The total capitalization of the cryptocurrency market (Totalcap) and Bitcoin (BTC) have recorded growth in the last 24 hours, even with the general feeling of the market still being scared. The token based on Ethereum, SPX, led the gains between the altcoins, with two -digit discharge in the period.

In today’s news (24):

- Ethereum’s quarterly transaction rates fell about 95% compared to the peak registered in the fourth quarter of 2021, mainly due to the lower contribution of second -layer solutions (Layer 2) and the drop in NFT market activity.

- Coinbase avoided an attack on its supply chain that could compromise its open source infrastructure. The incident was reported by Yu Jian, founder of Slowmist, citing a Palo Alto Networks Unit 42 report.

Fear feeling drives purchasing pressure

The fear and greed rate of the cryptocurrency market shows that the feeling follows strongly pessimistic, with the indicator scoring 28 points – a level that indicates fear. This reflects the caution of investors after recent falls.

However, historically, this kind of feeling can offer purchase opportunities as it may indicate undervalued assets. Many traders seem to be taking advantage of this, as Totalcap rose $ 98 billion in the last 24 hours, reaching $ 2.8 trillion at the time of the newsroom.

In the daily chart, the Balance of Power (BOP) indicator is 0.58, which confirms the increase in buying pressure. A positive BOP indicates that buyers are in control, boosting prices and signaling possible continuity of the high movement.

If buyers keep control, Totalcap may continue to rise up to $ 2.87 trillion. However, if profits are performed or increased pessimism, the amount can retreat to US $ 2.70 trillion.

Bitcoin is quoted at $ 87,182, up 3% in the last 24 hours. The recovery movement throughout the week led the BTC to overcome the 20 -day exponential average (EMA), which now acts as a dynamic support at $ 85,047.

However, EMA of 20 days represents the average prices of the last 20 days of negotiation, giving more weight to the latest data. When the price goes beyond this average, it is a sign of strengthening the tall trend.

If this trend is maintained, the BTC can advance up to $ 89,434. However, if the purchasing pressure weakens, the price may fall again to test the support at $ 85,036. If this level is not defended, the decline can reach $ 77,114.

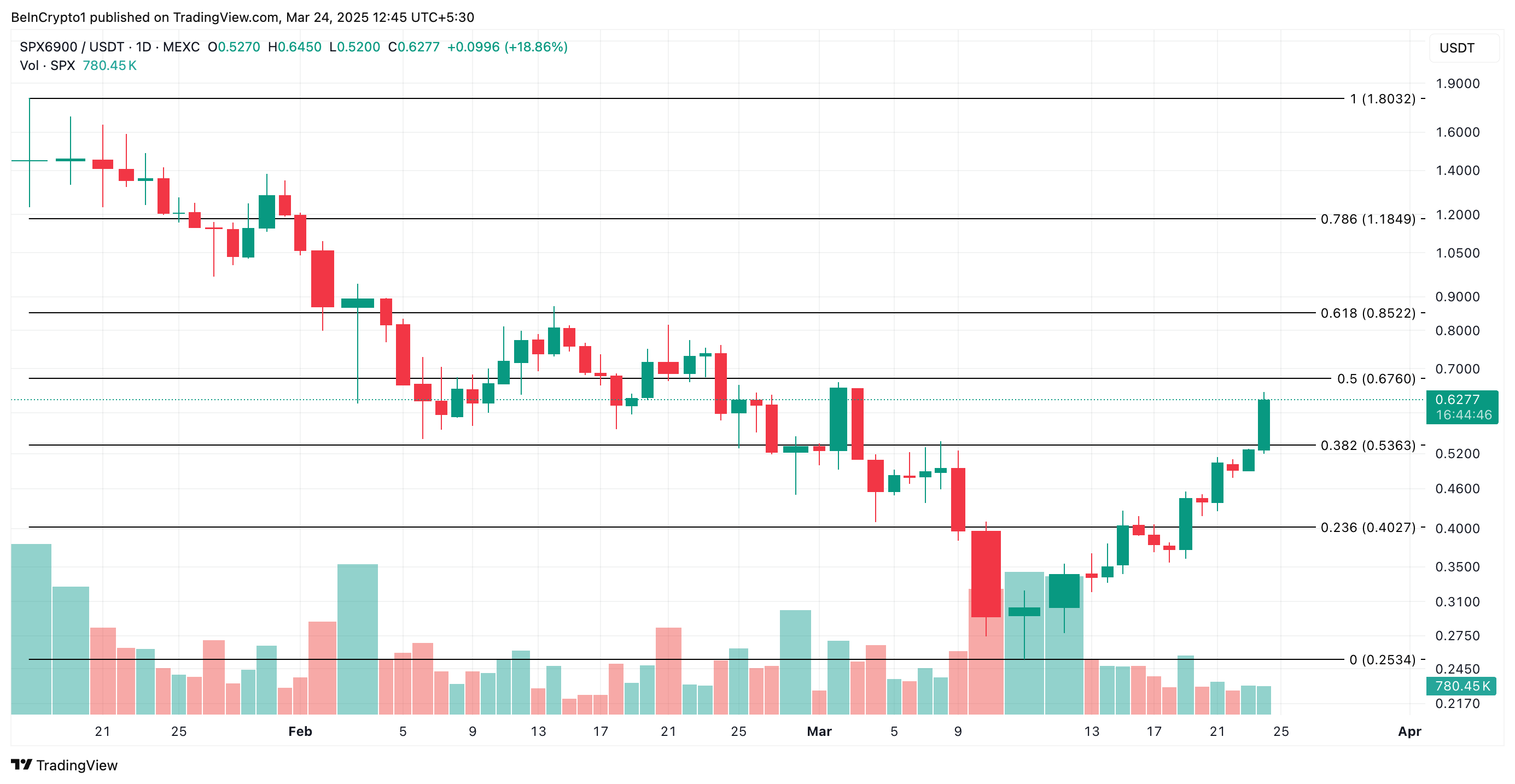

SPX is Altcoin with the best performance of the day, quoted at US $ 0.62, with a 20%increase. This significant advance was accompanied by an increase of 112% in the daily negotiation volume, which totals US $ 34 million at the moment.

In addition, the combination of appreciation and increased volume confirms the strong interest of purchase and validates the high trend. If this scenario continues, SPX can reach $ 0.67. On the other hand, a reversal can take the price back to $ 0.53.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.