Bitcoin (BTC) continues in a state of uncertainty.Both whale activity and technical indicators point to a market without strong conviction. Large holders remained inactive for more than a week, with the number of whale wallets containing between 1,000 and 10,000 BTC.

Meanwhile, technical graphs such as the cloud of Ichimoku and the EMA lines offer a mixed perspective, reflecting hesitation in high and low directions. With Bitcoin negotiating close to key and resistance key levels, the next few days can determine if April will break or deeper correction.

Bitcoin whales are not accumulating

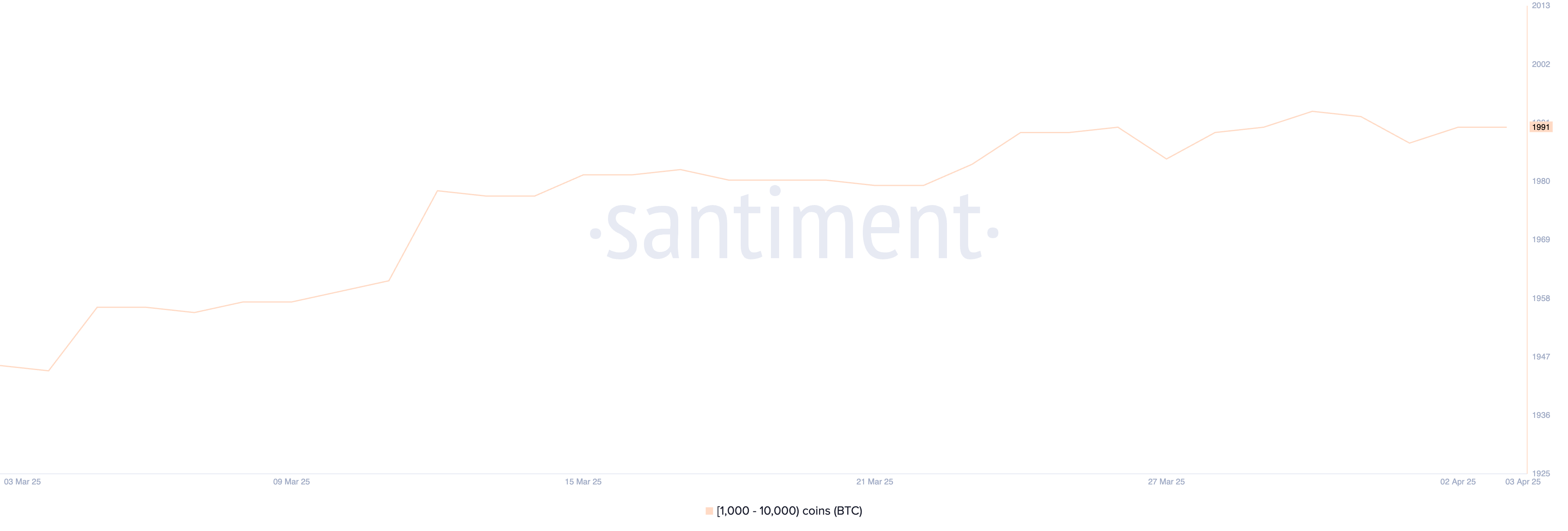

The number of bitcoin whales – ranks containing between 1,000 and 10,000 BTC – is currently 1,991. A number that has remained stable since March 24.

This level of consistency in the activity of large holders suggests that the main players are not accumulating or unloading their positions aggressively.

Given the size of these participation, even minor changes in whale behavior can significantly impact the market.

Accompanying bitcoin whales is crucial. This is because these great holders often have the power to influence price action through their purchase or sale decisions.

When whales accumulate BTC, this can signal confidence in future price appreciation, while large -scale sale may indicate imminent descending pressure. The fact that the number of whales has remained stable in the last 11 days may suggest a period of consolidation, where large investors await a clearer macro or market signal before making their next movement.

This may imply that major players see the current price of Bitcoin as a fair value, potentially leading to a short -term price action prior to a rupture in any direction.

Bitcoin’s Ichimoku cloud shows a mixed scenario

The current configuration of Ichimoku’s cloud to Bitcoin shows a mixed but slightly cautious feeling.

The price recently fell below the Red Base Line (Kijun-Sen) and, despite a brief boost in the cloud, was rejected and fell below it-Indicating that the high impulse of continuity.

In addition, the Tenkan-Sen conversion line is now a fall trend and crossed below the base line, which often reflects a short-term low time. Meanwhile, span A (green cloud limit) is beginning to flatten, while span B (red limit) remains relatively horizontal, forming a thin and neutral cloud ahead.

This type of thin and flat cloud suggests indecision in the market and lack of a strong moment of trend. The price hovering just below the cloud further reinforces the idea that the BTC is in a consolidation phase rather than a clear trend.

If the price can break again above the cloud and maintain this level, it can signal a renewed high force.

However, continuous rejection in the cloud and falling Tenkan-Sen pressure can keep the BTC in a corrective or lateral structure. For now, Ichimoku’s configuration reflects uncertainty without a dominant tendency confirmed in any direction.

Will Bitcoin return to $ 88,000 in April?

