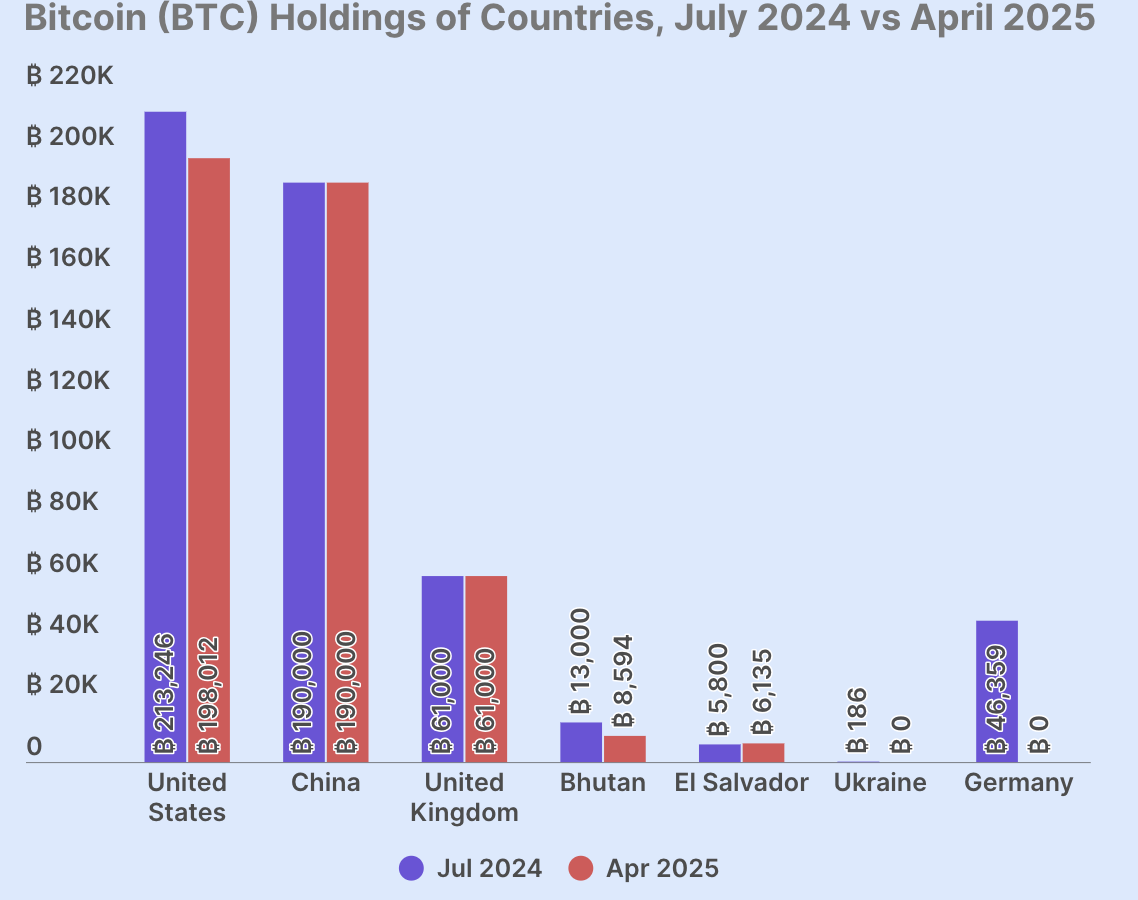

According to a new Coinggecko report, government accounts have 2.3% of the total bitcoin supply. Collectively, their possessions add up to 463,741 BTC, a 529,591 drop in less than a year.

Despite the apparent numbers, the general trend is declining: two of the seven governments have completely liquidated their assets, and only El Salvador continues to increase their Bitcoin reserves.

