David Sacks, appointed by President Donald Trump as the “Crypto tsar” at the end of 2024, recently announced that he sold his entire cryptocurrency portfolio.

Experts and Cryptian community reacted to this unexpected movement.

Reasons for David Sacks to sell all crypto portfolio

In a recent tweet In the X, the Trump administration’s “crypto” confirmed that it sold all its personal cryptors before the official administration start in January 2025. Specifically, the David Sacks cryptocurrency portfolio included Bitcoin (BTC), Ethereum (ETH) and Solana (Sol).

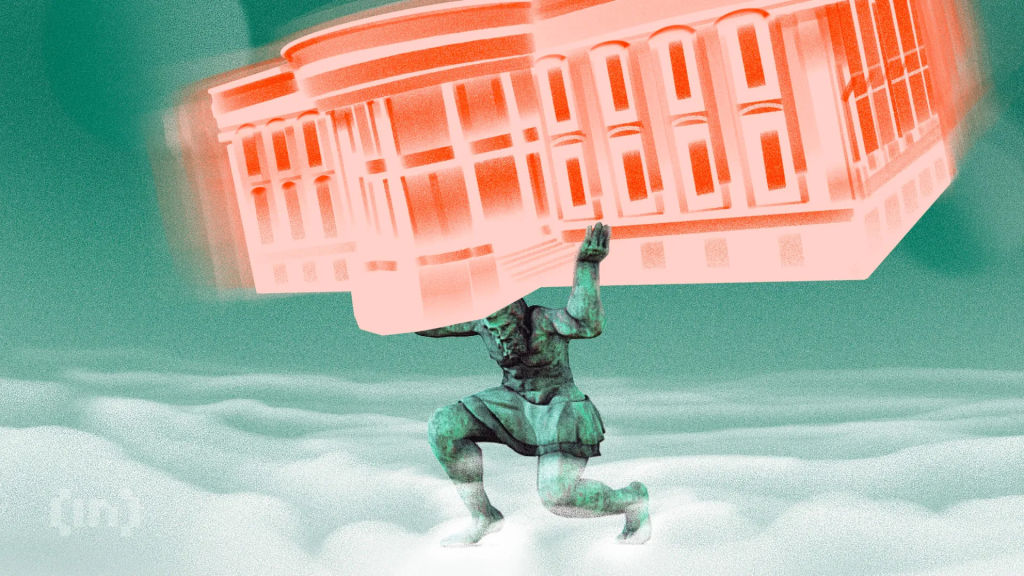

David Sacks’s decision to withdraw from the market is mainly seen as a personal choice. The community had paid significant attention to its appointment, expecting, for example, that it would promote policies in favor of crypto industry, facilitate the establishment of a Bitcoin National Reserve for the US government and balance investor protection with industry growth.

However, the decision to sell all participations in crypto can be understood by three reasons.

The first may be to avoid conflicts of interest. By not having cryptocurrencies, Sacks guarantees that there is no conflicts between his personal interests and those of the US government (US).

Secondly, the movement signals neutrality. As a leader of Cryptocurrency Policies in the US, David Sacks needs to maintain transparency and objectivity. Having any crypto could raise suspicions of bias whenever it made decisions that impacted the market.

The third reason may be the compliance with ethical regulations. High US government officials are often required to publicize their assets. In some cases, employees need to get rid of sectors directly related to their functions. For Sacks, renouncing their participations in crypto is a logical step in meeting federal ethical standards.

Sacks denies crypto participation in Bitwise

Some X users also suggested that David Sacks still have a large amount of crypto indirectly through their position as an investor at Bitwise Asset Management.

However, Sacks he responded To this question, claiming that it is not true.

This community note is a lie. I had a position of $ 74,000 in Bitwise’s ETF that I sold on January 22. I don’t have “great indirect participation.” I will provide an update at the end of the ethical process, posted on X, Sacks.

In short, the sale of all David Sacks’s crypto portfolio does not definitely signal a rejection of the industry. It can only be a “normal administrative procedure” and does not reflect negative views on crypture.

However, due to the sensitive psychology of investors, Bitcoin and some altcoins showed remarkable volatility.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.