Bitcoin seems to have started April in a less pessimistic note, while the broader crypto market continues to recover.

On-chain data now indicate that sales pressure among BTC holders may be decreasing, potentially paving the way for a price increase in the coming weeks.

Bitcoin short -term holders show confidence

On-Chain Metrics Key, including the Holder Spent Output Profit Ratio (STH-SOPR), suggest that fewer currencies are being sold in the market. This metric is at 0.9 at the time of publication, constantly falling over the past week.

BTC’s STH-SOPR evaluates the profitability of its short-term holders (those who have kept their currencies for three to six months) and provides insights on whether these investors are profitable or not.

When the Nth-SOPP is above 1, it indicates that these holders are on average selling their coins with profit. On the other hand, if the Nth-SOPR is below 1, it suggests that these holders are at the detriment.

With coins holding on unquited losses, they are not motivated to sell their possessions. This reduces Bitcoin’s sales pressure on the market and can increase its value as the optimistic feeling returns.

Long -term holders reduce sales

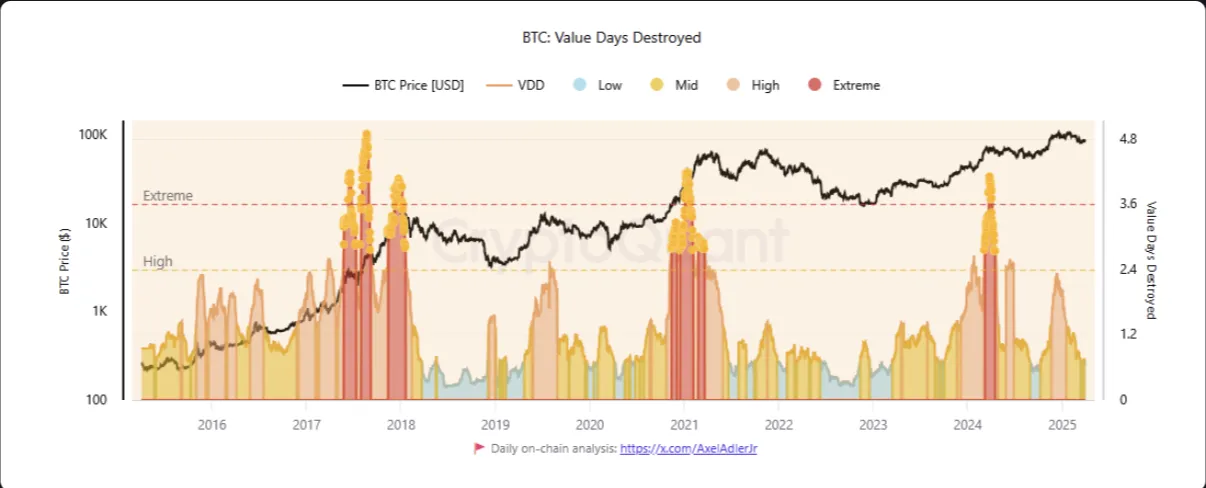

In addition, the drop in BTC’s Value Days Destroyed (VDD) confirms this gradual change in optimistic feeling about the main currency. In one report Recent, Cryptoquant’s pseudonym analyst Banker found that this metric plummeted in March, signaling a drop in sales between the BTC long -term holders.

Bitcoin VDD tracks the pattern of accumulation and distribution among long -term coin holders. When it rises, it indicates that older coins are being moved, suggesting that long -term holders are selling or making profits.

On the other hand, a drop in BTC VDD suggests that these holders are keeping their coins, indicating strong conviction and belief in future prices appreciation.

According to Banker, the BTC VDD rose to 2.27 on December 12, signaling that “long -term holders were aggressively making profits – a classic sign of market overheating alert.” However, in March, the metric fell to 0.65, indicating that the intense phase of profits had passed, with these holders now exercising more containment.

The subsequent drop to 0.65 in March 2025 tells a revealing story. This three -month -old descent suggests that the most intense phase of profits has passed, with long -term holders now showing more containment. Although this reduces immediate sales pressure, it also indicates that the market has entered a new phase of its cycle, Banker noted.

As highlighted by these metrics, the growing confidence of holders can push the BTC to new levels. This will further solidify your position in the market as investors’ feeling gradually becomes optimistic.

BTC RSI breaking can raise prices in addition to $ 87,000 to $ 91,000

In the daily chart, the BTC tries to break the neutral line of its relative force index, reflecting the growing purchase activity. At the time of publication, this key moment indicator is 47.10.

The RSI measures the market conditions of overcoming and overwhelming of an asset. It varies between 0 and 100, with values above 70 indicating that the asset is overdone and about to fall. On the other hand, values below 30 suggest that the asset is overwhelmed and may witness a recovery.

BTC’s RSI attempt to break above the 50 neutral line signal that the optimistic moment is gaining strength as more purchase pressure enters the market. This potential crossing may indicate the beginning of a high trend or a change towards a positive price action to the leading currency.

In this scenario, its value can exceed resistance at $ 87,775 and rise to $ 91,531.

On the other hand, if pessimistic dominance resurfaces, the price of currency can resume its fall and fall to $ 82,692.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.