Bitcoin’s price action has been volatile in recent days, with the main cryptocurrency struggling to ensure the $ 100,000 mark as a firm support. Despite multiple attempts, the BTC faced strong resistance, leading to an increase in sales pressure.

Recent market conditions suggest that Bitcoin’s inability to maintain key price levels can further weaken his position, leaving him vulnerable to possible correction.

Bitcoin investors are boosting the price

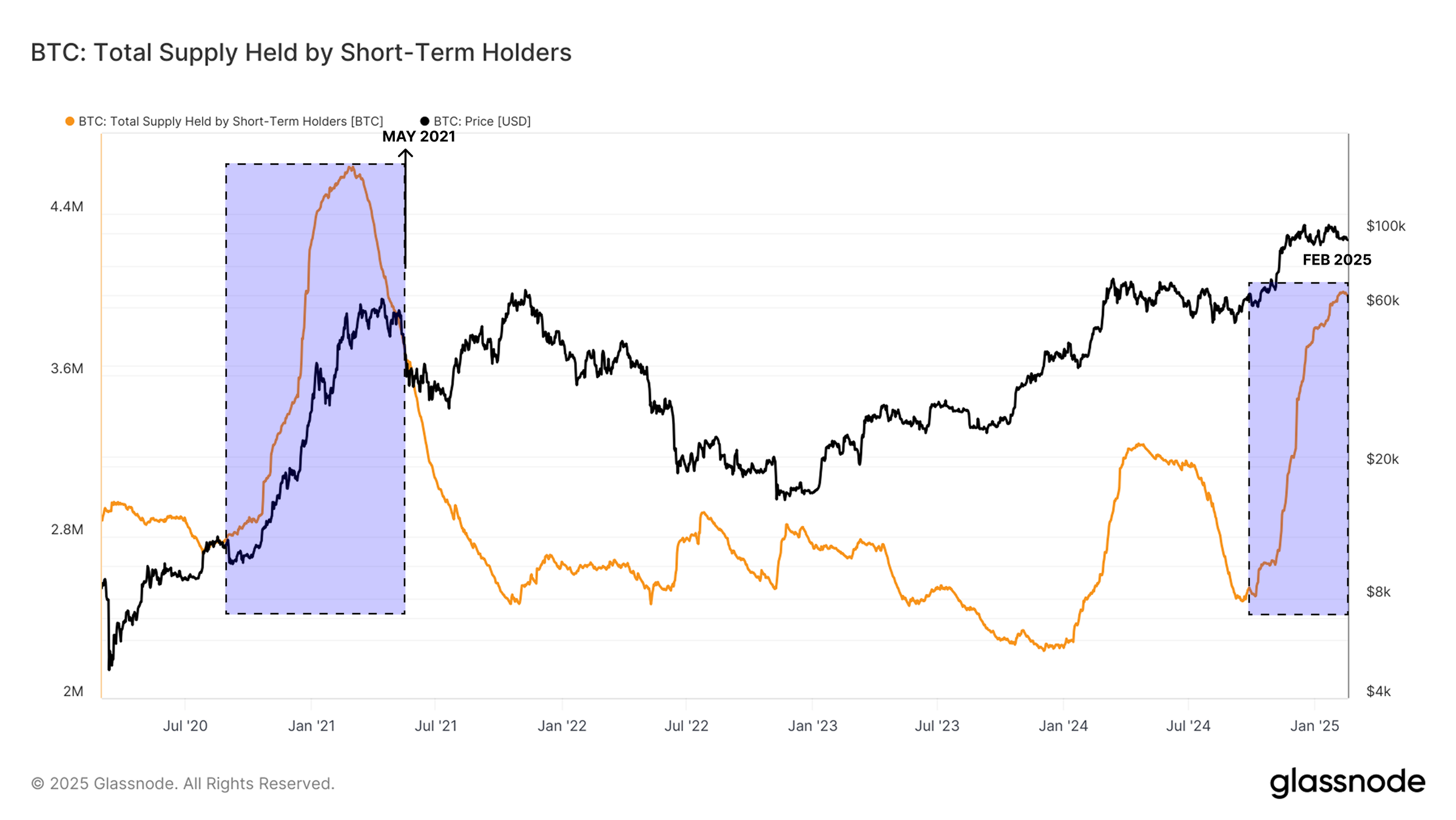

Short -term holders (STH) played a crucial role in the recent Bitcoin price action. Supply maintained by these investors indicates that the market is mirroring the accumulation phase seen in May 2021.

At that time, Bitcoin saw a significant influx of supply, leading to greater sensitivity among investors to any descending movement. If the BTC cannot keep support over $ 92,500, these holders may start unloading their assets by exacerbating the sales pressure.

If demand remains stable, Bitcoin could establish a new interval above its historical maxims. However, the lack of sustained purchase pressure can trigger a deeper correction.

Historically, Post-Aeth phases led to widespread panic among new participants, especially those who recently accumulated BTC at peak prices. If your appearances fall into unchanted losses, this can cause a wave of distribution, increasing the chances of a sharp drop in price.

