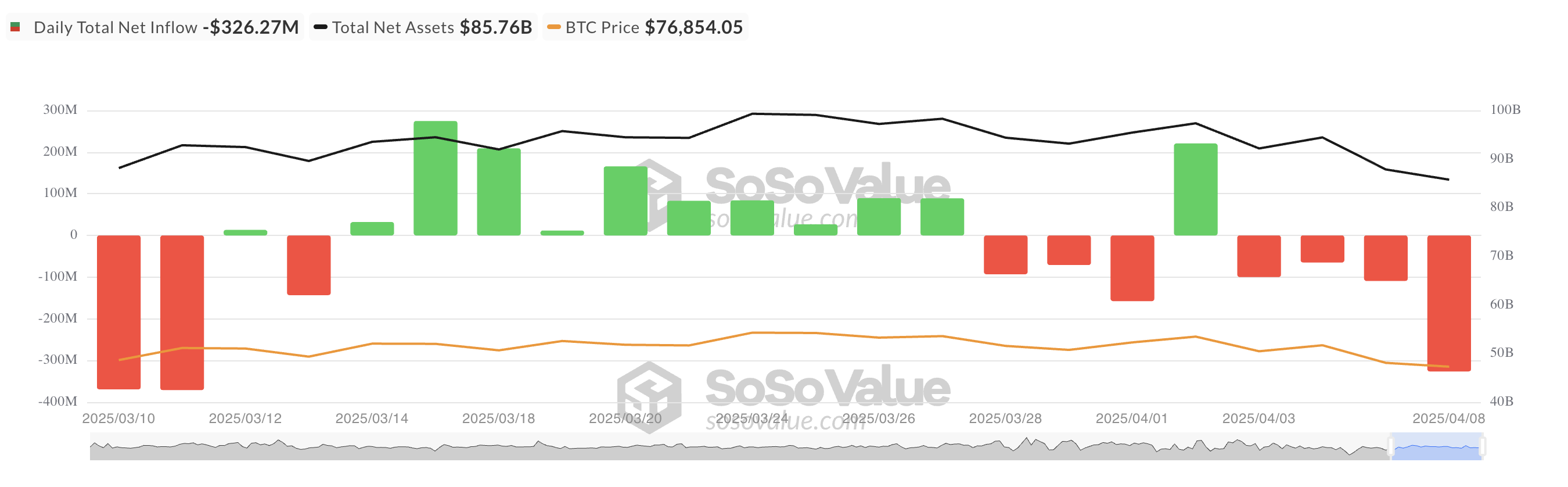

Institutional investors are increasingly averse to risk, shifting capital from Bitcoin ETF products. This change of feeling has led to a sharp increase in the capital exit, with Bitcoin ETFs listed in the US registering another day of exits on Tuesday.

This trend signals low -sustained pressure and a lack of conviction of institutional investors who previously boosted Momentum in the ETF market.

Bitcoin has a larger funds out since March

On Tuesday, the BTC ETF exits in sight totaled US $ 326.27 million, marking four consecutive days of consistent exits. Yesterday’s amount also represented the largest daily output of BTC ETFs in sight since March 10, signaling a remarkable change in feeling.

This sustained capital escape suggests that large investors are reducing the risk of their portfolios in response to macroeconomic pressures triggered by Donald Trump’s commercial wars. The trend is significant considering the role that institutional flows played in boosting BTC discharge through the demand for ETFs in the past.

According to Sosovalue, Blackrock’s ETF Ibit had the largest liquid exit on Tuesday, totaling US $ 252.29 million, raising its total historical liquid inputs to $ 39.66 billion.

Bitwise’s ETF Bitb was in second place with a daily net outlet of $ 21.27 million. At the time of this writing, the total historical ETF liquid inputs is still $ 1.97 billion.

For the second time this week, none of the twelve Bitcoin ETFs in sight listed in the US recorded a single net entry.

