Bitcoin (BTC) has undergone three previous halving cycles with a relatively clear price standard. Offer decreased, demand increased and the price of bitcoin then fired. However, in the fourth cycle of halving, there is a divergence.

Data suggests that Bitcoin’s growth trajectory no longer follows the historical interval established by previous cycles. Many industry experts believe the asset has entered a completely different phase compared to before.

What is different in Bitcoin’s fourth halving cycle?

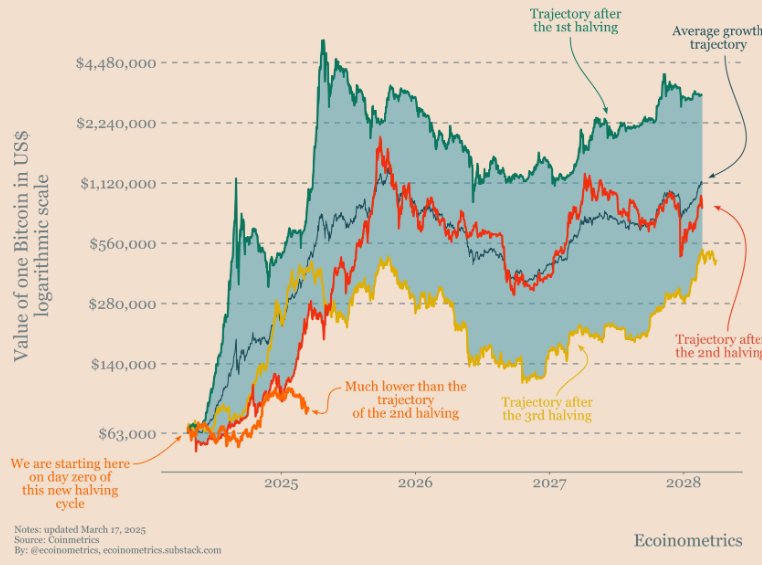

Observations of Ecoinometrics They show that the currency growth rate in this cycle is significantly lower than in the previous ones. This indicates that the halving event no longer plays a central role in conducting the price of bitcoin as before.

If the asset grew similarly to previous cycles, its price could range from $ 140,000 to $ 4.5 million from $ 63,000. However, currency is currently being negotiated around $ 80,000.

At this stage of the cycle, the lower limit of the historical interval should be around US $ 250 thousand. – EcoInometrics commented.

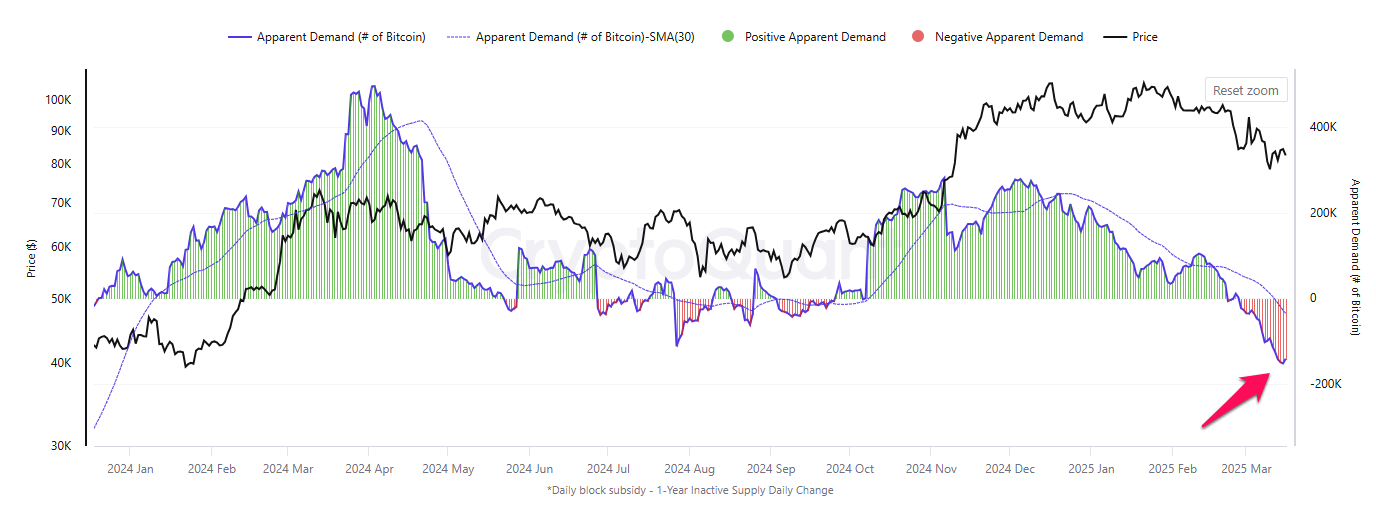

Another crucial factor is that the demand for Bitcoin has dropped to its lowest level by over a year, according to Cryptoquant data. The apparent asset demand metric compares the new offer with the inactive offer maintained for more than a year, highlighting the true demand.

This means that even if the halving event reduces supply, the price of the asset may have difficulty rising without new capital influx or strong interest from investors.

