Michael Saylor announced that Strategy bought almost $ 2 billion in Bitcoin. This is a significant leap in relation to last week’s purchase, which was already quite substantial.

However, the company only managed to make this acquisition thanks to major stock offers. Bitcoin’s price has fallen in recent weeks, and this can turn into a potential settlement crisis.

Strategy maintains bitcoin purchases

Since Strategy (former Microstrategy) has begun to acquire Bitcoin, it has become one of the largest BTC holders in the world. This plan totally reormed the company around its mass acquisitions, inspiring other companies to adopt the same plan.

Today (31), the company’s president, Michael Saylor, announced another purchase, much larger than the last.

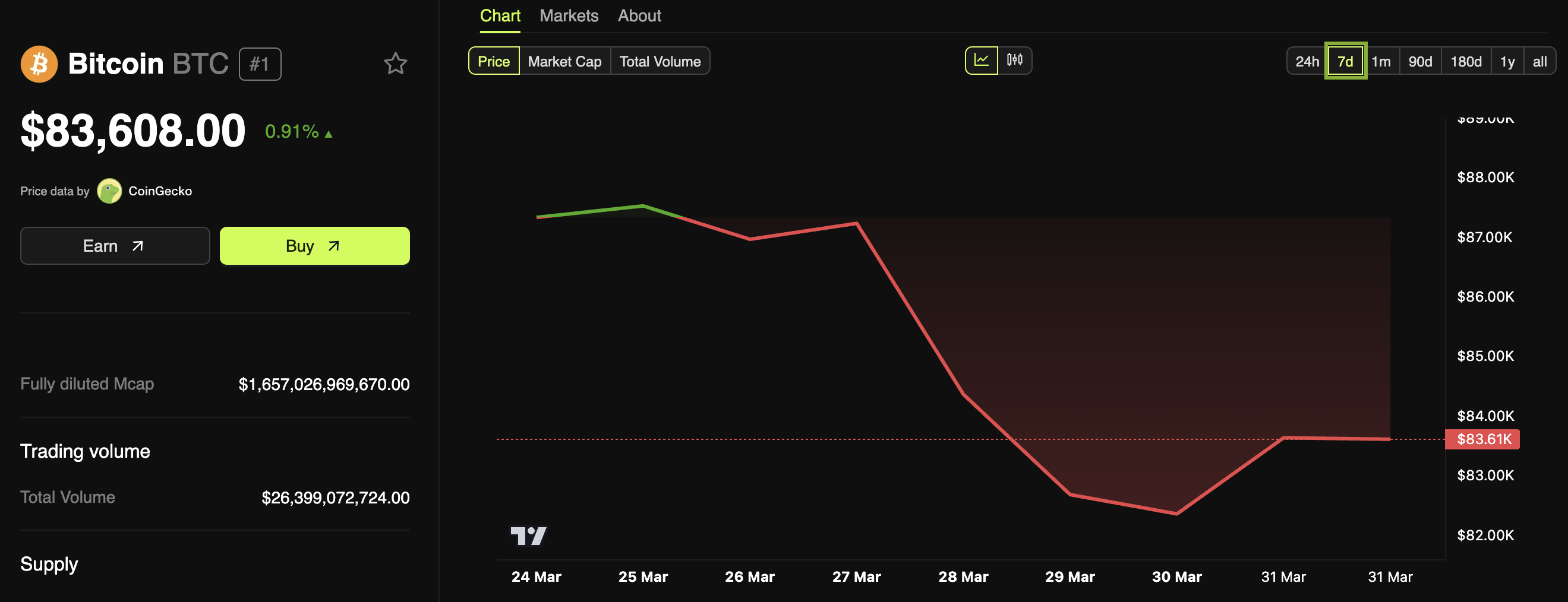

Strategy acquired 22,048 BTC for ~ $ 1.92 billion a ~ $ 86,969 per bitcoin and reached a ytd 2025 BTC yield. On 30/03/2025, Strategy holds 528.185 BTC purchased for ~ $ 35.63 billion a ~ $ 67.458 per ~ per ~ per $ 67.458 per Bitcoin, said Saylor via social networks.

Strategy’s latest acquisition of bitcoin, valued at almost $ 2 billion, is a significant commitment. In February, the company made a similar purchase of $ 2 billion, followed by a small purchase of $ 10 million and another of $ 500 million. The purchase of $ 500 million, which took place on March 24, was only possible thanks to a large new stock offer. This movement further reinforces Strategy’s confidence in BTC.

By making these billionaire purchases, Strategy can support the confidence of the whole market in Bitcoin. However, investors should be aware of some possible flaws.

First, Bitcoin’s performance is slightly below expected at the moment. Despite reaching a historic record recently, Bitcoin has been having its worst quarter since 2019, and there is not much impetus forward.

This can cause a unique problem for the company. Since Strategy is a pillar of market confidence, it cannot unload your assets without compromising the price of bitcoin.

The company’s debts are growing rapidly, and this may have dangerous implications if Bitcoin continues to fall. Strategy can be forced to settle, even if it seems unlikely now.

Even so, it is important to remember that these are only possible scenarios. Strategy has kept its investments consistent in Bitcoin for almost five years, and this has worked very well. However, if it continues to assume billions in new debt obligations, this confidence will turn into a very high risk bet.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.