Governments are falling out of Bitcoin

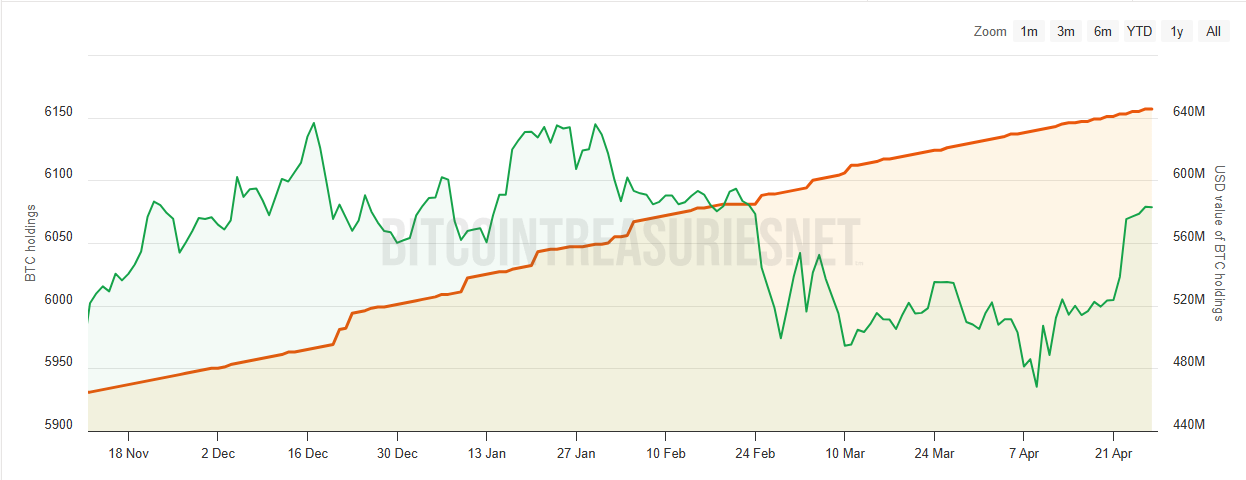

Although companies like microstrategy often attract media attention for its great bitcoin possessions, governments also represent two of the 10 largest investors in the main crypto.

Coingecko discovered some interesting trends by analyzing all relevant statistics. For example, only five nations currently holds active in Bitcoin.

The US Federal Government is Bitcoin’s largest institutional holder. The crypto industry closely monitors its movements while seeking to influence public policies. It is noteworthy that the United States does not acquire currency in the market – its reserves are the result of seizures in criminal operations.

In the final stretch of Joe Biden’s government, the United States began the settlement of its Bitcoin reserves, a movement that became one of the leading drivers of the creation of Trump’s Crypto Reserve. Her proposal is not to acquire new BTCs, but to manage existing assets and prevent them from being sold in the future.

China is a somewhat neglected Bitcoin government, which can be attributed to two reasons. Obviously, the country is somewhat hostile to crypto, and unqualified policy liberalization rumors can impact the market.

The country seized almost 200 thousand bitcoins in 2020 and has not moved them since. Thus, this great inventory can escape the overall attention.

The British government mirrors China’s Bitcoin strategy, maintaining its substantial reserves in a standard of waiting. Germany performed a complete settlement last year, zeroing its substantial possessions. He did this to cover a budget deficit, not for anti-criminal ideological reasons.

In addition, Ukraine has performed a similar total BTC liquidation to finance its war effort ongoing. All mentioned government investors obtained their bitcoin exclusively through criminal seizures except Ukraine, which accepted transfronist donations.

El Salvador isolates himself as the sole government to expand BTC reserves

On the other hand, only two holders are actively trying to get it. Bhutan attracted international attention for its BTC gains, but it comes from mining, and sold almost half of its supply in recent months.

In short, El Salvador is the only globally committed to expanding his Bitcoin reserves. Although he agreed to interrupt BTC purchases to obtain an IMF loan, the country continues to acquire more assets. This stance generated some internal resistance, but apparently the IMF is satisfied with the strategy adopted.

This means that Coinggecko has performed an in -depth analysis and came to some conclusions. Although governments have a significant amount of bitcoin, this trend is vulnerable and unstable.

Only seven governments had BTC last year, and two of them have lost it since. Some political changes could totally change this environment.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.