The crypto fear and greed rate fell to 25 yesterday, signaling “extreme fear” in the cryptocurrency market. However, an analyst suggests that current panic may be exaggerated, largely driven by the close bias.

This occurs while Bitcoin sails through market volatility triggered by broader macroeconomic conditions. The main cryptocurrency fell 11.4% in the year, reflecting the broader feeling of fear and uncertainty.

Is the recovery bias inflating fear around the price of bitcoin?

In the last X (former Twitter) post, analyst Lark Davis highlighted an interesting trend in the crypto fear and greed index. This feeling indicator measures the emotions of the market from 0 (extreme fear) to 100 (extreme greed).

On April 3, he plummeted to a minimum of 25, indicating high anxiety among investors, even with Bitcoin being negotiated around $ 80,000. In fact, the most recent value of 28 also indicated substantial fear among market participants.

However, according to Davis, the feeling was out of place, given the performance of the price of Bitcoin. He noted that the fall in the index contrasted with market conditions six months earlier. Although Bitcoin was being negotiated at $ 65,000, the index showed a neutral reading at the time.

This is what we call “close bias, and you can enjoy it,” he he wrote.

To contextualize, the recovery bias refers to the trend of investors or traders to give more weight to recent events or information when making decisions, while disregarding long-term trends or data. This psychological bias often leads to exaggerated reactions to short -term market movements, such as a sudden price increase or a fall.

This is why we are seeing higher fear readings at $ 80,000 today, than at $ 65,000 yesterday, David commented.

He suggested that fear seen in the market is not fully justified and that the reactions to short -term fluctuations are often more extreme than necessary.

This coincides with Bitcoin continuing to see fluctuations amid President Trump’s tariff plans and fears of a possible recession. Although it remains relatively stable compared to traditional markets, the drop in Bitcoin still raised doubts about its stability and long -term potential.

Saylor and Hayes defend Bitcoin amid the turbulence of the market

In fact, Michael Saylor, president of Strategy (former Microstrategy), stressed that short -term volatility does not reflect Bitcoin’s long -term potential.

Bitcoin is more volatile because it is more useful, it these.

Saylor explained that Bitcoin’s volatility is widely due to its liquidity and availability 24/7, which means that it is more susceptible to rapid sales during market panic. However, Saylor reiterated that while Bitcoin behaves as a short -term risk asset, its long -term value is not affected by these fluctuations, reinforcing its role as a value reserve.

Meanwhile, Arthur Hayes, the former CEO of Bitmex, offered another perspective on ongoing market conditions.

Some of you are running scared, but I love tariffs, said Hayes stated.

According to Hayes, global economic imbalances will eventually be corrected. Although short -term market pain is inevitable, Hayes predicts that the solution is likely to involve the impression of more money, which he sees as beneficial to Bitcoin.

The $ is weakening along with foreigners selling US technology actions and bringing money home. This is good for BTC and gold in the medium term, it PREVENTED.

Your comments are aligned with the recent benchrypto report on the reverse correlation between the US Dollar Index (DXY) and BTC. Thus, a drop in the first can benefit the second.

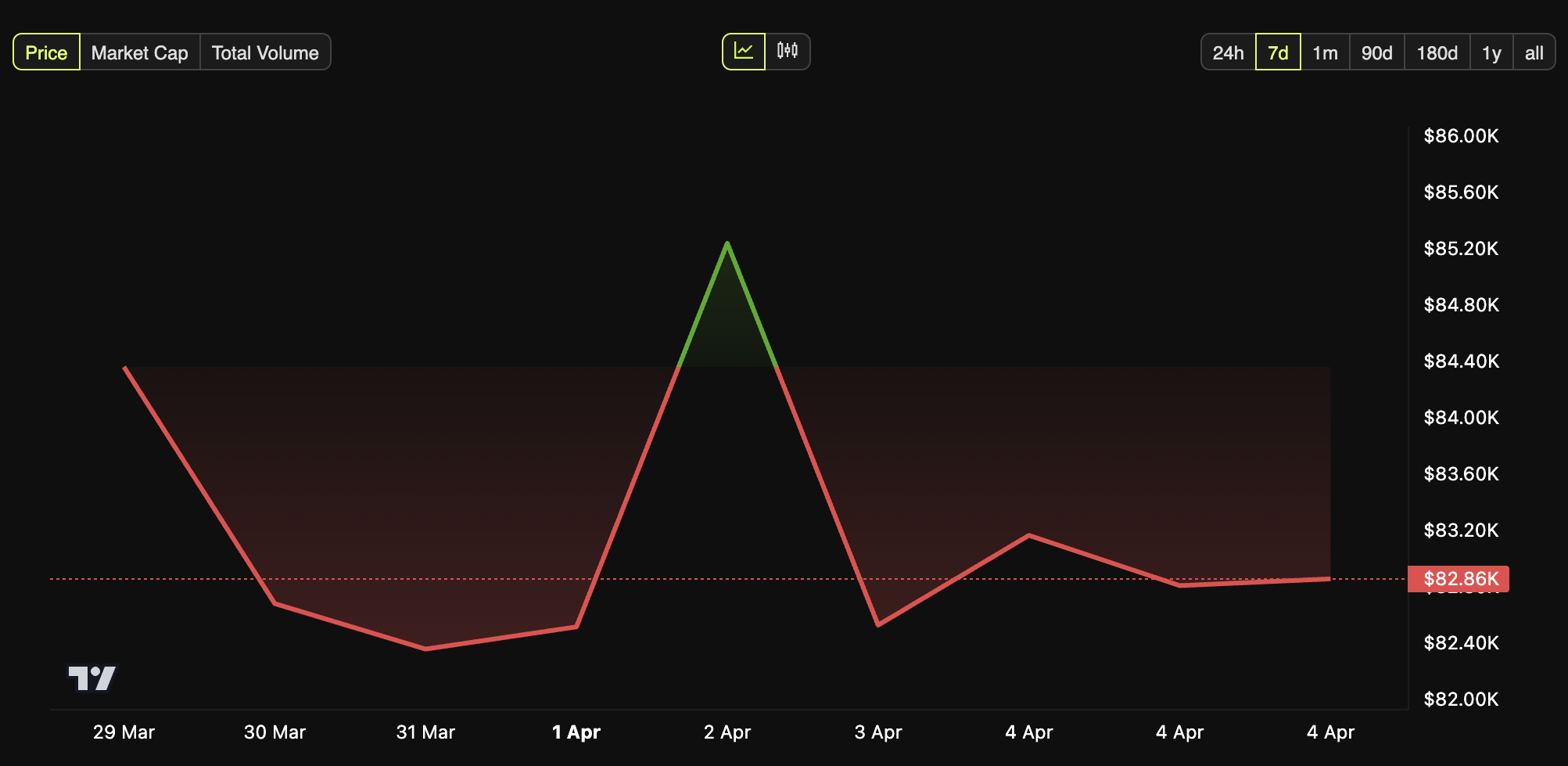

For now, Bitcoin continues to see modest losses. Last week, 4.5%fell. Meanwhile, the currency lost 1.0% of its value on the last day. At the time of writing, Bitcoin was being negotiated at $ 82,855.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.