More than $ 2.5 billion in Bitcoin and Ethereum options contracts are scheduled to expire on Friday (14). In addition, markets are still recovering from this week’s US economic data, including CPI and PPI, but can the derivative expiration event today raise prices over the weekend?

Bitcoin (BTC) remains well below the psychological level of $ 100,000, while the influence of macroeconomic events continues to direct the feeling.

How to enjoy the moment?

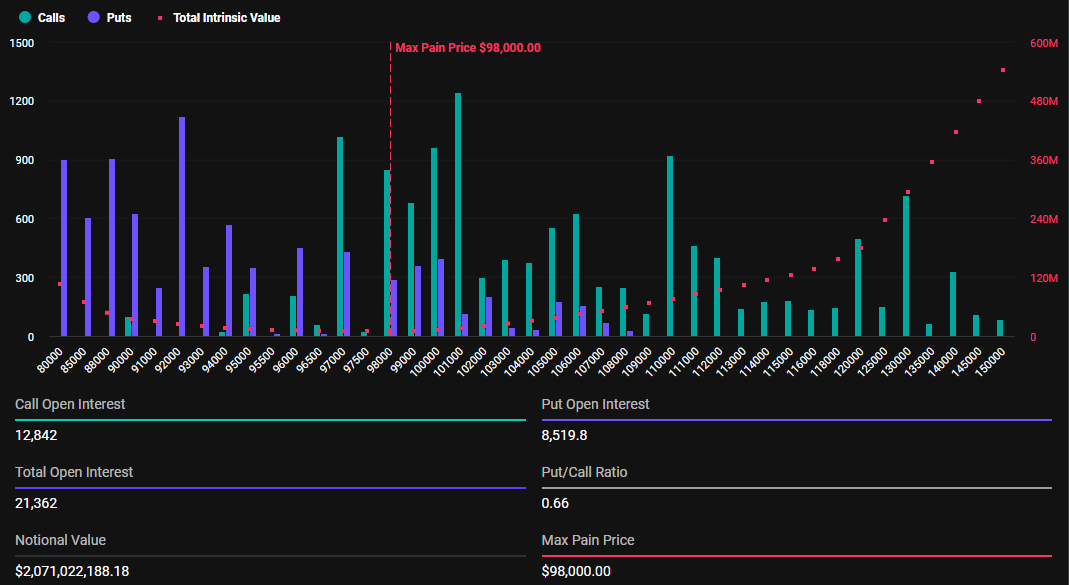

As bitcoin options expire, they have a maximum price or strike price of $ 98,000, where the asset will cause financial losses to the largest number of holders.

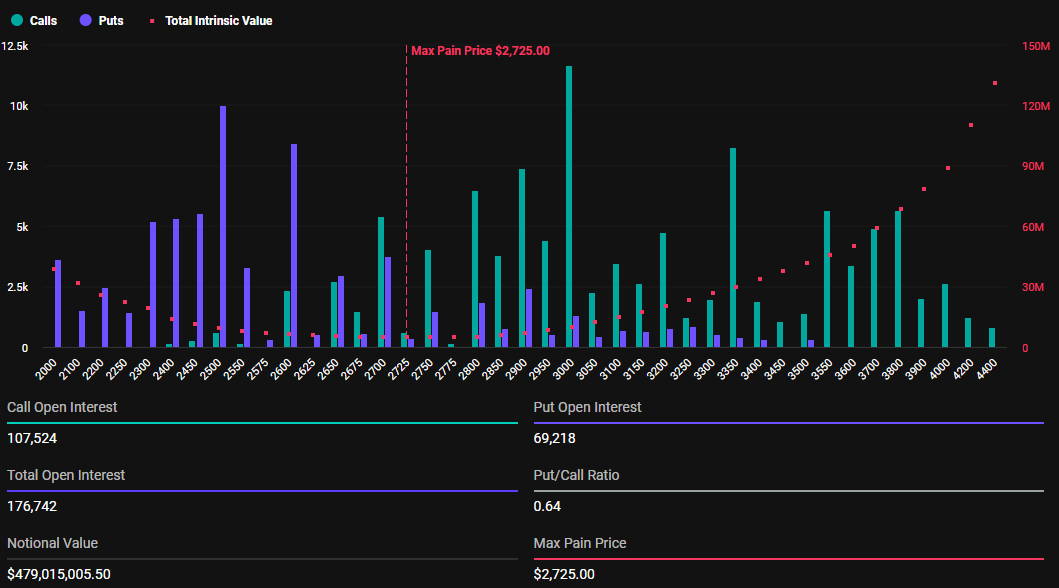

Similarly, crypto markets will witness the expiration of 176,742 Ethereum contracts, with a notional value of US $ 479.01 million. The Put-to-Call ratio for these Ethereum options that expire is 0.64, with a maximum pain of $ 2,725.

This week’s Expiration of Options Expiration event is much smaller than what the crypto markets witnessed last Friday. As reported by Beincrypto, approximately $ 3.12 billion in BTC and ETH options then exhaled, attributed to US President Donald Trump’s fares, who prevented Bitcoin’s price from exceeding $ 100,000.

Expiration of options can lead to price volatility, so traders and investors need to closely monitor today’s developments. However, Put-to-Call relations below 1 for Bitcoin and Ethereum in negotiation indicate optimism in the market. This suggests that more traders are betting on price increases.

Market feeling maintained a weak consolidation this week, commented to Greeks Live, which added that the implicit volatility It fell to its lowest level in almost a year, despite several positive news from the US government. This signals lower pricing fluctuations that can affect the pricing of negotiating options and strategies.

Since the BTC has effectively fell below the $ 100,000 mark, the main options of options have consistently sold short and medium term calls, with a significant increase in block call trading volume, but a drop in put volume in block, suggesting that while the market is not optimistic about the discharge, it is equally concerned with the low, shared Greeks.live .

In this context, Greeks.Live analysts indicate that institutions see February as a ‘lost time’. This means that a period of low activity or interest in the market can impact trading volumes and prices on the crypto market.

As options of options are approaching, Bitcoin and Ethereum prices can approach their respective maximum pain points. According to Beincrypto data, the BTC was negotiated for $ 96,714, while the ETH was exchanged for $ 2,696.

This suggests that BTC and ETH prices can rise as intelligent money seeks to move them toward the “maximum pain” level. According to Max Pain theory, options prices tend to gravitate to exercise prices where the largest number of contracts, both calls and puts, expire worthless.

Price pressure on BTC and ETH will probably decrease when Deribit liquidates contracts. However, the scale of these expirations can still feed a high volatility in the crypto markets.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.