Bitcoin (BTC) has long been considered as “digital gold”. However, while the global economy suffers from growing trade war tensions under Trump’s second term, institutional investors are running away to royal gold.

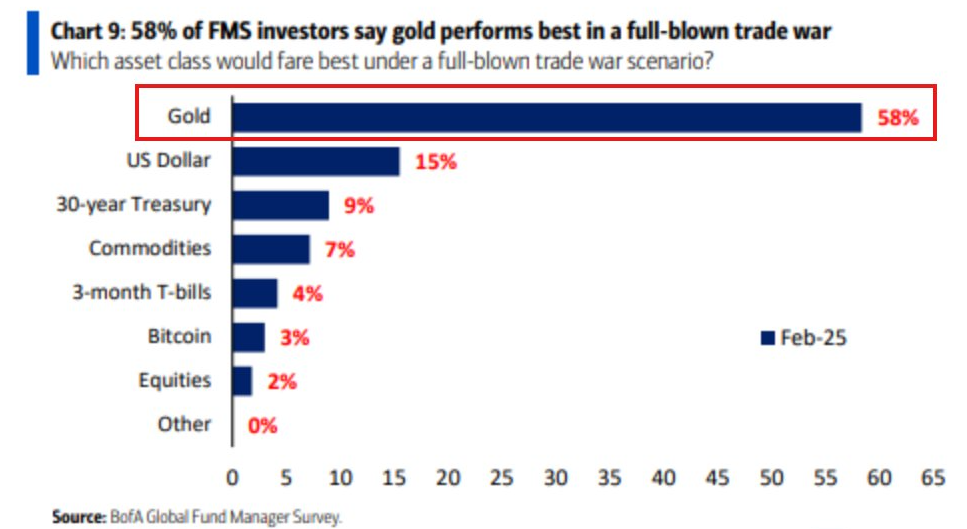

A recent Bank of America (Bofa) survey revealed that 58% of background managers see gold as the best performance refuge in a trade war, leaving Bitcoin with only 3% preference.

