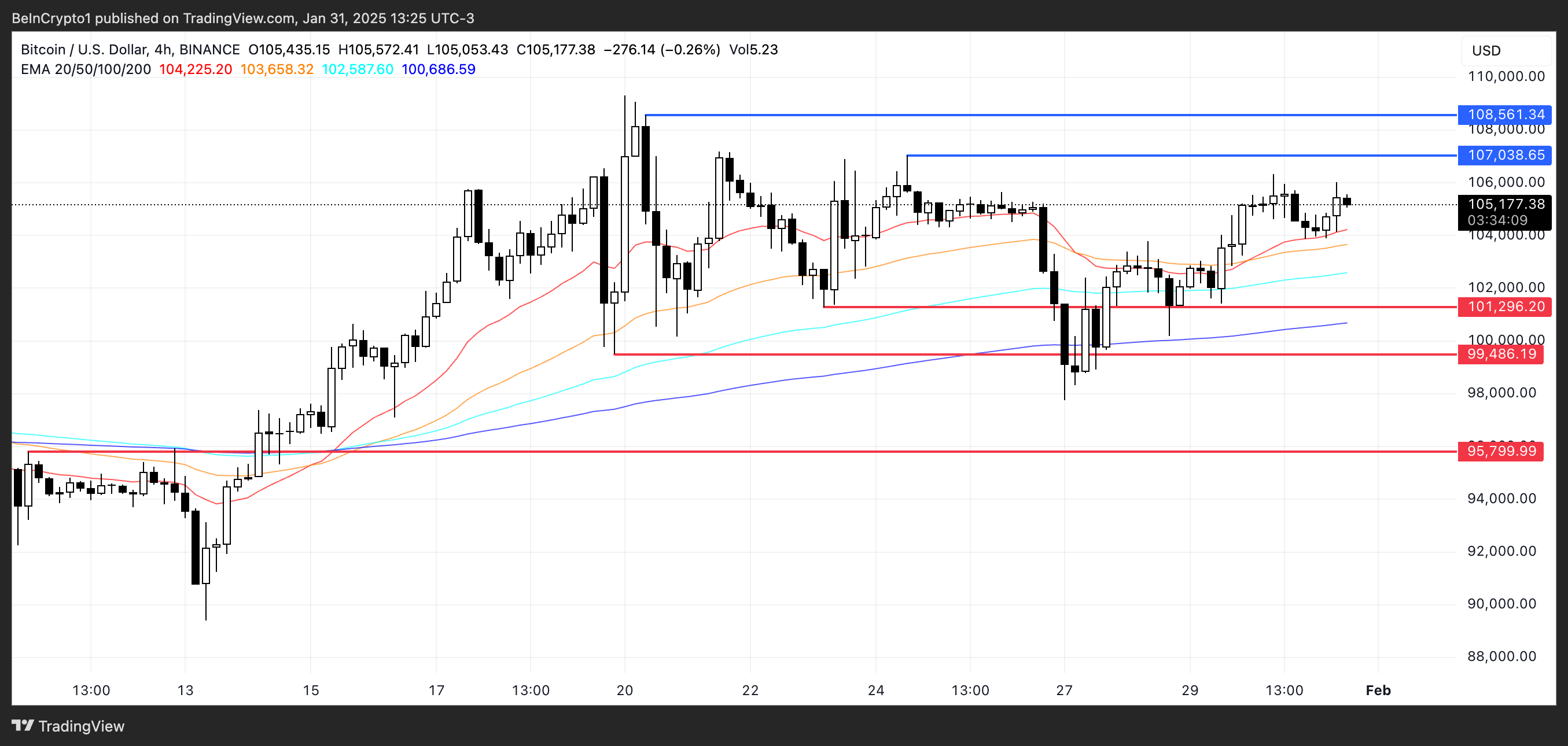

The price of Bitcoin (BTC) remained over $ 100 A thousand in the last three days, showing resilience despite recent volatility. A golden intersection formed on the EMA lines of the BTC, indicating potential for a discharge rupture if the key resistance levels are exceeded.

However, the BTC has faced difficulties to exceed $ 106,000, and the failure to do so can lead to a new lower support level test. If the BTC can advance toward $ 110,000 or face a retreat depends on how it reacts to these critical price zones in the coming days.

