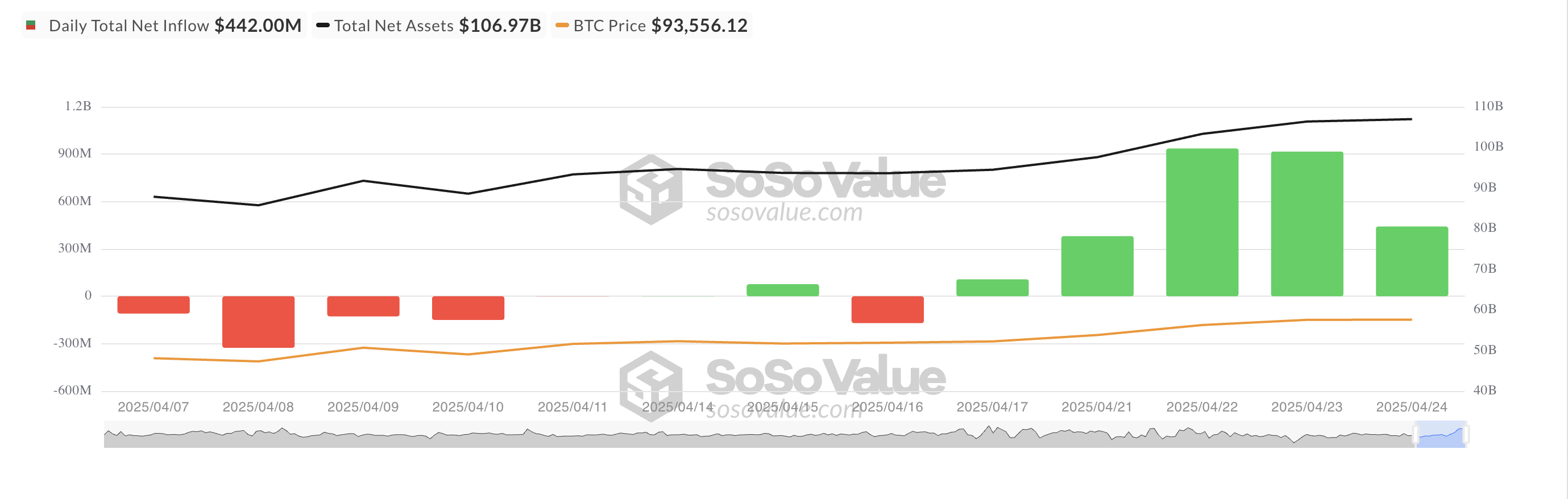

Bitcoin ETFs in sight extended their sequence of entries for another day yesterday (24), marking the fifth consecutive day of positive liquid flows. The total entry of the day was over $ 440 million.

Bitcoin ETF inputs reach US $ 2.68 billion a week

Continuous inputs occur amid modest market recovery in the last 24 hours.

On Thursday (24), Blackrock’s ETF Ibit recorded the largest daily net entry of US $ 327.32 million, raising its total cumulative liquid inputs to $ 40.96 billion.

Ark Invest’s ETF Arkb and 21shares ranked second with a net input of $ 97.02 million, raising its historical net inputs to $ 3.09 billion.