Bitcoin’s “refuge” status faces reality shock

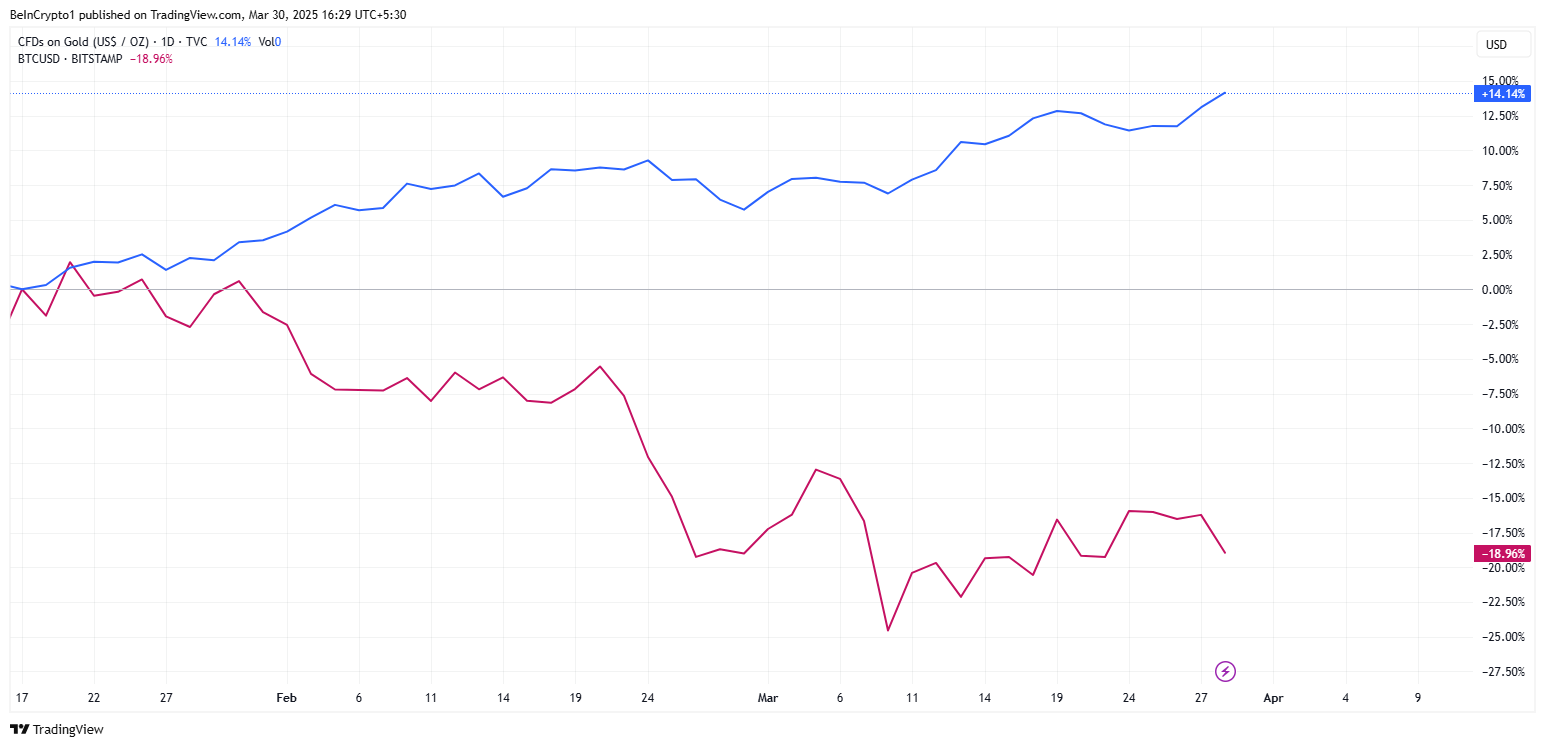

Gold is proving its dominance as the favorite crisis asset, while Bitcoin struggles to maintain its position. This occurs amid increased geopolitical risks, the growing US deficit and the uncertainty that drives capital escape.

“In a recent Bank of America survey, 58% of background managers said gold has the best performance in a trade war. This compares to just 9% for 30 -year -old treasure titles and 3% for Bitcoin,” said Kobeissi Letter noticed.

For years, Bitcoin advocates have promoted him as protection against economic instability. However, in the volatile macroeconomic environment of 2025, the asset struggles to gain the total confidence of institutional investors.

The research of Bank of America It reflects this status, with long -term US Treasury titles and even the US dollar losing appeal as commercial wars and tax dysfunctions shake market confidence.

The American deficit crisis – now designed to exceed $ 1.8 trillion – wore the confidence in traditional refuges such as US Treasury titles.

“This is what happens when the global reserve currency no longer behaves like the global reserve currency,” Ironized A trader in a post.

However, instead of looking at Bitcoin as an alternative, institutions are crushingly choosing gold, bending physical gold purchases to record levels.

Bitcoin institutional adoption barriers

Despite its fixed supply and decentralization, Bitcoin’s short -term volatility remains an important barrier for institutional adoption as a true asset of secure refuge.

While some traders still see Bitcoin as a long -term value reserve, it lacks the immediate liquidity and the risk of the risk that gold offers during seizures.

In addition, President Trump is expected to announce new comprehensive tariffs on the “Liberation Day”. Experts warn that the event can trigger extreme volatility in the market.

“April 2 is similar to the night of election. It is the biggest event of the year by an order of magnitude. 10 times more important than any FOMC, which is a lot. And anything can happen,”, PREVENTED Alex Krüger.

Commercial tensions historically directed capital to assets of safe haven. With this imminent announcement, investors position themselves again, favoring gold instead of Bitcoin.

“Gold is no longer just a protection against inflation; it is being treated like protection against everything: geopolitical risk, misleading, fiscal dysfunction and now, armed trade. When 58% of fund managers say that gold is the best performance in a trade war, it is not just feeling, when even long titles and the dollar are in the background, it is a signal. In a world of increasing tariffs, currency tension and twin deficits, gold can be the only politically neutral value storage, ”Trader Billy Au noted.

Despite Bitcoin’s struggle to capture institutional flows of safe haven in 2025, its long -term narrative remains intact.

Specifically, the global reserve currency system is changing, concerns about US debt are increasing and monetary policies continue to change. Despite all this, Bitcoin’s value proposition as a censorship resistant asset and without borders is still relevant.

However, in the short term, its volatility and the lack of generalized institutional adoption as a crisis refuge mean that gold is leading.

For believers in Bitcoin, the key issue is not whether Bitcoin will one day challenge gold, but how long institutions will take to adopt it as a safety escape asset.

Until then, gold remains the undisputed king in times of economic turbulence. Meanwhile, Bitcoin (BTC stock exchange funds apart) struggles to prove its place in the next change of financial paradigm.

“The demand for ETF was real, but part of it was purely for arbitration … There was a genuine demand for having BTC, just not as much as they made us believe,” analyst Kyle Chassé recently said, said recently in a statement.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.