In recent days, the wave of liquidations in the cryptocurrency market has shook investors’ confidence, leaving many traders apprehensive. With the strengthening of low pressure, many BTC holders are distributing their coins.

Bitcoin long -term holders, usually known to keep their coins for prolonged periods, began to sell, further increasing the pressure in an already cautious market. What does this mean for the currency in the short term?

Ancient BTC goes to Exchanges – Are long -term holders losing confidence?

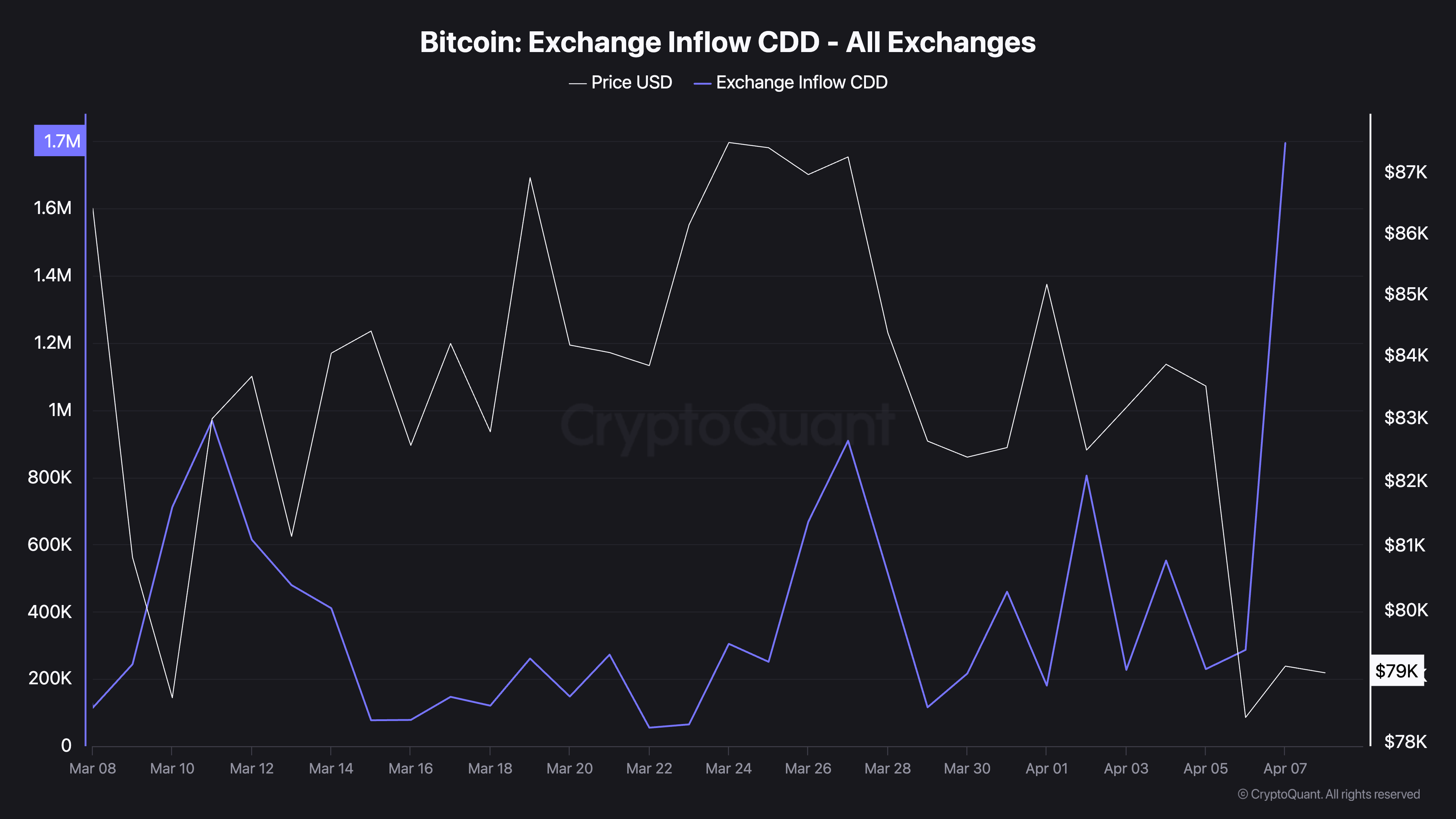

Bitcoin deposited coin Days Destroyed (CDD) has reached its highest point in 30 days.

According to Cryptoquant, it is currently 1.79 million, rising more than 850% since early April. This increase signals that coins maintained for long periods are being transferred to Exchange, a classic precursor of possible sales.

BTC’s Exchange Inflow CDD tracks the movement of older coins for Exchange. It is calculated by multiplying the amount of BTC moved by the number of days these coins were kept without being spent.

When there is a peak, it means that LTHs are moving their coins to Exchange, possibly to sell. This trend is significant because this group of investors has “strong hands”. They rarely sell unless there are worrying market conditions. Therefore, when they do, suggests that your trust is weakening and indicates a possible price drop.