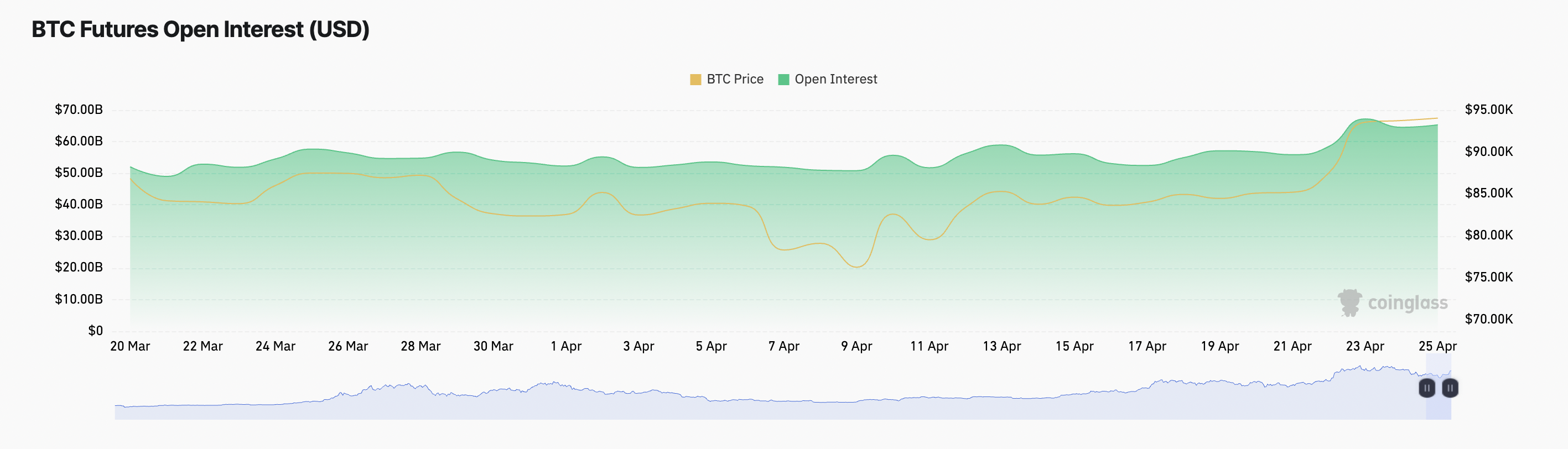

BTC futures show increased demand

The crypto market has witnessed a modest recovery in the last 24 hours, raising the price of the BTC by 1% on the last day. During the same period, open interest in BTC futures also increased, signaling a slight increase in investor demand.

At the time of publication, this is $ 65.31 billion, an increase of 1% today. The gradual increase in the price of the BTC and the open interest signals increasing market share and confidence in the ongoing trend.

This simultaneous increase suggests that new positions are being opened to support the price movement, often interpreted as a discharge indicator.