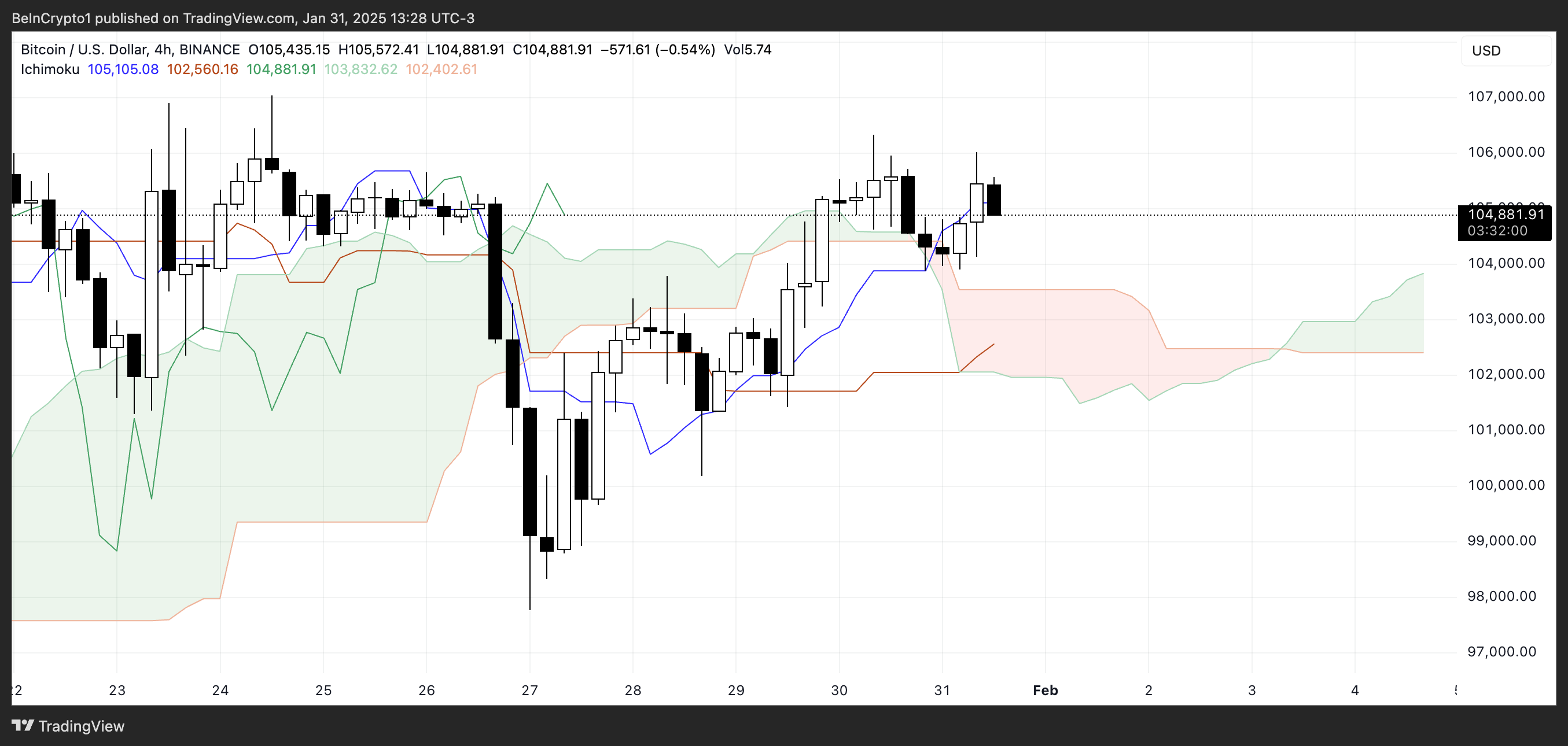

BTC's Ichimoku cloud shows mixed signs

The Ichimoku Cloud chart to Bitcoin has a mixed perspective. Thus, the price is currently above Tenkan-Sen (blue line), indicating a short-term high moment. However, the Kijun-Sen is slightly lower, suggesting a possible continuation of the trend if the price remains above it.

In addition, Chikou Span is above most of the past price, reinforcing the current high bias. However, Kumo (cloud) has a thin structure ahead, meaning less supportive strength or resistance in the near future.

The cloud itself is changing from red to green, which usually signals a possible change of trend to discharge conditions. However, the flat nature of Senkou span B (red cloud limit) suggests some hesitation at the moment. If the price of bitcoin remains above the cloud, the upset is strengthened, but any drop back in the cloud may indicate consolidation or indecision.

The fine cloud in the future means that the trend lacks strong conviction, making the next candles crucial to determine whether the BTC can maintain its upward trajectory.

Bitcoin whales fell to minimums of the year

The number of whales that have at least one thousand BTC fell significantly between January 22 and January 29, from 2,061 to 2,034, the lowest level from February 2024. Thus, this constant decline suggested that large holders were reducing their exposure, potentially signaling reduced confidence or profit in the market.

Thus, following the activity of whales is crucial because these great holders often influence market trends. When whales accumulate, it may indicate increasing confidence and price valorization potential, while distribution phases may precede falls or increased volatility. Therefore, their movements provide insights on the widest market sentiment and possible trend changes.

After consecutive falls, the number of whales began to rise again, currently back to 2.039. Although this remains low compared to previous months, it can signal a return of large holders to the BTC. If this trend continues, it may indicate a new accumulation, which could support the price of the BTC in the coming days.

BTC price forecast: $ 110,000 in February?

The BTC EMA lines recently formed a golden crossing, signaling potential momentum, but the price has struggled to break over $ 106,000. If Bitcoin makes another attempt and exceeds this level, it can quickly test $ 107,000.

A rupture above this resistance can push the price of Bitcoin towards $ 108,000, and if the purchase pressure remains strong, it may even reach $ 110,000, marking a new historical record.

On the other hand, if the price of the BTC does not maintain the moment and the trend is reversed, it may fall to $ 101,296, a key standard level. Losing this level can speed up the sales pressure by pushing the BTC to $ 99,486.

If this support is also broken, the BTC can continue its decline towards $ 95,800, where buyers can intervene to avoid more falls.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.