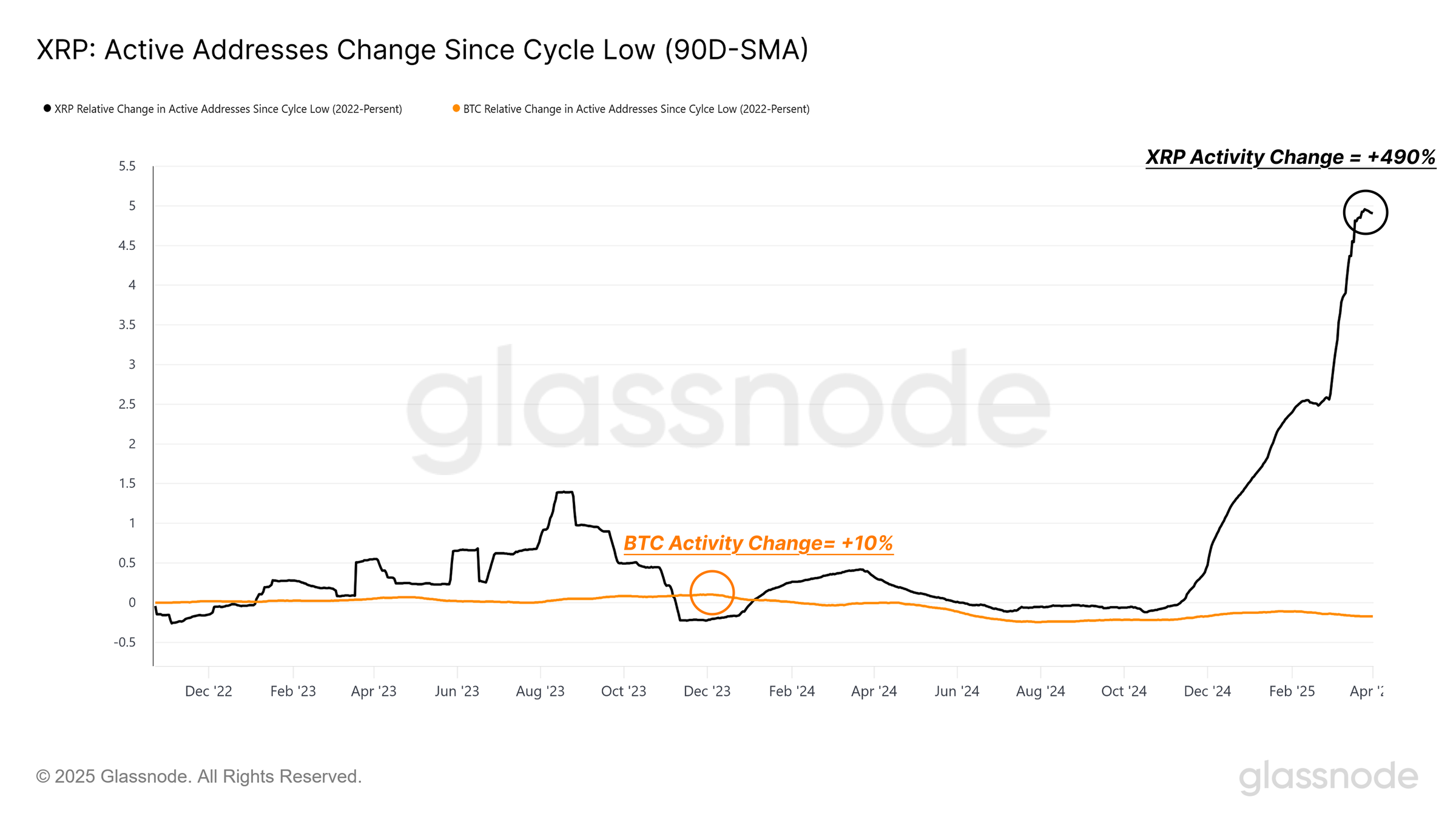

Retail investors are showing a growing preference for XRP compared to Bitcoin (BTC), according to recent Glassnode on-chain data. The data highlight a 490% increase in the quarterly average of daily active addresses of the XRP. By comparison, Bitcoin grew only 10%.

This contrast suggests that speculative retail demand is boosting the resurgence of XRP. Meanwhile, Bitcoin’s rally remains predominantly led by institutions.

How are investors impacting XRP growth compared to Bitcoin?

In its last bulletin, Glassnode highlighted the divergent paths of these two cryptocurrencies. Although both assets reach similar price gains – approximately 5x to 6x from the lowest points of the 2022 cycle – their trajectories reveal different behaviors of investors.

From the lowest point of the 2022 cycle, the quarterly average Active Addresses Daily XRP has jumped at +490% compared to only 10% for Bitcoin. This striking contrast suggests that the enthusiasm of retail was attracted to the XRP, thus providing a mirror to the speculative appetite in the crypto space, ”the newsletter said.

According to Glassnode, Bitcoin’s growth has been constant. Meanwhile, the launch of ETFS Spot or US elections triggered a period of significant ascending movement. In fact, Bitcoin reached a historical record (ATH) shortly before President Donald Trump’s inauguration.

On the other hand, Glassnode observed that the XRP rally was characterized by a sudden rupture from December 2024, driven by retail speculation.

During this recent increase, the XRP CAP almost doubled from US $ 30.1 billion to US $ 64.2 billion, reflecting a substantial capital entry, Glassnode added.

However, the increase also raises some signs of alert, as it seems to be driven more by recent investments than for a long -term sustained demand. Glassnode observed a rapid concentration of wealth among new investors, with those who entered the market in the last six months representing almost half – about $ 30 billion – of this increase.

In addition, the participation of the XRP CAP maintained by addresses less than six months rose from 23% to 62.8% in a short period. More insights from Google Trends data revealed that interest in currency is predominantly concentrated in Europe and the United States, with significantly less search activity in Asia and Africa.

Warning signs indicate possible cooling in retail demand

This geographical disparity has suggested that the increase in XRP retail may be linked to specific market dynamics in Western regions, potentially influenced by regulatory clarity or hype driven by the community.

When seen in conjunction with the strong retail participation, this sharp increase in new holders raises signs of alert, where many investors are probably vulnerable to low volatility, given their now high base cost, Glassnode noted.

Although the appeal of the XRP for retail is evident, the sustainability of its rally remains uncertain. The Glassnode report indicates that capital entry has slowed since late February 2025, suggesting a cooling of retail speculation.

In addition, the loss/profit ratio has been constantly diminished since January 2025. This suggested that investors are seeing less profits and facing greater losses.

Given the retail dominated and wealth widely concentrated in relatively new hands, this alludes to a condition where the confidence of retail investors in the XRP may be decreasing, and this can also extend throughout the market, the bulletin said.

Therefore, Glassnode warned that demand for the XRP may have already reached the peak. The company recommended caution until more definitive signs of recovery appear.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.