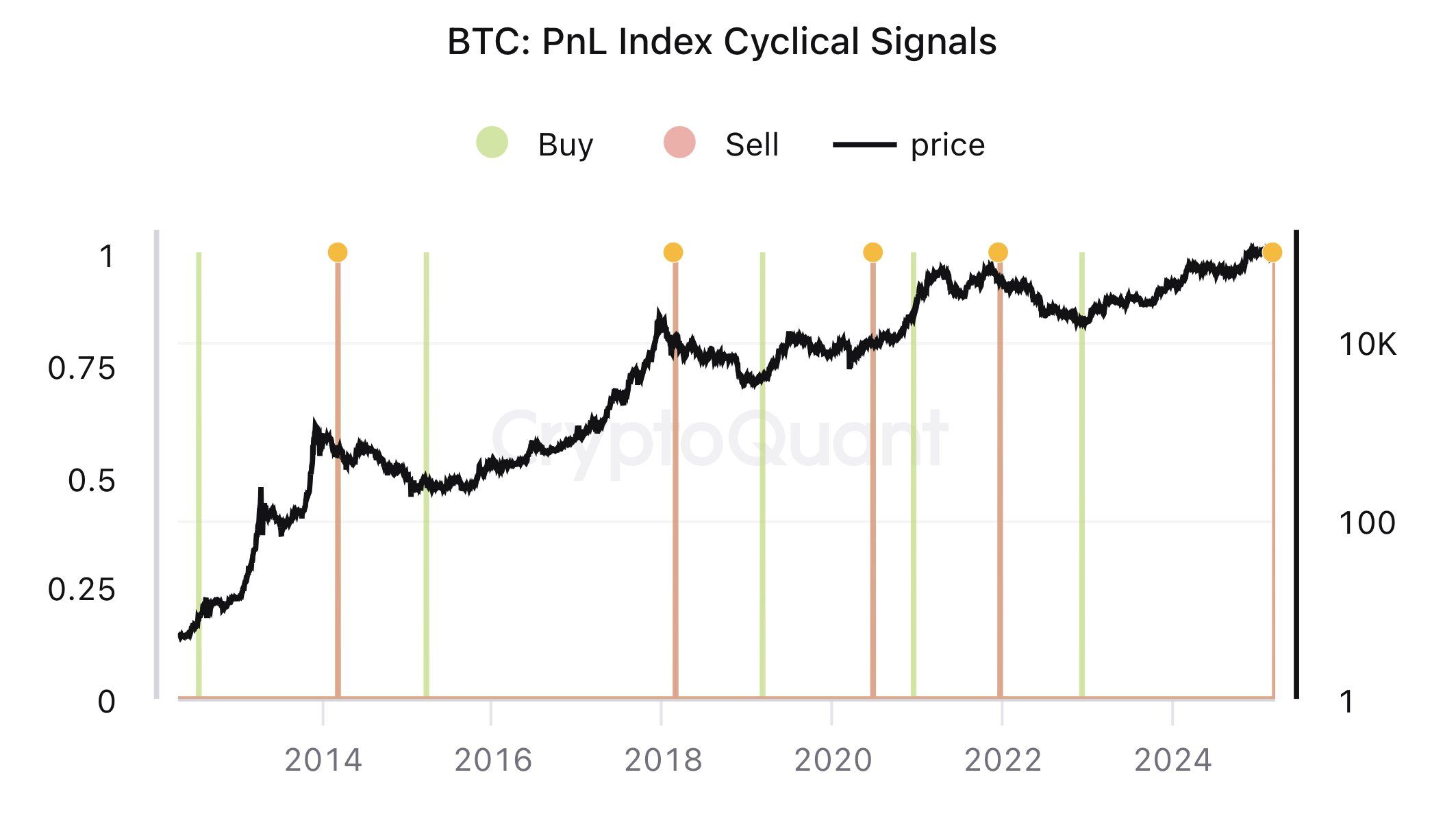

Along with Apparent demand from bitcoinKi Young Ju, founder of Cryptoquant, also analyzed the cyclic signs of the NLP index of the currency. This metric applies a moving average of 365 days to important on-chain data such as MVRV, SOPR and CUPL. It signals “buy” or “sell” at important turnaround points in a large cycle rather than short -term fluctuations.

Based on these data, Ki Young Ju predicted that Bitcoin’s discharge cycle ended.

Bitcoin’s high cycle is over, waiting 6–12 months of low or side price action, Ki Young Ju PREVENTED.

Charles Edwards, founder of Capriole Investments, highlighted another important difference in this Bitcoin cycle. Unlike the previous one, which has benefited from expansionary monetary policies from central banks, this time central banks are squeezing or maintaining neutral policies.

During the last cycle, Bitcoin prospered as central banks injected liquidity into the economy, creating a favorable environment for risk assets such as crypto. However, the current monetary stance lacks this same support force, making it harder for the currency to support a strong upward impulse.

Despite this, Charles Edwards remains somewhat optimistic. He noted that US liquidity is showing technical signs of a possible recovery.

In this Bitcoin cycle, we have largely faced a stable monetary cycle, in contrast to the strong discharge trend of the previous (green) cycle. This may be about to change. We are now seeing the first signs of a potential important background of several years in US liquidity, with an Eve/Adam background forming today. It has been almost 4 years since the squeeze started. 2025 would make sense for a change in the tendency of monetary policy amid tariff tensions. Let’s see if this new trend can keep up, predicted Charles Edwards .

The halving cycle has already been the most important factor influencing the price of currency. However, current data paints a different picture. Weak demand, unfavorable monetary policies and expert predictions suggest that the asset has entered a new phase.

In this environment, macroeconomic factors and institutional capital flows will probably dictate asset price trends more than the halving event itself.

Check out our Bitcoin Forecast Page (BTC).

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.