It shows the fragility of altcoins against Bitcoin, highlighting the continuous growth of the main cryptocurrency as the first choice for capital preservation in the crypto market.

The results highlight Bitcoin as a safer asset in the midst of the cryptocurrency market volatility. The research has analyzed the performance of the 300 main altcoins over the last five years, revealing that many of them suffer rapid depreciation.

Bitcoin x Altcoins: Which is best?

Swan shared its perceptions on a thread in the X (former Twitter).

Altcoins not only perform lower than Bitcoin. They collapse in relation to him, said the publication.

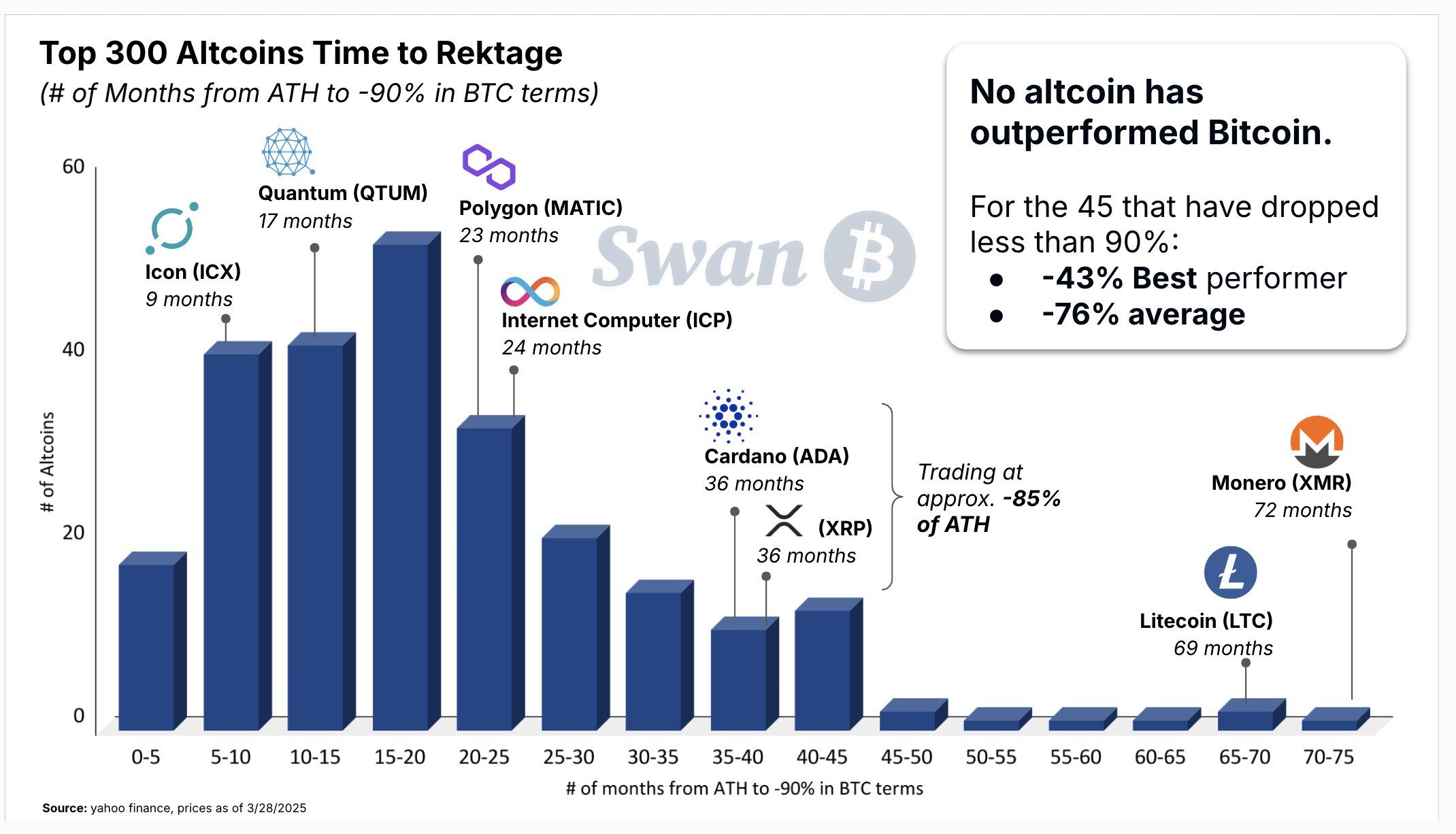

The analysis focused on the time these assets take to devalue 90% over Bitcoin after reaching their historical maximums (ATH).

The median Altcoin reached a 90% drop in just 10 to 20 months, Swan revealed.

In addition, according to Swan data, the Earth (Luna1), Ontology Gas (NGO) and Bitgert (Bise) collapsed faster, reaching the 90% drop in less than two months. Larger and more established altcoins were not immune to this trend.

For example, Cardano (ADA) and XRP (XRP) took 36 months to depreciate 90% of their record peak. Meanwhile, Litecoin (LTC) has experienced a gradual fall, taking 69 months. The Monet (XMR) was slower, taking six years to reach a 90%drop.

Swan’s analysis extends to 45 altcoins that have not yet experienced the 90%drop. Although they have not yet “collapsed”, the data suggest that they are just postponing their inevitable losses.

The average drop for these coins is 76% of their maximum value. Even the best performance Altcoin is still 43% below the BTC.

Bitcoin remains the framework for capital preservation. These assets do not protect the BTC – they bleed over it, added Swan.

The results point to a systemic problem in the Altcoins space. The data suggest that it, often marketed as alternatives to Bitcoin, fail to deliver sustained value over time compared to the main cryptocurrency.

Swan also stressed that the long -term performance of Altcoins is a rare exception. The company believes that the survival bias-the tendency to focus on successful projects-has disguised the widespread decay that affects most of the market.

With such performance, it is surprising that Altcoins continue to exist. On the other hand, humans love to bet, commented John Haar, an executive of Swan .

Why can the Altcoins season never come back?

The growing saturation in the Altcoins market adds to concerns. According to coinmarketcap data (CMC), more than 1.8 million tokens were created only last month.

However, the vast majority of these tokens fail to deliver results. The beinchrypto recently reported that 89% of the tokens listed at Binance in 2025 are in the red. Thus, the value of new altcoins is more driven by short -term and hype negotiations than on lasting fundamentals.

In addition, this increase in the number of tokens has fragmented market liquidity. These factors even delayed the long -awaited “Altseason”. However, some analysts even argue that the traditional Altcoins season may never return.

This change is largely due to the growing domain of Bitcoin in the market, driven by institutional adoption and growing regulatory attention. While cryptocurrency solidifies its position as the dominant digital asset, it cannot be said to altcoins, which struggle to maintain investors’ relevance and interest in the continuous rise of the BTC.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.