After spending much of February negotiating in a break, Bitcoin (BTC) broke down below the consolidation zone, falling to less than $ 90,000 for the first time since November last year. The largest cryptocurrency on the market is now traded at $ 88,396 thousand.

This fall signals mainly a low -growing pressure, raising concerns that the decline can extend even more in the month coming.

Limited or breaking? Experts

According to Brian, Santment analyst, Bitcoin whales continue to reduce negotiation activity, increasing the likelihood of an additional decline in the currency value.

Bitcoin’s whales seem to have paused and are not accumulating at the moment (especially remaining stable), Brian told the beinchrypto.

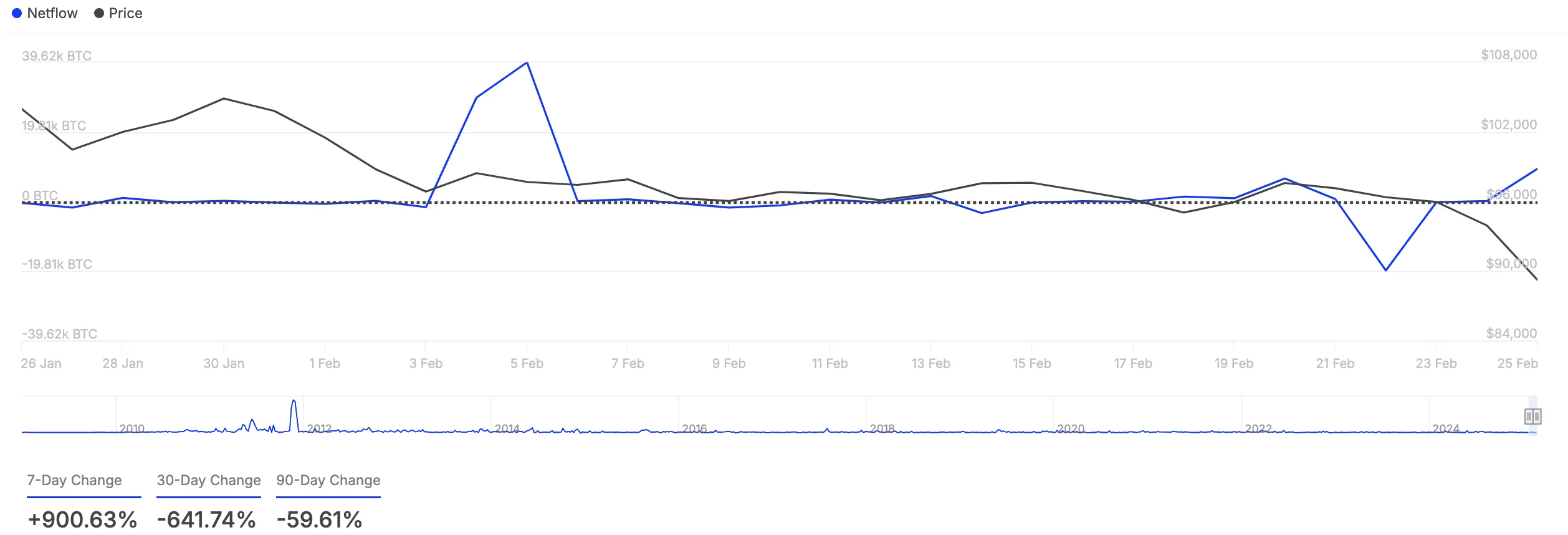

The decline in the liquid flow of the large holders of Bitcoin corroborates Brian’s position. According to Intotheblock, the metric has plummeted more than 600% in the last 30 days.

Large holders refer to whale addresses that have more than 0.1% of the circulating supply of an asset. Its liquid flow tracks the amount of currencies they buy and sell in a specific period.

When it falls, these key investors are reducing participation in tokens, signaling an increase in sales activity. This can exacerbate the low pressure on the price of the BTC as supply increases in the market.

For LEDN’s Investment Director John Glover (CIO), the BTC will probably remain limited between $ 89,000 and $ 108,000 in March.

From a technical perspective, the BTC is following one of two paths. First, there is a good potential for a drop to $ 89,000 or up to $ 77,000 before the next rally. Secondly, we have seen the minimums, and the next movement will be up to ~ $ 130,000. It is impossible to predict which way we are, and short-term predictions are insignificant when intra-seman/intra-sem movements are dictated by news and recently by the actions of large players like Strategy. My personal vision is that we remain stuck in an interval of $ 89,000 to $ 108,000 in March, ”said Glover.

In addition, given President Donald Trump’s pro-criminal stance, some investors wonder how policies may impact Bitcoin’s price in March. However, Glover believes that most of the “Trump effect” has already been felt.

Most of the “Trump effect” has already been felt. We know that he is very favorable to digital assets and put his plans into practice to simplify the regulations associated with crypto. I don’t think he’s an important factor in the short term, he believes Glover.

Bitcoin approaches about overwhelming levels – Is there a recovery on the horizon?

Bitcoin may be overwhelmed and ready for a repique, as reflected by Relative Strength Index (RSI) readings. At the time of publication, this moment indicator is falling at 31.16.

The indicator measures the market conditions of overcoming and overwhelming of an asset. It varies between 0 and 100, with values above 70 indicating that the asset is overdone and about to fall. On the other hand, values below 30 suggest that the asset is overwhelmed and can witness a repique.

BTC’s RSI reading suggests that it is approaching the over -vending territory. This indicates a possible peak toward $ 92,325 if the sales pressure decreases.

On the other hand, if this drop persists, the price of coin could fall to $ 80,835.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.