Bitcoin has struggled to break the $ 100,000 mark since early February amid the recent market volatility that left the main currency in a standard of waiting.

However, a new report suggests that this trend may change soon, with two indicators pointing to a high trend.

Bitcoin’s discharge cycle is not over yet, says analyst

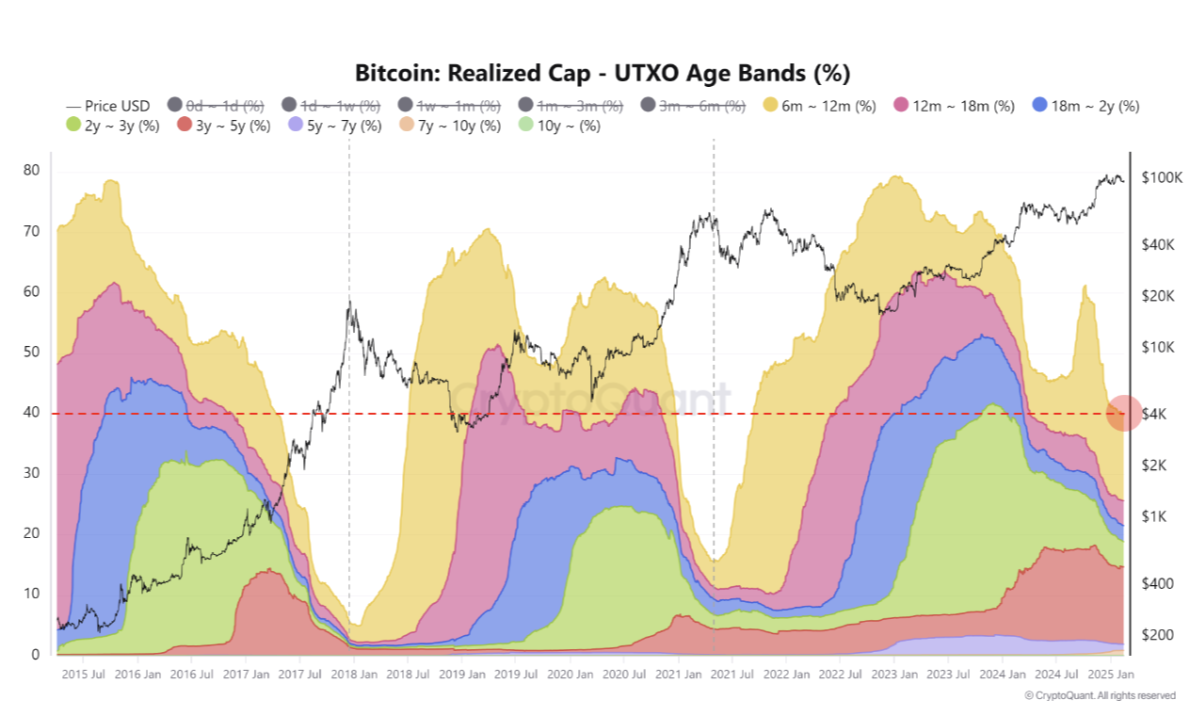

According to Cryptoquant’s pseudonym analyst, Mac_D, “the Bitcoin market rise cycle is not over yet.” This is based on assessment of the analyst on the market capitalization held of the main currency and the proportion detained by its long -term holders (LTHS).

Bitcoin’s market capitalization, which measures its total value at the price it was last moved, rose to a $ 857 billion record. This is significant because this metric accurately reflects the amount arrested by long -term investors and the actual cost of currency currencies.

When the BTC market capitalization rises like this, it suggests that long -term investors are holding a larger amount of currency. It also means that coins that have changed hands are being negotiated at increasingly higher prices. This is seen as a sign of trust in Bitcoin’s future value.

With more coins being kept at higher prices, the sales pressure of LTHs can be reduced. They are unlikely to sell less than the amount of currency reaches levels well above the acquisition cost. This can reduce the downward pressure on the currency and lead to more upward boost in the short term.

In fact, the increase in the proportion of coins detained by the BTC LTHs confirms this trend.

At peak price of the previous cycle, its proportion was 15.66%, while currently 39.74%. This suggests that the market probably has not yet reached its peak, considering the proportion of the previous cycle, writes MACD_D.

This increase suggests that long -term investors now have a significant part of Bitcoin. Given that the price peak of the previous cycle occurred when the proportion was much lower, the current proportion suggests that there is still room for price growth before reaching the top of the cycle.

BTC Price Forecast: Performing profits can discharge rally

Bitcoin is currently being negotiated at $ 96,834, above the $ 95,513 support level. A sustained increase in lths -arrested coins can lead BTC towards the next resistance at $ 98,118.

Bitcoin can exceed $ 100,000 if this key resistance is broken, unlocking a new phase in the high race.

However, if profits intensify, this optimistic perspective can be invalidated. In this case, the price of currency could fall below the $ 95,513 support, potentially falling to $ 91,473.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.