The crypto market continues to face a prolonged period of capital escape. According to the latest Coinshares report, investment products in digital assets experienced the fifth week of exits.

This occurs amid a feeling of continuous low, with Bitcoin (BTC) suffering the worst, as seen at its price, which remains well below the limit of $ 90,000.

Crypto exits increase to almost 1.7 billion

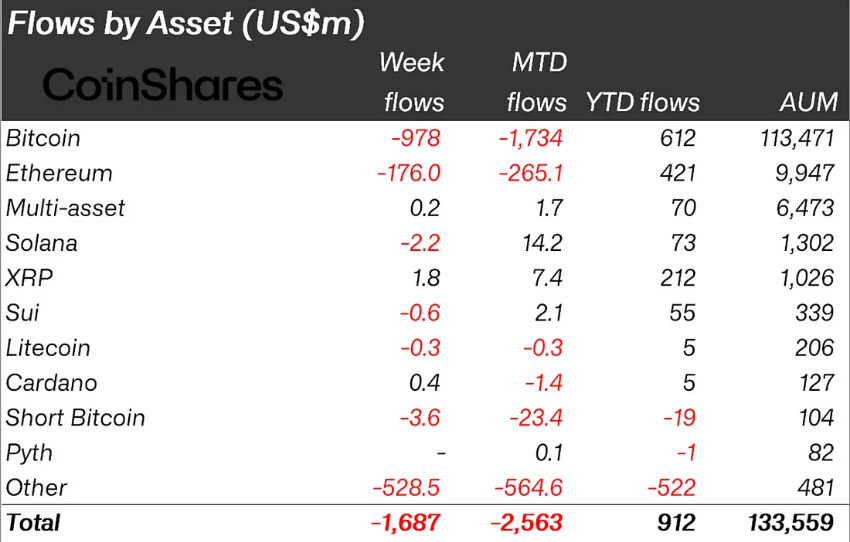

O report It indicates that total crypto exits reached $ 1.687 billion, raising accumulated losses during this negative sequence to $ 6.4 billion. With this, we have reached almost 20 consecutive days of exits, the longest period of uninterrupted capital withdrawals since 2015.

Despite the sustained drop, the year -year -old entries (YTD) remain positive at $ 912 million. However, the recent market correction and consistent removal from investors resulted in a drop of $ 48 billion in total management assets (AME) in investment products in digital assets.

According to the report, the US remains the epicenter of the ongoing crypto exits, with $ 1.16 billion in exits. This represents approximately 93% of all outputs during this negative sequence. In contrast, Germany has experienced a modest entrance of $ 8 million, indicating regional variations in investors’ feeling.

Bitcoin continues to support the worst of investors withdrawals, with an additional $ 978 million output last week, raising its five -week total to $ 5.4 billion. Meanwhile, the positions sold in Bitcoin also saw $ 3.6 million in exits, indicating a general decrease in low -pioneer crypto bets.

And how is the XRP?

While most digital assets have been dropped, XRP continues to attract investments. It registered an additional entry of $ 1.8 million, standing out as one of the few actives with positive impulse.

This optimism probably stems from the abundant hope of an imminent conclusion from the long legal battle between Ripple and the US SEC (Securities Commission). There is also hope that SEC can reclassify XRP as a commodity.

One of the most striking developments during this market fall was the almost elimination of assets under Binance management. The departure of a key investor drained almost all assets under Exchange management, leaving the company with only $ 15 million remaining.

Meanwhile, this sustained sale follows a standard of weeks with negative feeling. The previous week, crypto exits reached $ 876 million, with US investors leading market settlements.

Prior to that, the exits had already approached $ 3 billion, driven by the weak feeling of investors and increasing market fears.

Persistent crypto exits and the fall in Aum numbers suggest that trust in the sector has not yet recovered. However, hopeful acts – such as XRP entries and small gains in Germany, indicate that investors’ appetite has not completely disappeared.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.