This Friday (25), expire billions in options of Bitcoin (BTC) and Ethereum (ETH), a movement that has led investors to position themselves in the face of a possible rise in volatility.

Traders and investors closely follow the salary of options, given their significant volume and high notional value – factors that increase the impact potential on short -term trends. Indicators such as put-to-Call ratio and maximum pain points help anticipate possible developments and market directions.

Insights on Bitcoin and Ethereum options

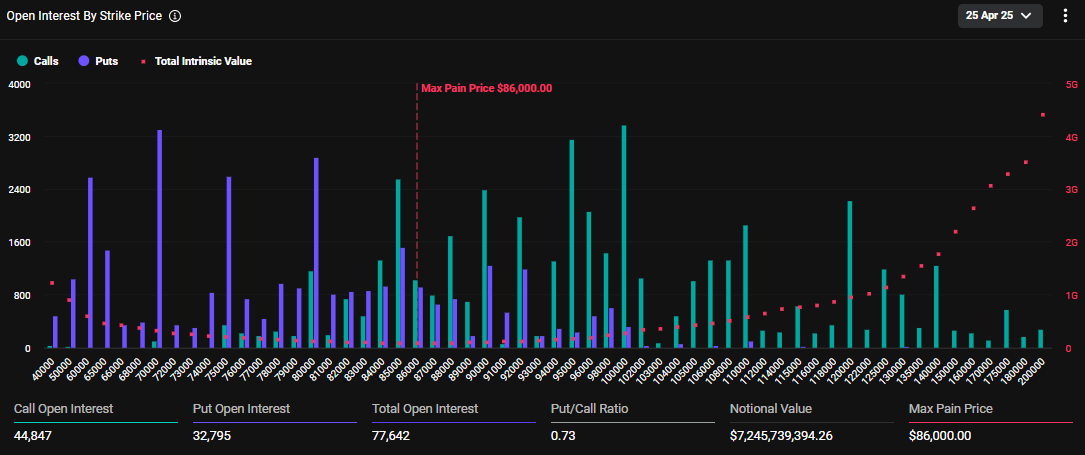

The notional value of bitcoin options that expire today is $ 7.24 billion. According to Deribit data, these 77,642 Bitcoin options that expire have a put-to-Call ratio of 0.73. This suggests a prevalence of call options (Puts).

The data indicate that the maximum pain point for the options that win today is $ 86,000. This is the value where most investors who operate with options – buying or selling – loses more money. In other words, it is the price that causes the largest collective loss in the market.

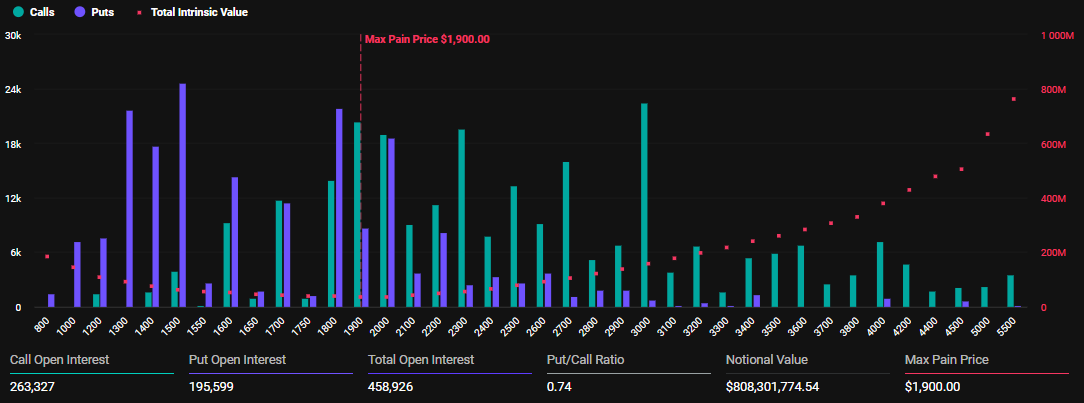

In addition to Bitcoin options, today 458,926 Ethereum options contracts, totaling US $ 808.3 million. The ratio between sales and purchase options is 0.74, and the maximum pain point is $ 1,900 – that is, this is the price where investors tend to have the highest combined losses.

