Bitcoin taken from hundreds of millions of dollars in large exchanges caught the attention of the crypto community.

However, if Bitcoin does not exceed the resistance of the $ 86,000, a price correction remains a concrete possibility, especially in the face of the unstable confidence of investors.

BTC whales remove hundreds of millions in bitcoin

Account data OnchainDataNerd In the X, today (17), reveal that several large whales of Bitcoin performed large withdrawals of top exchanges. The Digital Galaxy removed 554 BTC, valued at approximately $ 76.74 million from OKX and Binance.

Abraxa Capital removed 1,854 BTC, worth about US $ 157.26 million from Binance and Kraken.

Two other whales, identified by 1MNQX and 1Beru addresses, removed 545.5 BTC (US $ 45.5 million) and 535.2 BTC (US $ 45.44 million) from Coinbase, respectively. In a single day, more than $ 280 million in Bitcoin were removed from exchanges.

Such withdrawals from bitcoin whales, such as those of digital galaxy and Abraxa capital, often signal a BTC Move strategy for cold storage. This is usually seen as a high signal, reducing sales pressure and reflecting expectations of future price increases.

Increased Bitcoin buyers for the first time

A Glassnode report highlights an increase in bitcoin buyers for the first time. This influx of new investors can boost short -term price gains. However, long -term holders paused their accumulation, signaling caution amid the high market volatility.

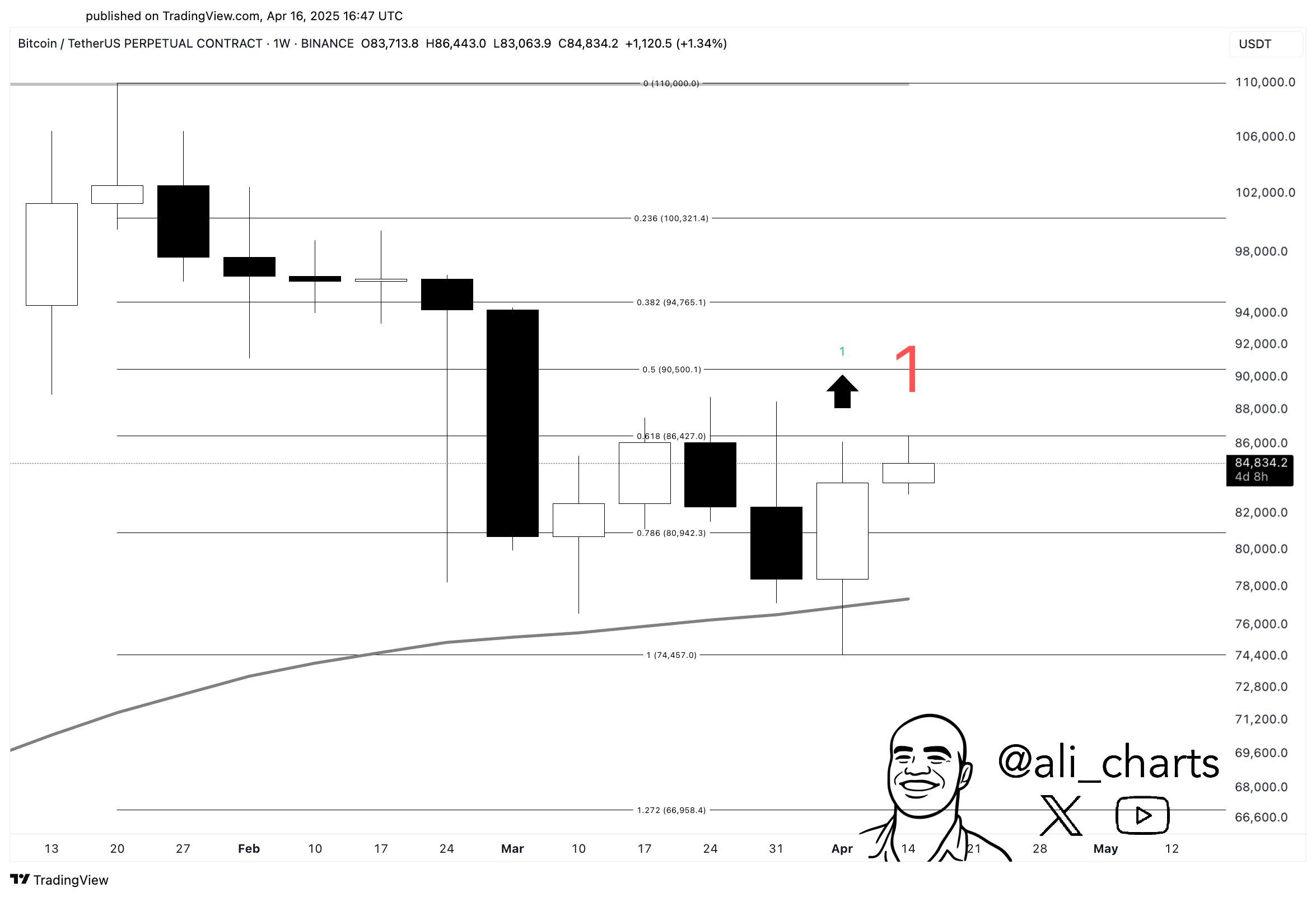

In an X post, the analyst there used the technical indicator TD Sequenteial to analyze the price trend of Bitcoin. According to him, the indicator issued a purchase signal on the weekly cryptocurrency chart.

