Crypto markets will witness today (11) the salary of more than $ 2.5 billion in Bitcoin (BTC) and Ethereum (ETH) options.

Traders closely follow this event as it can impact short -term trends due to the volume of expiration contracts and their notional value. Put-to-Call’s analysis and maximum loss points analysis offers clues about market sentiment and possible price movements.

Bitcoin and Ethereum options win today

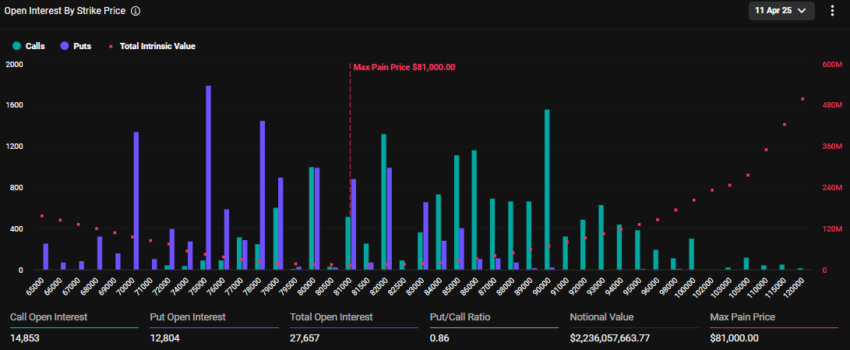

The notional value of the BTC options that win today is US $ 2.23 billion. According to Deribit data, these 27,657 Bitcoin options that expire have a put-to-Call ratio of 0.86. This suggests a prevalence of call options (Puts).

The data also reveal that the maximum damage point to these expiration options is $ 81,000. In negotiating crypto options, the maximum damage point is the price at which most contracts expire worthless. Here, the asset will cause the largest number of financial losses to holders.

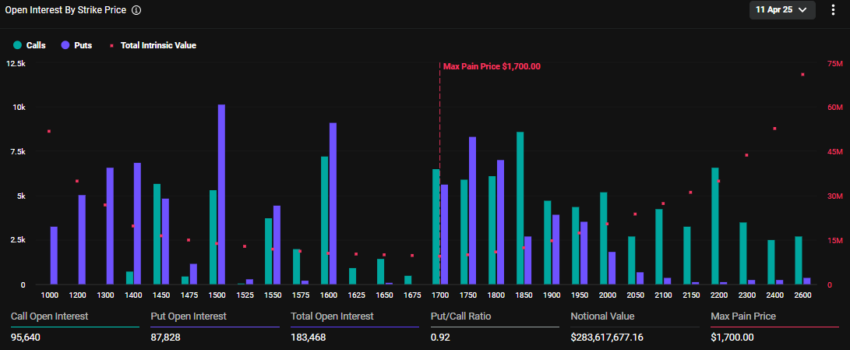

In addition to Bitcoin’s options, there are 183,468 Ethereum contracts scheduled. These derivatives represent a notional value of US $ 283.6 million, with a put-to-Call ratio of 0.92. The maximum damage point is located at US $ 1,700.

Current market prices for Bitcoin and Ethereum are below their respective maximum damage points. The BTC is being negotiated at $ 80,622, while ETH is at $ 1,543.

With the recent market volatility and ongoing tariff developments, how do you think these maturities will impact prices? Deribit he asked.

Deribit is an Exchange of Options and Futures of Crypto. In fact, this market is recovering from a massive volatility induced by the chaos of the trade war after President Trump’s fares. Meanwhile, Cardano founder Charles Hoskinson says future fares will be ineffective in crypto.

He believes the tariffs are already priced and that future ads will be a “failure” for the market.

Crypto options market points to prolonged weakness and increased perception of risk

On the other hand, Deribit analysts identify a change in the behavior of crypto options: short -term falls continue to generate demand for selling options (puts), while calls for purchasing options (calls) focus on more distant salaries and have retraction.

Now you have to look until September before the calls resume their bias. Traders may be preparing for prolonged weakness, the deribit highlighted.

This indicates that traders may be positioning themselves for prolonged weakness in the market. The drop in the Calls Award – reflected in the reduction of implicit volatility (IV) over PUTS – signals lower appetite for high and medium -term bets.

A negative – or reverse – volatility bias occurs when Puts OTM sell options have a higher implicit volatility than call options (calls OTM). This pattern is common in stock markets and usually reflects the concern of investors with possible falls in asset prices.

This pattern has also been reflected in the crypto options market, signaling a growing perception of low -investor risk. According to Greeks.live analysts, the implicit volatility of Bitcoin has shrouded significantly and currently holds around 50% in all maturities.

In contrast, the implicit volatility of Ethereum remains at higher levels, especially in short to medium deadlines. With the IV close to 80%, analysts evaluate that selling Ethi options in this interval can represent an attractive strategy for traders.

Crypts face risk aversion scenario and greater likelihood of unexpected shocks

Global economic uncertainty, including the US and China tariff war, reduced risk appetite. The inherent volatility of crypto may also be feeding this cautious perspective.

The feeling was more panic this week, with Trump’s frequent change in tariff policies making the market extremely averse at risk, Greeks.live analysts wrote.

Greeks.live analysts agree with the expectations of prolonged weakness deribit. However, unlike Hoskinson, they expect continuous uncertainty and volatility on the market for a long time.

For traders, this suggests the need for hedge strategies, such as buying puts or diversifying at stablecoins.

Crypts are currently suffering from the lack of new investments, the absence of new narratives and a more contained feeling of investors. In this most unfavorable market, the likelihood of a black swan event will be significantly higher, and buying some simple sale options would be a good choice, Greeks.live analysts have completed.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.