US $ 3.29 billion in Bitcoin and Ethereum option contracts are scheduled to win on Friday (14). This can trigger short -term price volatility and mainly impact traders profitability.

With abundance of contracts about to win, traders are preparing for possible fluctuations in the market. Experts highlight the importance of maximum pain and the impact of these salaries on the price movements of cryptors.

Bitcoin and Ethereum owners are preparing for volatility

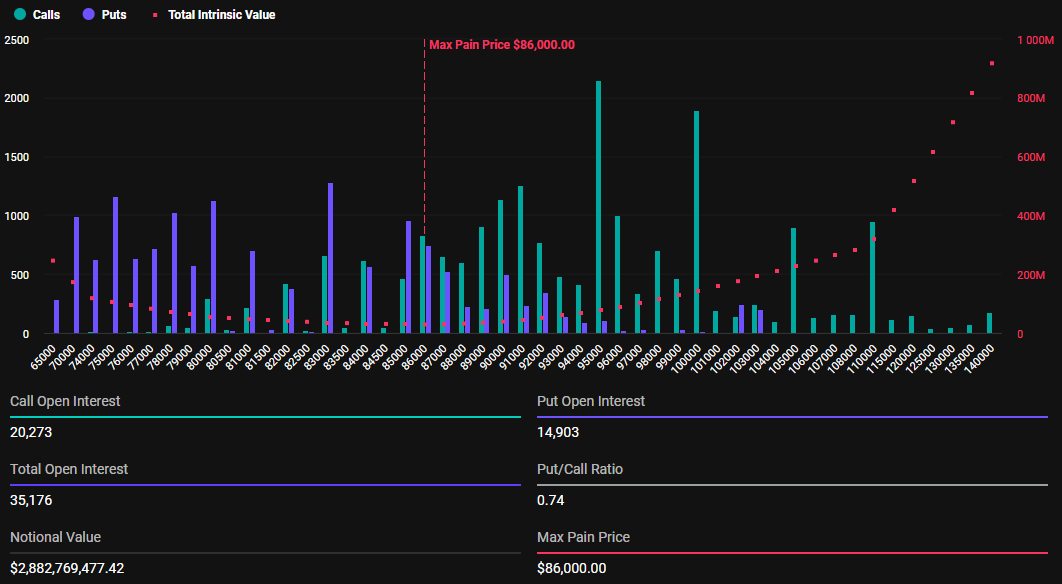

According to data from Deribit, 35,176 Bitcoin options win today, little more than last week, when 29,005 BTC contracts were closed. Options contracts that expire today have a PUT-TO-CALL ratio of 0.74 and a maximum pain point of $ 86,000.

This relationship indicates a generally optimistic feeling, despite the continuous fall of the pioneering crypto from the $ 90,000 mark.

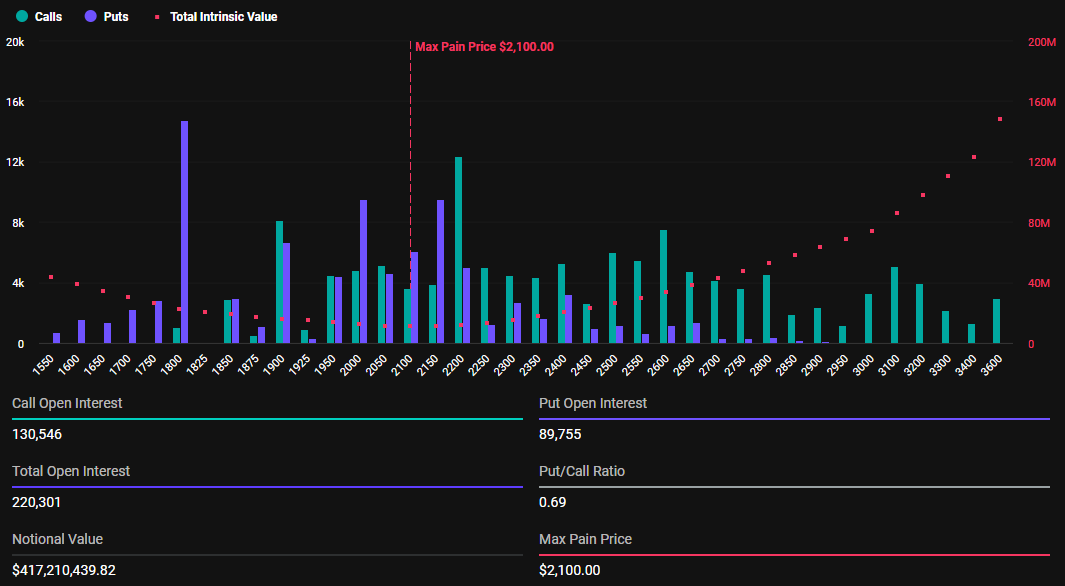

Meanwhile, 220,301 Ethereum options will exhale today, a drop from 223,395 last week. With a PUT-TO-CALL ratio of 0.69 and a maximum pain point of US $ 2,100, salaries can influence the ethi short-term price movement.

The BTC was being negotiated at $ 84,5322 – up 4.45% in 24 hours – at the time of this text. Already the ETH was worth US $ 1,933, appreciation of 4.31% in 24 hours.

This suggests potential recovery for both prices as intelligent money seeks to move them toward maximum pain level. According to Max Pain theory in options negotiation, prices tend to gravitate towards exercise prices where the largest number of contracts, both calls and puts, expire worthless.

The maximum pain has decreased week after week. Do you see this continuing, or is a reversal to come? Questioned Deribit Analysts.

Analysts discuss the feeling of the crypto market

According to Greeks.live analysts, market feeling is predominantly pessimistic in the short term. Despite positive US CPI data (consumer price index) earlier this week.

Traders are observing key potential support levels and discussing a possible background for the BTC, with some suggesting levels of $ 60,000 as a possible fall target, wrote.

They also note that some believe that President Trump’s fares and inflation are more significant market engines than geopolitical events, such as a peace agreement in Ukraine.

Vladimir Putin says he agrees with proposals for ceasefire-but adds that he has questions and Russia ‘is now in the offensive in all areas’, reported a Sky News.

Adjustments, volatility and uncertainties in the crypto market

Analysts observe that peace and stability can increase market confidence, which can be positive for stocks and crypto. This is aligned with a recent JPMorgan survey, in which 51% of traders identified tariffs and inflation as the main engines in the market for the year.

Tony Stewart discussIu No X, options in the Crypto market, focusing on negotiating Bitcoin derivatives at Deribit. It indicates changes in market sentiment and negotiation strategies. Put buyers and calls of Calls profited from the price drop on March 11. The levels reached $ s 76,500, followed by a less sustained recovery due to the heavy sale of calls over $ 90,000.

According to Stewart, this highlights a strategic rotation on the part of traders, moving from excessively optimistic calls from March and June to the most conservative Calls of April and May. This also reflects adjustments to market volatility.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.