If Bitcoin can close consistently above $ 86,000, there is a strong probability of new advances in the price. Cryptocurrency is currently maintaining over $ 80,000, signaling possible appreciation. However, the decisive overcoming of resistance at $ 86,000 is crucial to confirming the continuity of the high trend.

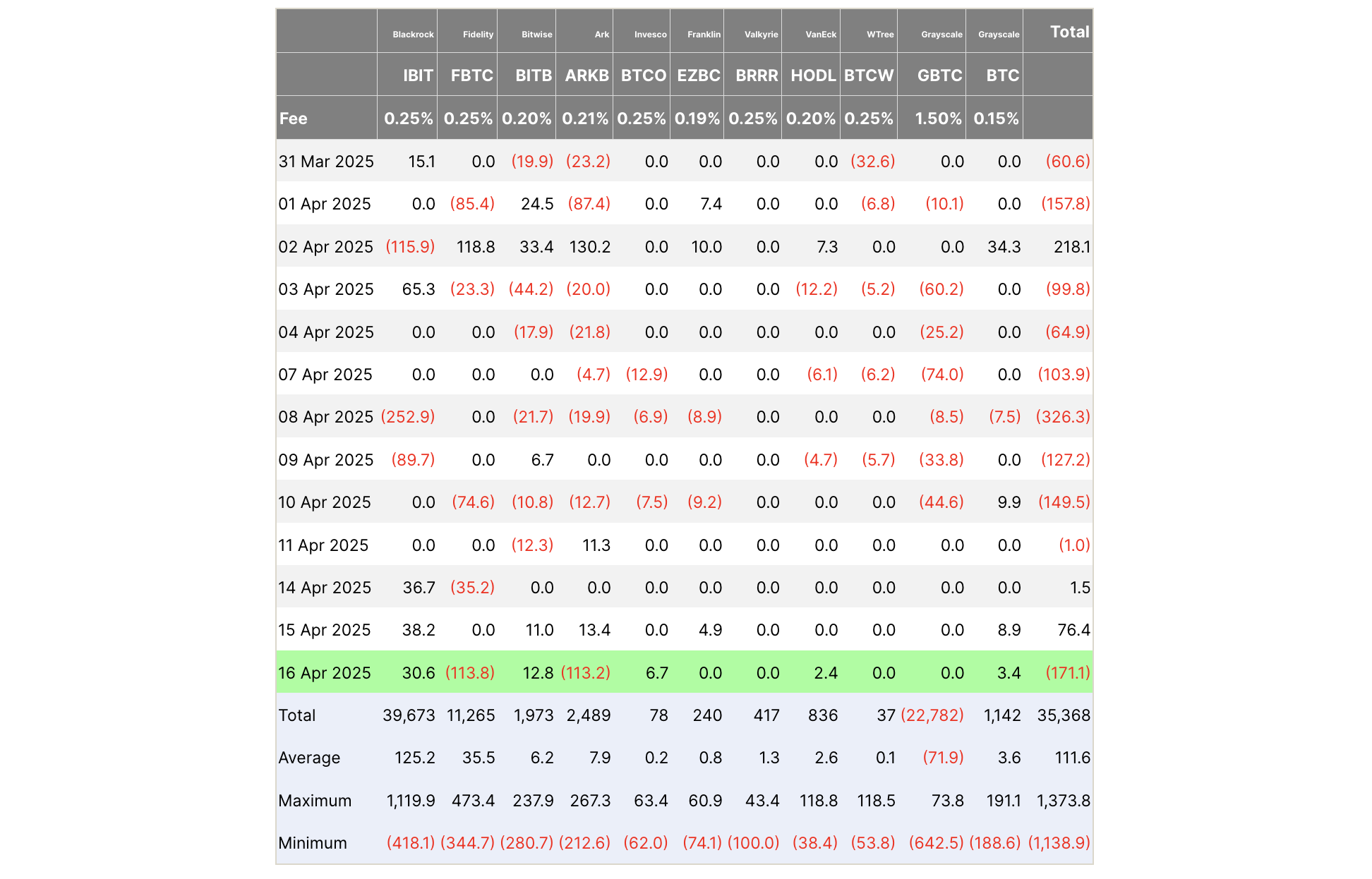

Despite the recent accumulation of whales, not all signs are positive. Bitcoin ETF entrances fell significantly. This drop suggests weakening investors’ confidence, which can exert descending pressure on prices without new catalysts.

In addition, data from Lookonchain indicate that more than $ 1.26 billion in Bitcoin has been removed from Babylon. If this capital returns to exchanges, sales pressure can intensify, making it difficult to overcome key resistance levels by cryptocurrency.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.