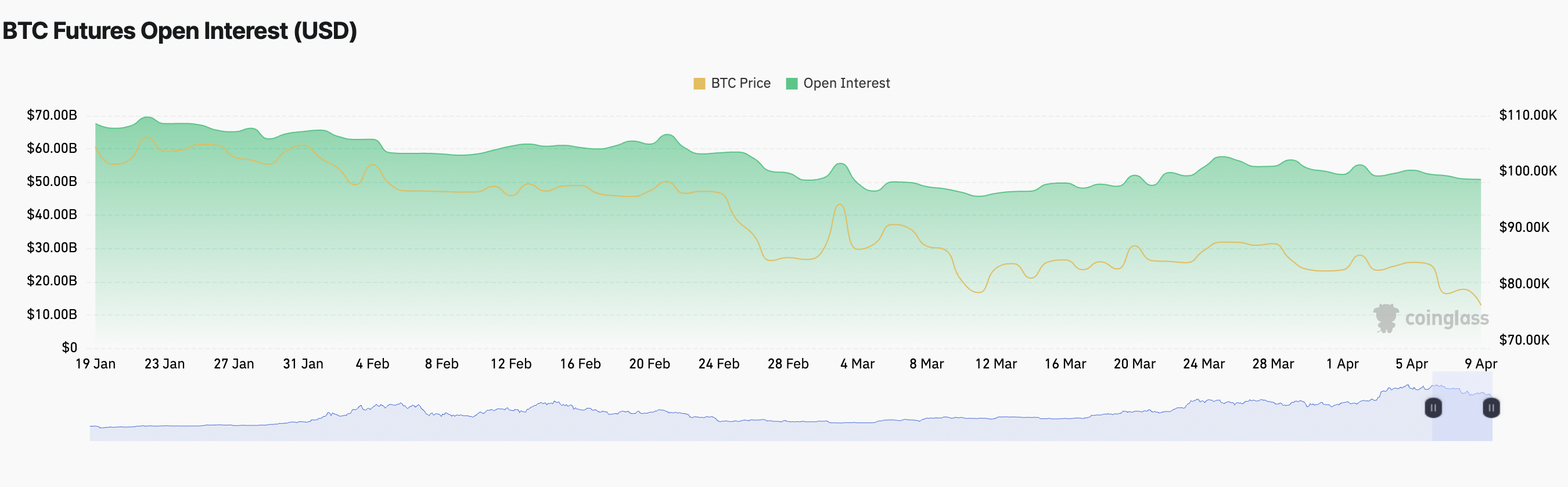

Bitcoin futures cool as options traders bet on recovery

At the same time, Open Interest (Oi) in BTC futures remains suppressed, a sign that the conviction between leveraged traders has not returned. At the time of publication, it is $ 50.81 billion, falling 0.27% on the last day.

When the BTC Oi drops, existing future contracts are being closed or settled faster than new ones are being opened. This signals a reduced participation of traders or a weakened conviction in today’s market trend.

Nevertheless, many futures traders remain optimistic, as reflected by the positive currency financing rate, which is 0.0090% at the time of publication. Oi falling the BTC and the positive financing rate suggests that its traders still pay a prize to maintain long positions, but the overall market share is decreasing.

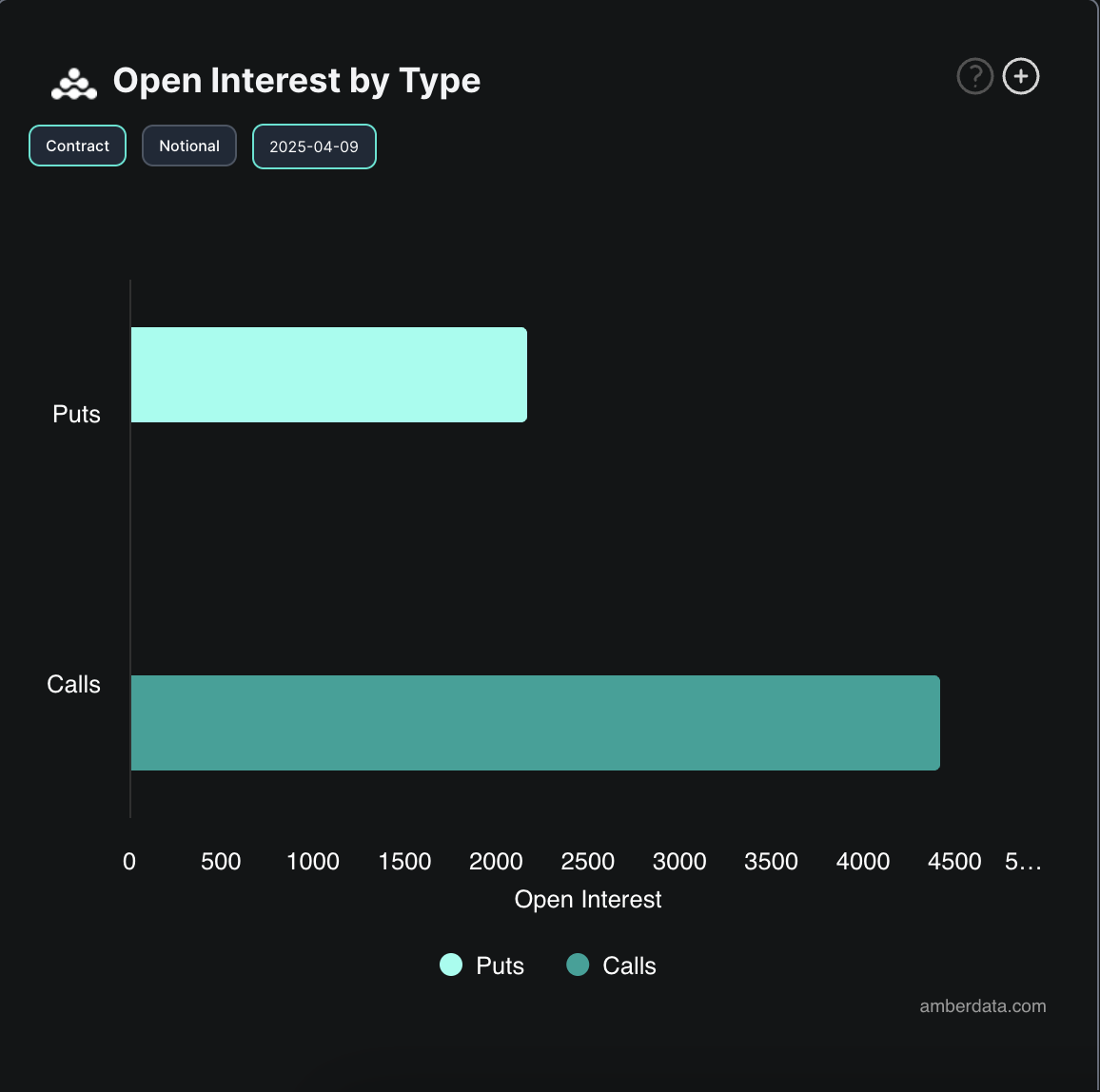

In fact, on the side of the options, the demand for purchase contracts has now exceeded sales.

This means that more traders are betting or protecting themselves against price increases. Indicates an increased demand for exposure to discharge, suggesting confidence in potential rally.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.