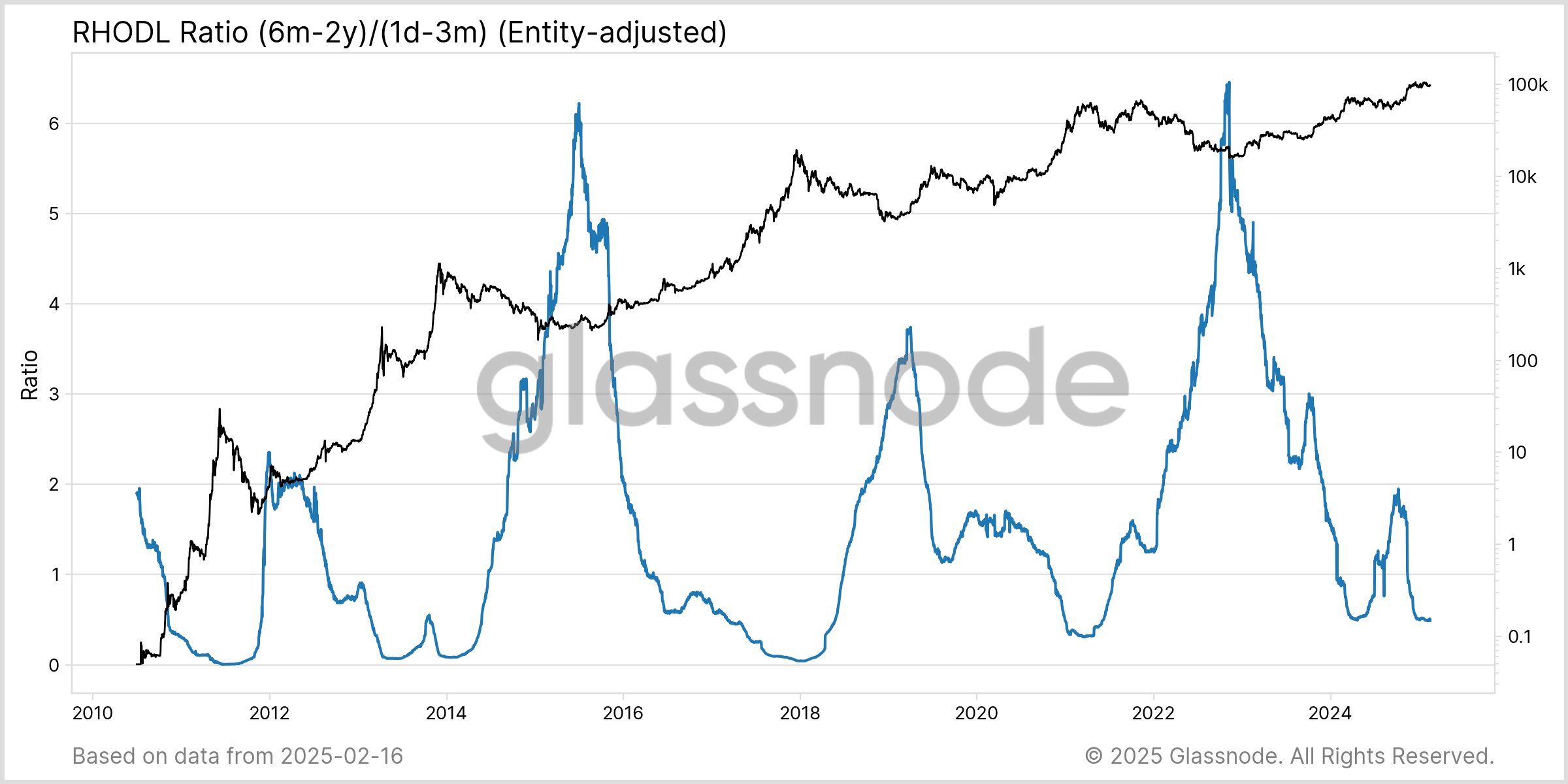

The Rhodl Ratio, which measures the balance between medium cycle holders (6 months to 2 years) and new participants (1 day to 3 months), has decreased. This trend suggests that short -term speculation is increasing, a common indicator observed before market tops. Although the index is not yet at extremely low levels, its current movement is aligned with patterns seen in the final stages of previous high cycles.

An additional drop in Rhodl Ratio can signal imminent correction. Historically, when the index recovers after reaching a low point, he scored key turn points in bitcoin price cycles. If this pattern repeat itself, Bitcoin can enter a distribution phase before stabilizing or starting another upward movement.

BTC price forecast: may have difficulty climbing

The price of Bitcoin is currently consolidating between $ 98,212 and $ 95,761 and is at risk of decline. Multiple lower support tests indicate that the BTC remains susceptible to another retest. If this level is not maintained, Bitcoin may face further sales pressure, leading to a sharper drop.

Given the macro trends in progress and the distribution of supply of STth, the price of bitcoin can see a correction in the short term. A drop to $ 93,625 is plausible, and if the low momentum intensifies, the BTC may fall even longer to $ 92,005. These levels can act as critical support zones, influencing the next movement of the market.

On the other hand, the continuous accumulation by investors with a long -term perspective could provide Bitcoin the support needed to break the $ 98,212. If BTC successfully recovers the $ 100,000, the rise momentum can accelerate, boosting cryptocurrency toward its $ 105,000 maximum.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.