassnode.

This score reflected a period of 15 days of intense purchase activity. However, after this peak, the score fell slightly to about 0.65. Although this suggested a more moderate rhythm of purchase, it still pointed to constant accumulation by large holders.

Meanwhile, small bitcoin holders, categorized as those with possessions between <1 BTC and 100 BTC, have changed their focus to distribution. On-chain data revealed that these groups significantly increased their sales activity, with accumulation scores falling to between 0.1 and 0.2.

This divergence shows that the big players are still accumulating, while small holders are selling. Market feeling remains divided, observed a user no X.

The growing difference between the actions of large and small holders is indicative of divergent market feelings. Whales seem to bet on Bitcoin’s long -term growth. At the same time, small holders can be more cautious or reactive, choosing to settle their positions as a protection against possible market declines.

Contrastant strategies arise amid increasing geopolitical tensions and commercial wars concerns, which some analysts believe they will increase Bitcoin’s appeal as a protection. The sector expert Will Clemente recently commented on the broader implications.

Expanding vision, seeds are being planted for the global accumulation of BTC not only as protection against monetary supply, but also against unflobalization and geopolitical tensions. These allocation will not come overnight, but that’s what Bitcoin was done for, Clemente commented.

Despite long-term optimism, macroeconomic conditions weighed on the BTC, making it fall below $ 80,000. However, beincrypto data showed that Bitcoin had modest gains of 5.0% on the last day. At the time of writing, it was negotiated at $ 79,454.

Reservations in loss and pause on purchases indicate caution in the bitcoin market

In fact, the price drop has led to significant unchairmed losses to public companies that have Bitcoin reserves, with many now seeing their possessions evaluated below the acquisition costs. In fact, Strategy even paused its Bitcoin purchases, reflecting caution to the uncertainty of the market.

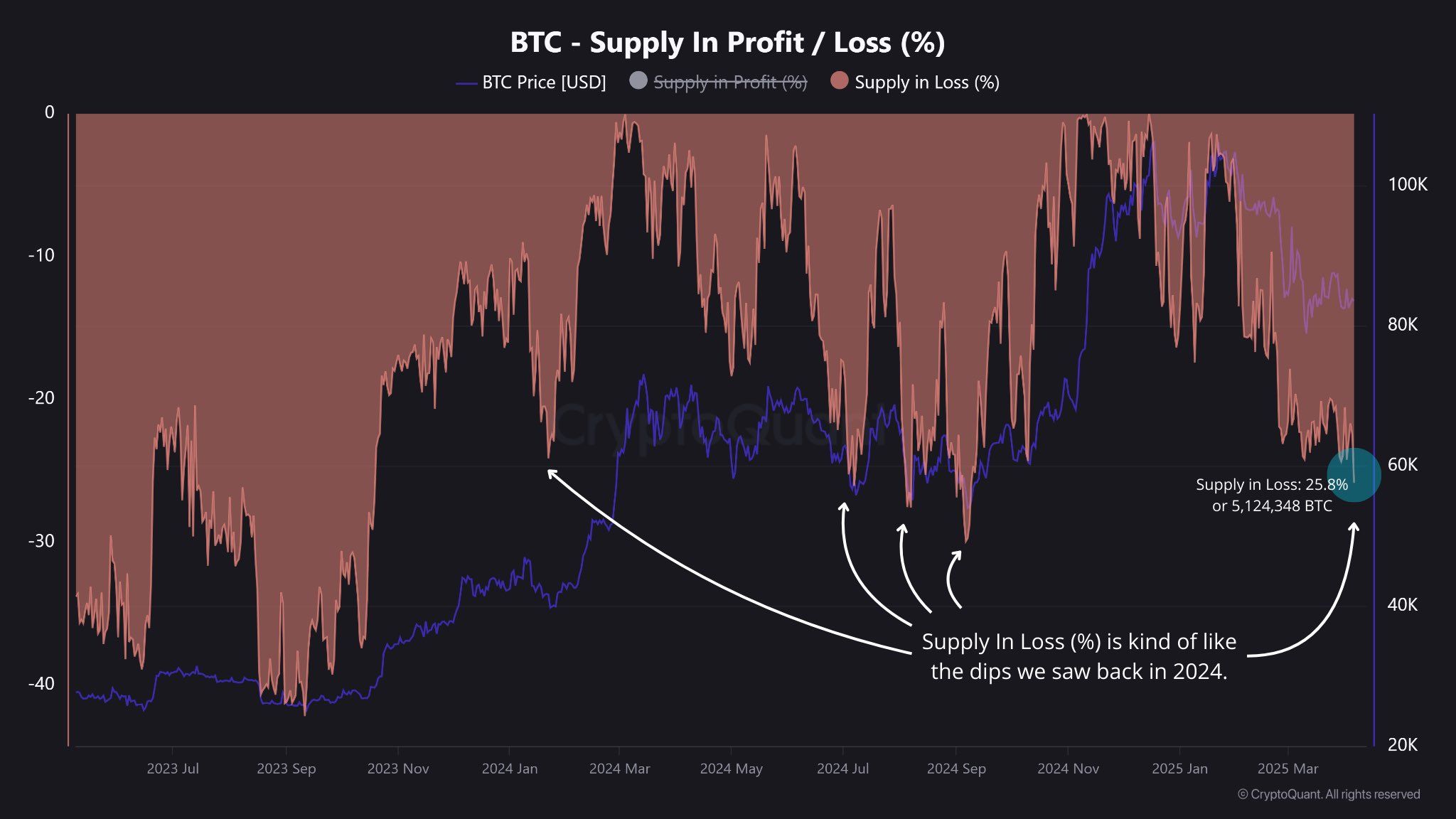

In addition, Cryptoquant data revealed that 25.8% of the total bitcoin supply is in loss.

Although it may seem alarming, it is not unprecedented, it observed the publication.

Cryptoquant added that similar scenarios occurred over 2024, where a substantial part of Bitcoin was also kept in loss. For example, in January 2024, 24.1% of Bitcoin in circulation was submerged. In September, this number rose to 29.9%.

Thus, these fluctuations show that periods when Bitcoin is kept in loss are not uncommon and part of the cyclical nature of the market, where price corrections affect a significant part of the supply.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.