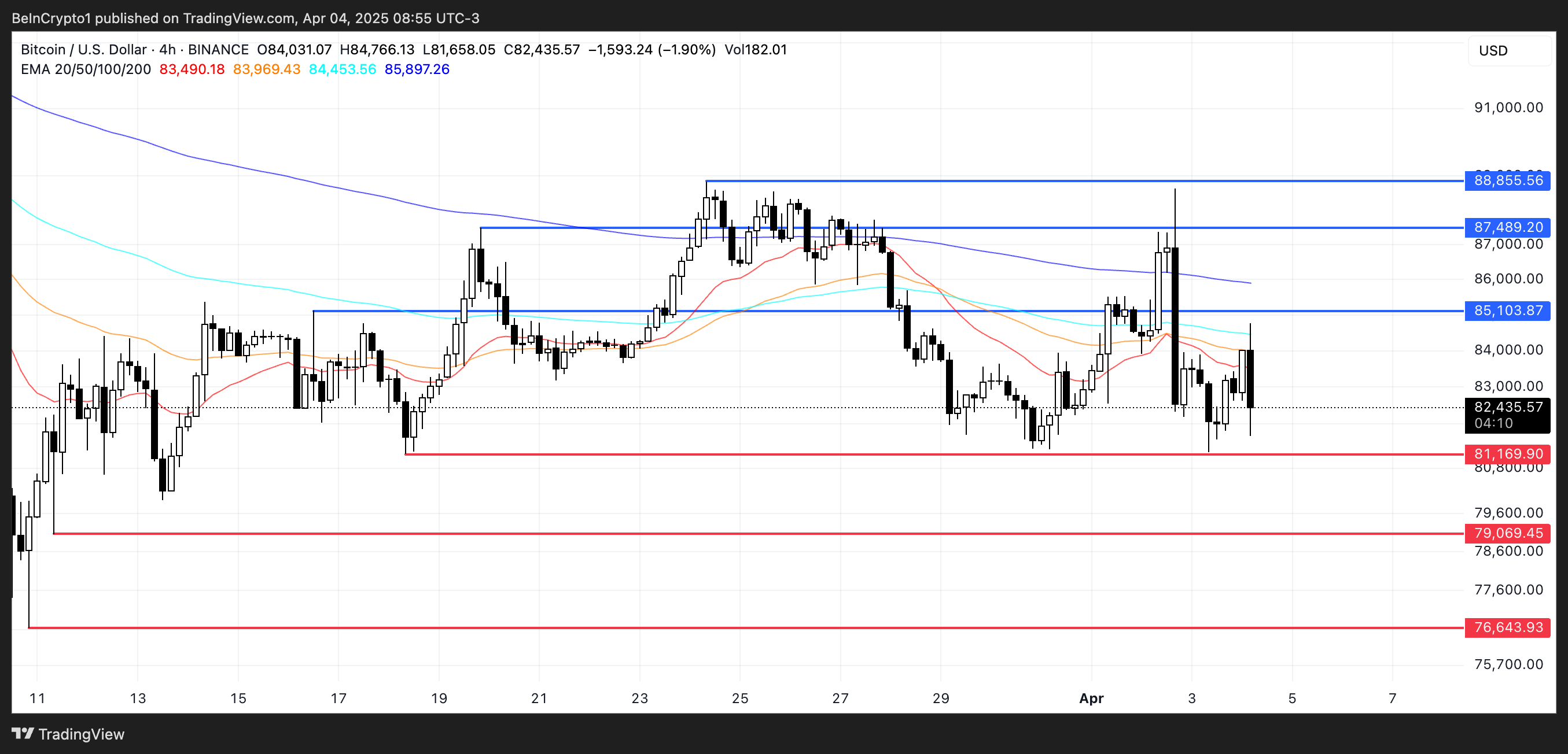

Bitcoin’s EMA structure is still tilted to the general low, with long -term emas positioned above the short term. However, the recent movement of high -term emes suggests that a rebound may be forming.

If this short -term force develops in a sustained movement, Bitcoin can first test resistance at $ 85,103. A successful breach above this level can signal a change at the moment, paving the way for higher targets at $ 87,489. Recently, Standard Chartered predicted that the BTC will likely exceed $ 88,500 this weekend.

If the high pressure remains strong beyond this point, the price of Bitcoin can advance further to challenge $ 88,855, a level that would mark a more convincing recovery of the recent retraction.

“(…) After Wednesday’s volatility, the BTC recovered more than 4% and remains firmly over $ 79,000, with a key-standing level forming at $ 80,000 and daily loudly higher exchange volumes, which is a positive signal. In addition, Bitcoin ETF flows suggest that the feeling remains strong, with $ 220 million inputs on ‘Tariff’ day ‘, April 2, ”said Nic Puckrin Founder of The Coin Bureau, to the beinchrypto.

However, if Bitcoin cannot gain enough boost for this rebound, the risk of falling remains. The first key level to note is the $ 81,169 support.

As the trade war between China and the US intensifies, a drop below this level can make the BTC fall below the $ 80,000 psychological brand, with the next target around $ 79,069. If this zone is also lost, the low trend can intensify, bringing the BTC even lower towards $ 76,643.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.