The supply of profit bitcoin continues to rise constantly, despite recent setbacks and contrary winds in the market.

On-chain data show that more than 85% of the BTC circulating supply is currently in profit. This is a historically optimistic sign, but often marks the beginning of euphoric phases in market cycles.

BTC enters the territory of discharge, but analysts warn of possible retreat

The supply of profit BTC measures the percentage of investors who have acquired their assets at prices lower than today’s market value. When this number increases, it indicates broad confidence of investors and strong capital entrances in the asset.

In a new reportCryptoquant’s pseudonym analyst Darkfost found that more than 85% of BTC’s circulating supply is currently in profit. Although this trend represents an optimistic signal, it comes with a caveat.

“Having a large part of profit supply is not bad, quite the opposite. Of course, there are certain levels that are more“ comfortable ”than others, but usually an increase in profit supply tends to boost optimistic phases,” wrote Darkfost.

According to the analyst’s note, the market is now entering the euphoric area, a phase that arises when the profit supply approaches or exceeds 90%. These levels, although optimistic, often coincide with local market tops as traders begin to make profits, triggering short to medium term corrections.

“Historically, when profit supply has surpassed the 90%threshold, it consistently triggered euphoric phases, and now we are approaching this level. However, these euphoric phases can be short duration and are often followed by short to medium term corrections.”

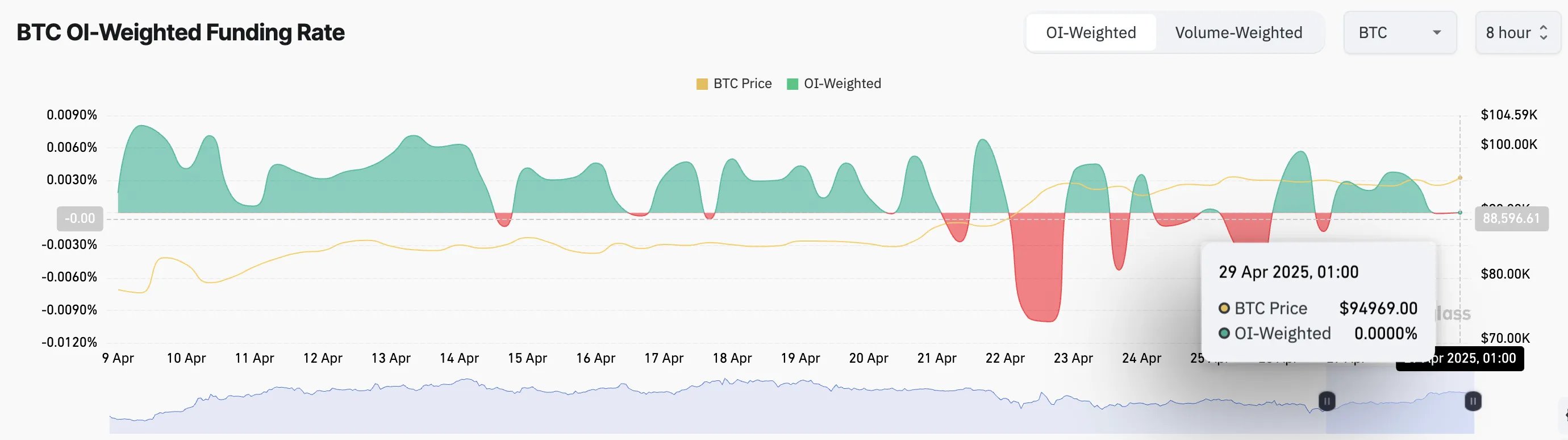

Financing rate signals market in waiting mode

Interestingly, the BTC financing rate remains relatively balanced, indicating that the market is in a state of advance. At the time of publication, the currency financing rate is 0%.

The financing rate is a periodic payment between traders in future perpetual markets, used to maintain the prices of contracts aligned with the market in cash. Just like the BTC, when the asset financing rate is 0%, it indicates a neutral market feeling, where neither long nor short positions dominate.

This signals that BTC investors are waiting for a catalyst to provide a clearer direction. This neutral market feeling and increased profit supply prepare the scenario for potential short -term price volatility.

Bitcoin remains firm below the resistance

At the time of publication, the main currency is being negotiated at $ 95,125, below an important resistance level of $ 95,971. Despite the recent market volatility, the demand for BTC among market participants remains significant, as reflected by its relative force index (RSI), which is currently at 68.21.

The RSI indicator measures the market conditions of overcomparance and overwheliness of an asset. It varies between 0 and 100, with values above 70 suggesting that the asset is overdone and due to a price drop. On the other hand, values below 30 indicate that the asset is overwhelmed and can witness a recovery.

Reading the BTC RSI indicates space for higher price growth before the currency becomes overcomposed. If the demand is strengthened, the currency could break above the resistance of $ 95,971 and rise to $ 98,983.

However, if the feeling of low grows, the BTC can resume its downward trend and fall to $ 91,851.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.