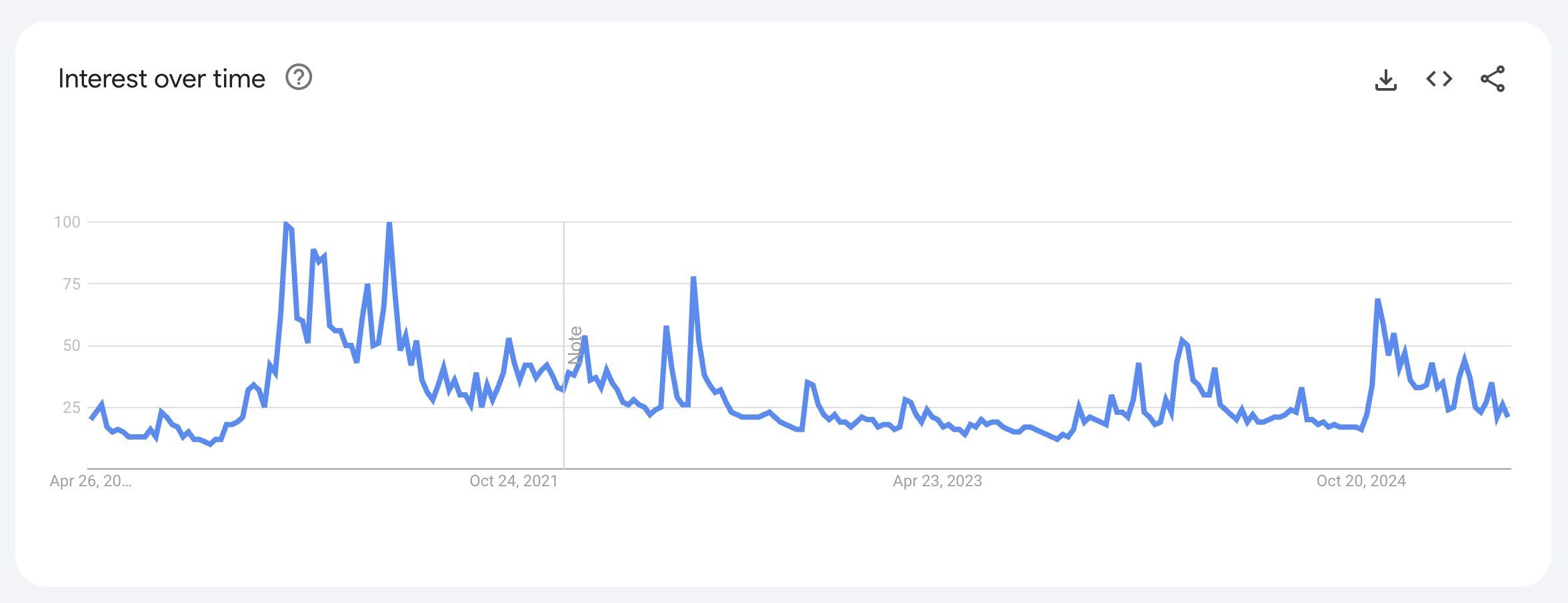

The amount of Bitcoin searches on Google has been a key indicator of the public interest. Historically, Bitcoin research increases are often aligned with valuing the price of cryptocurrency, creating a correlation between popular interest and market movements.

However, Bitwise CEO Hunter Horsley recently observed an intriguing phenomenon. Despite the volume of searches for the keyword “Bitcoin” on Google remains consistently low for a long period, the price of cryptocurrency continues to be around $ 90,000.

Bitcoin search volume falls: sign of change in market dynamics

In the last year, the public interest fell from almost 75 points to about 25 points, with no clear signs of recovery. The Google Trends chart reveals that the public interest gradually decreased after peaks in the volume of searches during 2017 and 2021, aligned with large highs of Bitcoin. Now it has floated at a low level for several years.

Meanwhile, the price of the main crypto in 2025 increased 380% compared to its 2017 peak, and 38% compared to its maximum of 2021.

Hunter Horsley emphasized that while the price of cryptocurrency is rising, the lack of public attention suggests that this rise is not driven by the (fear of losing) from retail investors. Instead, Horsley believes institutional investors are the main force behind this discharge.

Bitcoin at $ 94,000, still – Google searches for ‘bitcoin’ near long term minims. This was not driven by retail. Institutions, consultants, companies and nations entered space, Horsley stated.

The participation of investors in the Bitcoin market diversified considerably, signaling a new phase of maturity for the cryptocurrency sector. However, this does not imply that retail investors have lost their interest. They remain active, but now through investment products focused on the institutional level.

Large institutions such as Blackrock, Fidelity and Ark Invest actively entered the market through Bitcoin ETFs. These funds attracted substantial capital flows indirectly from retail investors through institutional channels.

I think the retail is already inside. And a lot inside. But they are not buying in sight. When people say they are the institutions (Blackrock, Fidelity, Ark, etc.) that are doing all shopping, it is the retail money behind it all. An investor commented on X

Fidelity recently reported that public companies added nearly 350,000 BTC after the US election. They have bought more than 30,000 BTC per month so far in 2025. In addition, Ark Invest predicts that Bitcoin can reach $ 2.4 million by 2030, driven by institutional adoption.

Other reasons behind the drop in the volume of search for bitcoin

Several other factors may explain this fall:

First, BTC is no longer a new concept. After more than a decade of existence, most people interested in crypto already have basic knowledge. They no longer need to look for information about Bitcoin as often as before.

Second, changes in information search behavior also play a crucial role. Many users now resort to AI tools or social media platforms like X to get updates rather than depending on Google searches.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.