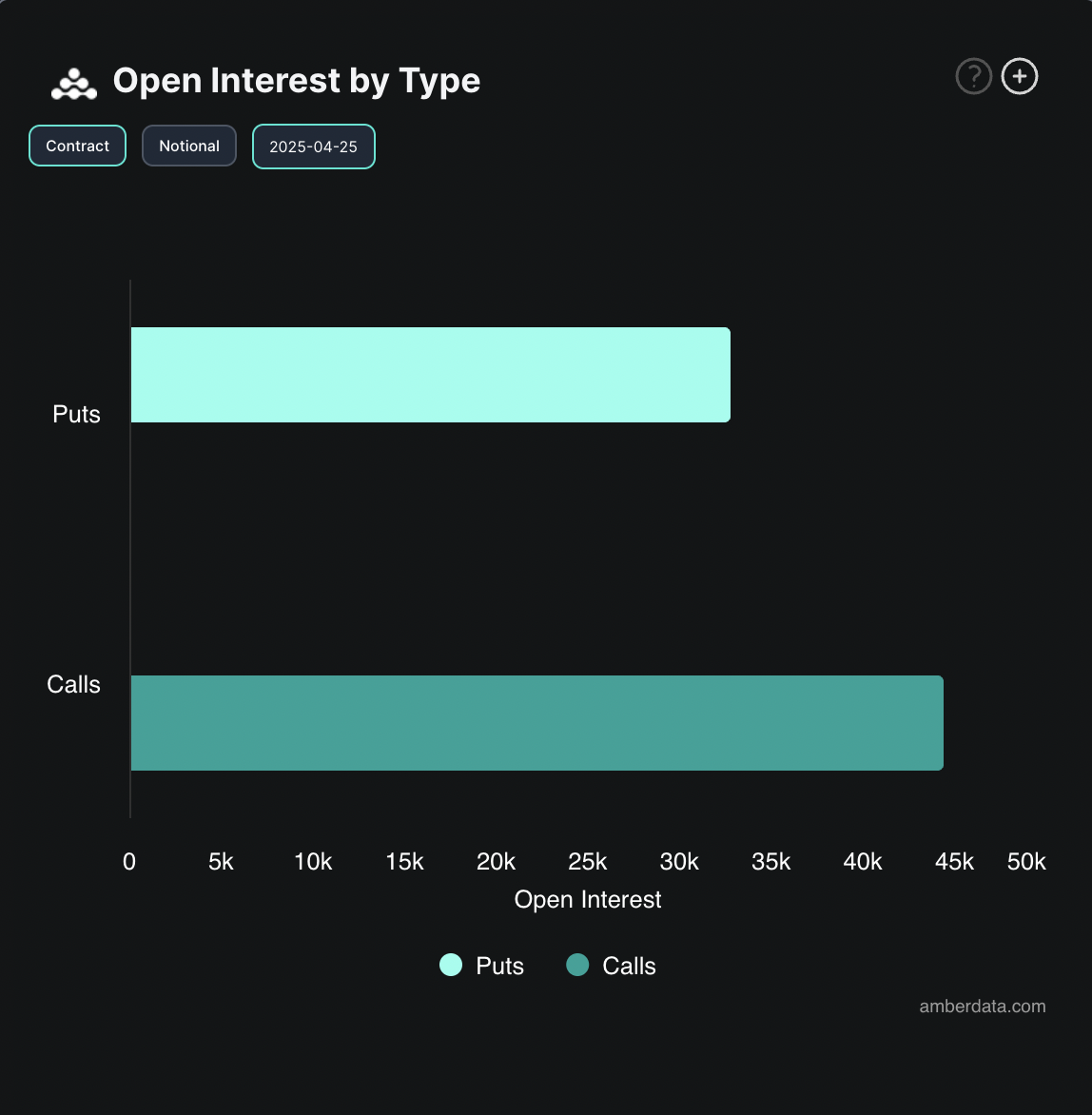

In addition, Call’s volumes surpassed PUT’s in the options market, reflecting a slope for the feeling of high. At the time of this report, the PUT-TO-CALL ratio of the coin is 0.74.

When the put-to-Call ratio of an asset is below 1, more call options are being purchased than puts, reflecting a feeling of discharge from options traders. This suggests that investors are positioning themselves to a high sustained in the price of the BTC.

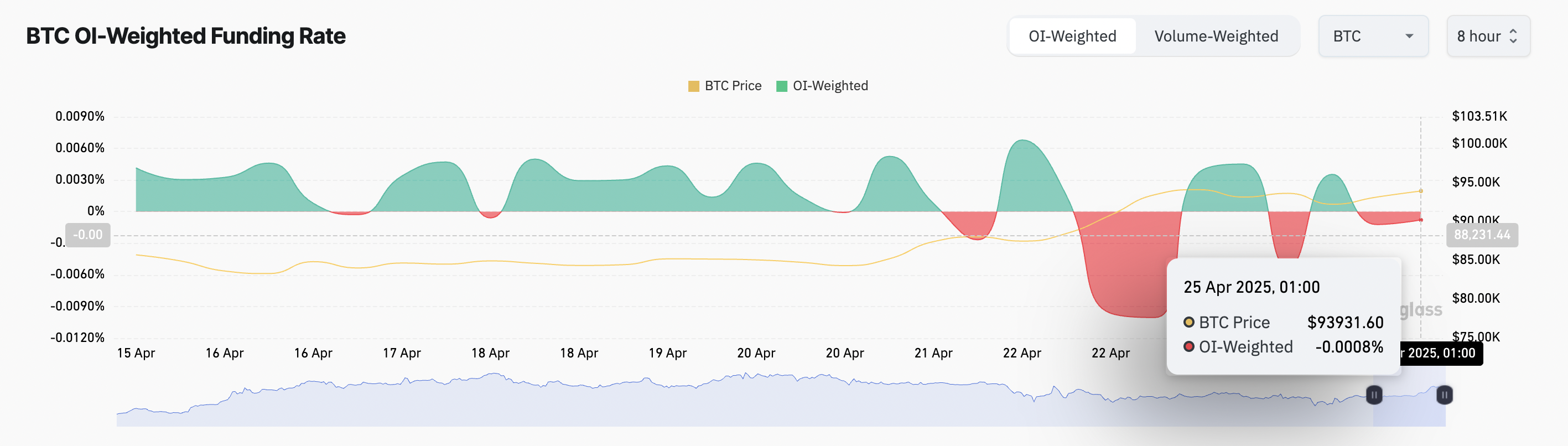

Optimistic feeling prevails

However, despite these positive indicators, the BTC financing rate remains negative. At the time of publication, the metric is -0,0008%.

In addition, the financing rate is a periodic payment between long and short positions in perpetual future contracts. It maintains the price of the contract in line with the market in cash. When the financing rate is negative, it indicates a feeling of low, as more traders are betting on a price drop.

This suggests that some futures traders are still betting on the short -term drop in the BTC, even if the demand for ETFs and market metrics show renewed force.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.