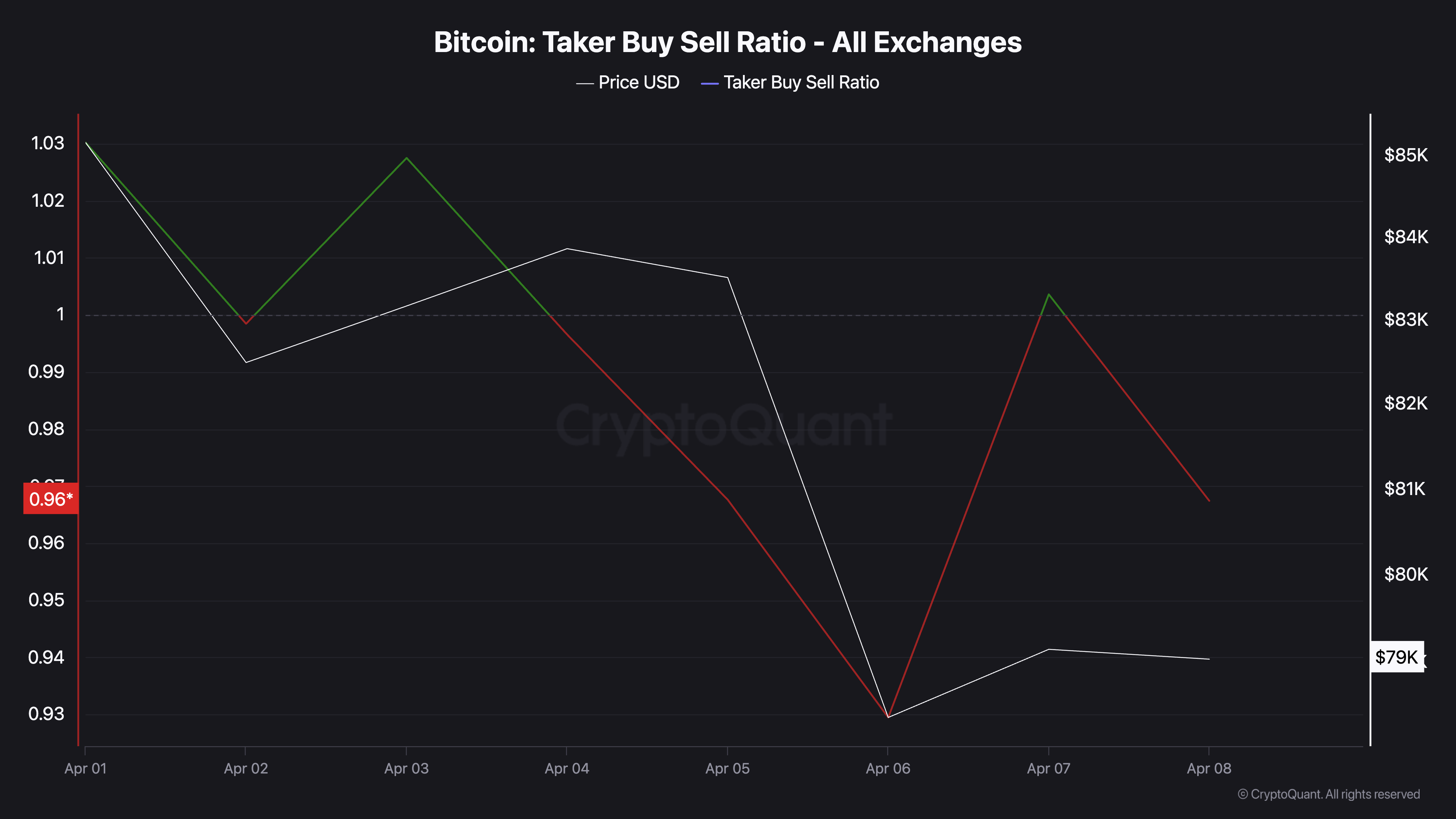

The sales impetus is also reflected in the derivative market. The BTC borne purchase ratio is currently below one, indicating that the sales orders exceed the purchase of future and perpetual contracts.

This suggests that currency derivatives traders are positioning themselves to more falls, amplifying the current feeling of low.

BTC Rally faces resistance while purchasing power weakens

The market has attempted a modest recovery in recent hours, with the total value of the crypto market by adding $ 48 billion on the last day. This increase in activity has raised the price of BTC by 4% in the last 24 hours.

However, Chaikin Money Flow (CMF) in falling coin is issuing a warning signal, forming a divergence of low. At the time of publication, the CMF fell below the zero line to -0.15 and continues the downward trend.

Low divergence comes when the price of an asset rises while its CMF falls. This signals that the purchase pressure is weakening under the surface despite the price rally. If this continues, the BTC may lose recent gains to negotiate at $ 74,389.

However, if the currency witness a resurgence in the new demand, it may maintain its rally and climb toward $ 80,776.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.