The total value of the cryptocurrency market (Totalcap) and Bitcoin (BTC) are in green, although they hardly move in the daily chart. Among the altcoins, Virtual Protocol (virtual) is emerging as the best performance token, with 40% increase today.

In today’s news (29):

- The Arizona Legislative Assembly approved Bill SB1025 and SB1373 on the Bitcoin Reserve, which now await the approval of Governor Katie Hobbs to become law. Projects, approved with time off, can guarantee the future of the reserve if they are sanctioned after the end of the hobb veto in a financing dispute.

- Rice Robotics has partnered with Floki to launch a MiniBot with AI and Floki theme technology, and its Token Rice, which will be distributed by Airdop to Floki holders. The minibot will assist users in tasks, and interactions will reward users with Rice tokens, helping to train the company’s AI models.

The cryptocurrency market prepares for a high

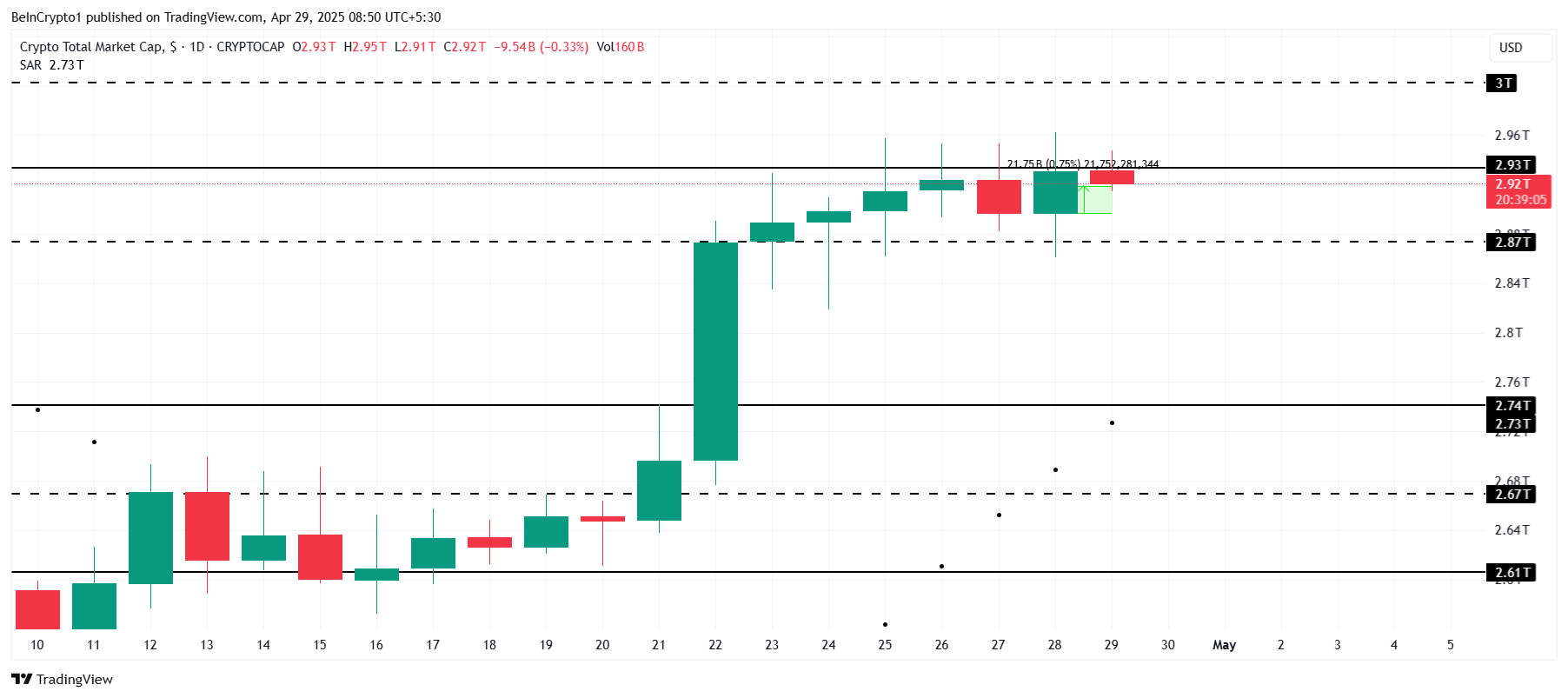

The total value of the cryptocurrency market has risen $ 21 billion in the last 24 hours, currently being US $ 2.92 trillion. The market in general is proving stable, with most cryptocurrencies remaining stable. This positive movement suggests confidence among investors, reinforcing the idea of continuous growth in the general market in the short term.

Totalcap is approaching the resistance of US $ 2.93 trillion, and breaking this level can boost the market value to US $ 3.00 trillion. For this to happen, the market needs to maintain investors’ stability and confidence. A successful breach above $ 2.93 trillion would signal an even higher boost for the general cryptocurrency market.

If resistance at US $ 2.93 trillion remains, the market value of cryptocurrencies may be declined. Falling below $ 2.87 trillion support would indicate potential weakness, possibly leading to totalcap to $ 2.80 trillion or less.

Support for new bitcoin tests

The price of Bitcoin has risen less than 1% in the last 24 hours, still trying to break the critical resistance of $ 95,761. This level is crucial to confirming the next phase of your high momentum. A successful breach above this resistance can put Bitcoin on the way to new gains.

Recent demand in the general market, driven mainly by Michael Saylor’s strategy, has boosted Bitcoin’s discharge. The purchase of 15,355 BTC per Saylor, worth more than $ 1.42 billion, is feeding optimism. This buying pressure can lead Bitcoin to exceed the $ 95,761 barrier and eventually approach the $ 100,000 brand.

However, if Bitcoin loses support at $ 93,625, a significant drop may occur. A fall below this level can lead to additional losses, potentially raising the price to $ 91,521 or up to $ 89,800. Such a movement would completely invalidate the current optimistic perspective for Bitcoin, signaling a possible reversal.

Virtual Protocol wins today

The virtual rose almost 40% in the last 24 hours, being negotiated at $ 1.48. Altcoin is testing the crucial resistance of $ 1.59. A successful breach of this level can signal the continuation of its high trend, potentially leading the virtual to achieve higher price goals in the coming days.

For the virtual, exceeding $ 1.59 is essential as it can make way for a movement towards US $ 2.27. This break would mark the end of a period of consolidation of three months, potentially allowing Altcoin to gain a stronger boost.

However, if investors decide to guarantee profits in advance, the virtual may be significant. A drop below $ 1.25 may trigger a new drop towards $ 0.95, invalidating the current optimistic perspective. Monitoring investors’ behavior will be critical to understanding the potential for continuous growth of the virtual.

Exemption from liability

All information contained on our site is published in good faith and only for general information purposes. Any action that the reader takes based on the information contained on our site is at his own risk.