Options salary indicates pressure on BTC and ETH prices

The number of Ethereum options that expire today (25) was significantly higher than last week. Beincrypto reported that last week’s options were 177,130 contracts, with a notional value of $ 279.789 million.

Until the publication of this text, Bitcoin was being negotiated well above its maximum pain level at $ 93,471. Meanwhile, Ethereum was being negotiated below its exercise price at $ 1,764.

BTC negotiates above the maximum pain, eth below. Positioning for maturity is far from aligned, Deribit analysts observed.

With the maximum pain level (also called the exercise price) often acting as a price for the price due to intelligent money stocks, both Bitcoin and Ethereum can approach their respective levels.

The positioning of open interest to BTC and ETH reveals intense activity of traders near maximum pain levels. The strong concentration in the histograms of both assets – between $ 80,000 and $ 90,000 in the case of Bitcoin, and between $ 1,800 and $ 2,000 in Ethereum – highlights the most pressure zone in the market.

This positioning suggests potential for short -term price consolidation or volatility.

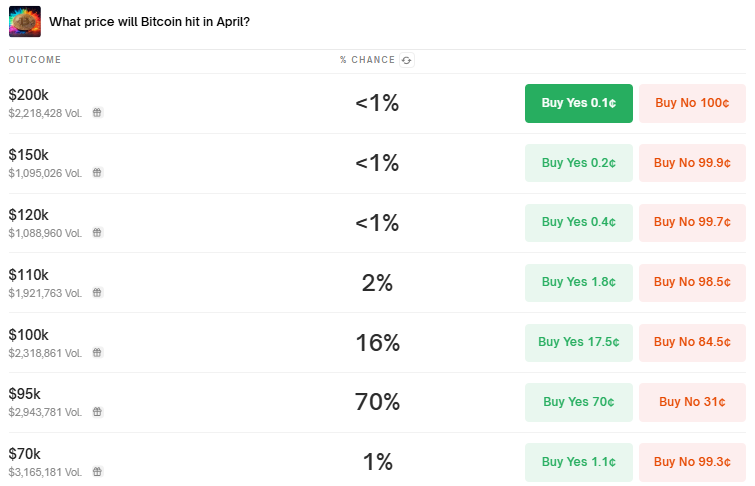

Polymarket: Only 16% Chance Bitcoin Price Price reaches $ 100,000 in April

According to Deribit, traders are selling guaranteed sales options on Bitcoin. In addition, they are using stablecoins to collect prizes while positioning themselves to buy BTC at lower prices. This reflects a long -term optimistic perspective.

BTC traders at Deribit are expressing long -term optimistic feeling, selling cash puts using stablecoins to potentially buy at low and collect yields, deribit he wrote.

Deribit analysts have also noted that many bitcoin options contracts are concentrated in the price of $ 100,000. This shows that a relevant part of the market believes that the BTC can reach this value, reinforcing the positive feeling about the future of cryptocurrency.

However, data on the Polymarket forecast platform shows traders estimating only 16% chance of the BTC reaching $ 100,000 in April.

Another interesting observation is that the cumulative Delta (CD) between BTC and Deribit -related ETF options reached $ 9 billion. Although this shows a sensitivity to bitcoin price changes, it also suggests a volatility as market makers protect their positions.

This view is in line with what Crypto Analyst Kyle Chassé points out: Hedge Funds usually do not bet on Bitcoin’s long -term appreciation. Instead, they prefer to profit from arbitration, a strategy that seeks fast and risk -free gains. When these opportunities decrease, they remove money from the market, which can increase sales pressure on the BTC.

However, Deribit analysts also reveal an increase in the purchase of Bitcoin purchase options for earnings from April to June 2025. Investors are allegedly targeting strikes between $ 90,000 and $ 110,000, a feeling inspired by the price of Bitcoin exceeding 89,000.

This suggests that optimistic market feeling was probably driven by the Fomo as the price of the BTC exceeded $ 90,000. Analysts also highlight a market stabilization effect from the reversal of Trump’s tariff policy on April 9. The measure reduced the volatility of the global market, encouraging a rotation of gold for crypto, contributing to the recovery of the price of Bitcoin.

In fact, not all the activity that led to the recovery of Bitcoin was new money or a new capital injection. According to a Deribit Tony Stewart analysis, half involved the adjustment of existing positions, indicating strategic adjustments by traders.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.