The industry labeled April 7 today, such as Black Monday, or “Black Monday” of crypts. The feeling that comes from the blood bath that occurred over the weekend.

In the last two days, more than $ 1 billion in long and short positions have been eliminated by weekend volatility.

What happened over the weekend?

Coinglass data show that up to $ 116.59 million in positions were settled on Saturday, April 5. This included $ 33.02 million in short positions and $ 83.57 million in long positions.

The next day, the volume of traders and investors eliminated increased, with cryidal settlements exceeding US $ 850 million. As the day before, most of these settlements were long positions, at $ 743.115 million, against US $ 107.881 million in short positions.

“In the last 24 hours, 320,444 traders have been settled, totaling US $ 985.82 million in settlements”, Coinglass noted.

This volume of liquidations has fueled widespread pessimism in the crypto market. In addition, coingcko data show that the total market value of cryptum fell more than 10% to $ 2.5 trillion.

Among the top 10 free -fall crypts, the price of XRP leads the fall, falling more than 15.4% to negotiate at $ 1.7 at the time of this writing. Similarly, the price of Ethereum fell 14.3%, selling at $ 1,480 at the time of publication.

Analysts in the X (former Twitter) are commenting on the potential of a historical Crash, similar to the “Black Monday.”

“Tomorrow (meaning April 7) is shaping to be Black Monday 2.0,” commented analyst Maine noted.

“Black Monday” refers to a significant and sudden CRASH of the stock market on October 19, 1987. That day, the main stock rates around the world plummeted, with Dow Jones Industrial Averag (DJIA) in the United States falling 22.6%. This marked its biggest percentage drop in a single day in history.

In this context, panic has settled as negotiation volumes overloaded the markets. The lack of mechanisms to pause negotiations during extreme volatility allowed free fall to remain without control.

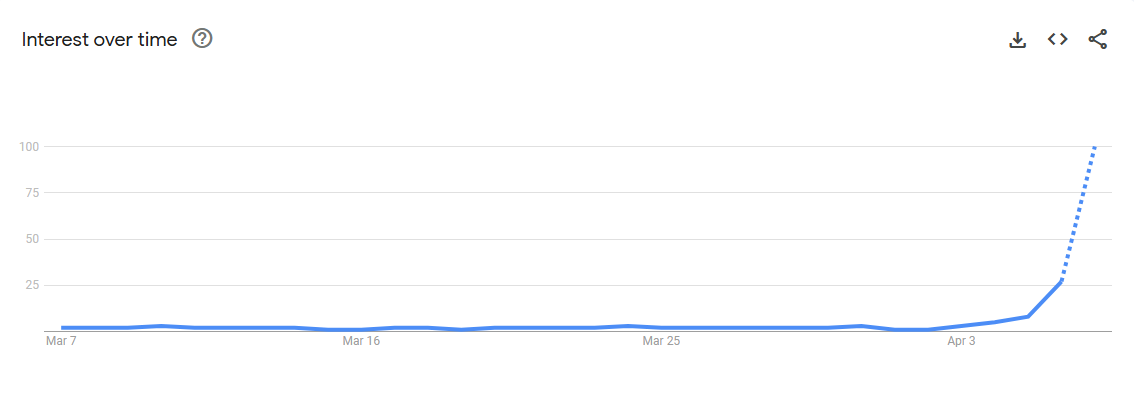

After massive settlements, Google Trends data show that global searches per “black Monday” are at maximum levels.

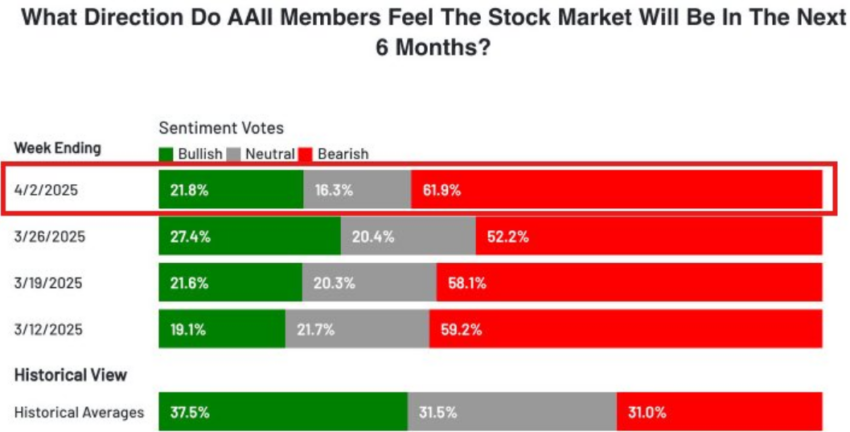

“The feeling of low is undoubtedly on its highest levels in history,” The Kobeissi Letter noted.

Panic Week: What is behind the Crypto fall?

The renowned market commentary attributed pessimism to uncertainty around the proposed tariffs, describing the “black Monday” as the consensual vision. Based on this, analysts from The Kobeissi Letter predict “short -term capitulation” this week.

“Down and then up,” analysts wrotesuggesting a volatile market, but with recovery potential.

This feeling is aligned with AAII’s feeling research, which reported an impressive low perspective of 61.9%. In fact, this is double its historical average of 31.0%.

“Black Monday 2.0”, Themainewonk alerted.

Analyst Duo Nine supports this assumption. He warns that Trump fares can dismantle global supply chains, reduce productivity and lead to a prolonged low crypto market. However, he believes this could last 1-2 years if a recession occurs.

“If the US does not do a march reversal soon, then the only conclusion is that this is intentional and the damage will only increase over time. Unfortunately, for crypto, it means the beginning of a prolonged low market. It can last 1-2 years or more if a global recession begins,” Duo Nine explained.

While fear fears dominate, contrary investors can see extreme pessimism as a sign of buying. Thus, perception is based on the assumption that when such dark predictions become common, the market bottom may be close. Such a movement would offer opportunities in the peak of fear.

Not everyone agrees with the apocalyptic tone. Ryan Wollner, founder of Pearpop, asked for caution against exaggerated narratives in X. He too Denied comparisons with the 1987 crash.

“I think we can be looking only at A 2-3 week transition, and then we will see people buying again as soon as the tariffs are more understood, ”Wollner these.

Therefore, Wollner suggested that experienced traders could profit from selling now and buying soon at low prices. He emphasized that, unlike fraud -driven past recessions, this fall reflects temporary change, with funds probably flowing to US companies and failed nations.

In addition, beinchrypto data show that Bitcoin has dropped almost 8% in the last 24 hours to negotiate for $ 77,030 at the time of publication.

While markets are preparing for turbulence, opinions remain between imminent misfortune and opportunistic recoveries.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.